Analysis for October 28th , 2015

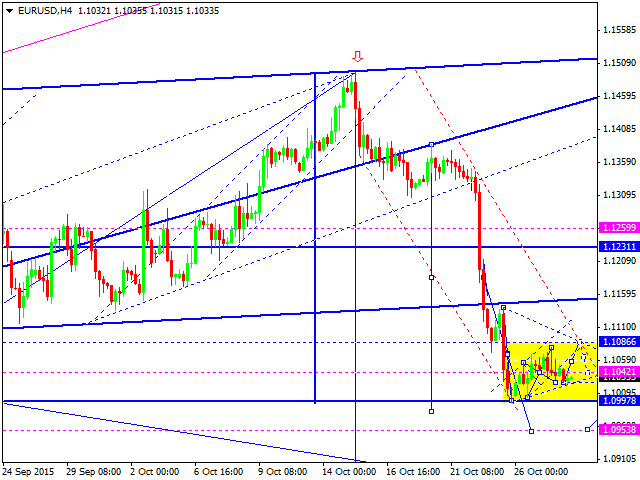

EUR USD, “Euro vs US Dollar”

Eurodollar has expanded the second impulse upwards and then corrected it. We think, today, the price may form another impulse towards 1.1090, complete the correction and then fall towards 1.1040 to test it from above. Thus, the market defines the borders of another consolidation channel. If later the pair breaks this consolidation downwards, it may continue falling inside the downtrend according to the main scenario. The next target will be at 1.0954. If the channel is broken upwards – the correction may continue to reach 1.1133.

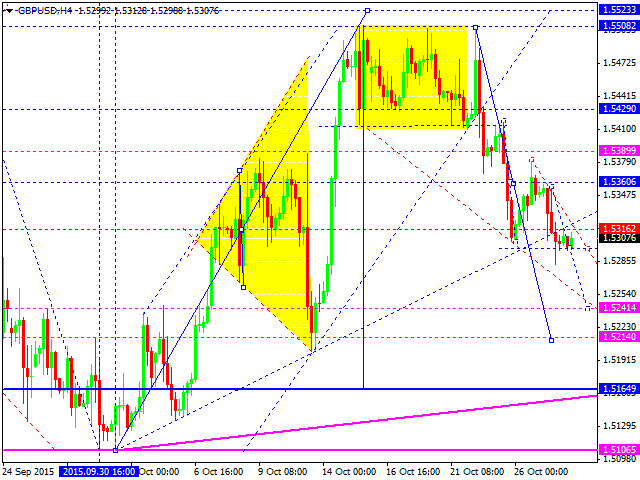

GBP USD, “Great Britain Pound vs US Dollar”

Pound has renewed the minimum of its descending structure. We think, today, the price may continue falling towards 1.5240, return to 1.5316, and then move downwards again to reach 1.5214. After that, the instrument may be corrected towards 1.5300. The main scenario suggests that the market may continue falling inside the downtrend with the target at 1.4660. All attempts to grow will be considered as an alternative scenario to start a new correction.

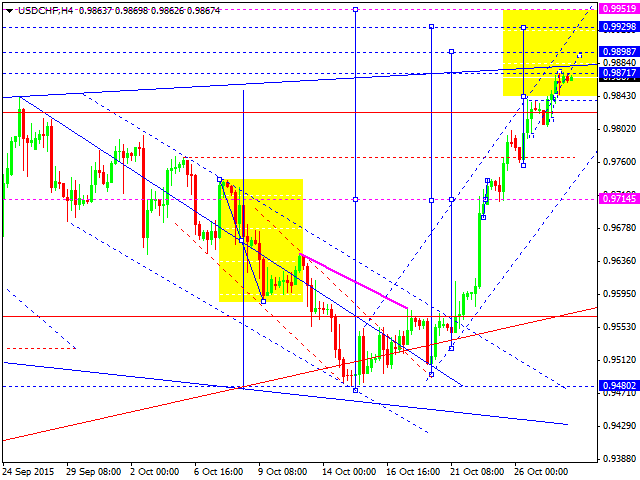

USD CHF, “US Dollar vs Swiss Franc”

Franc has reached its upside target, but this ascending structure may yet continue. We think, today, the price may reach 0.9900 and then fall towards 0.9840. After that, the instrument may move upwards again to reach 0.9950.

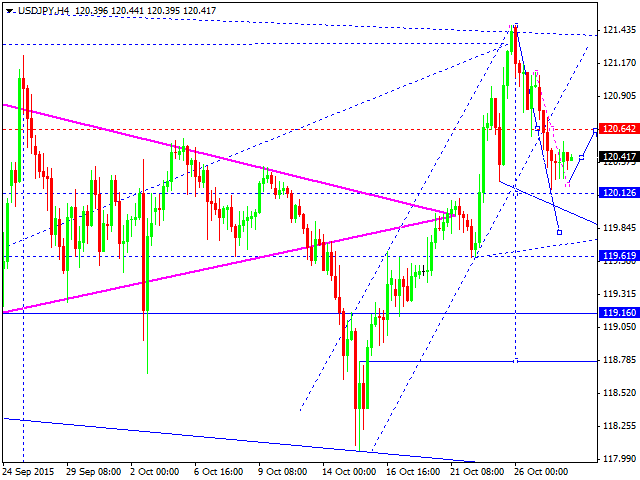

USD JPY, “US Dollar vs Japanese Yen”

Yen is being corrected towards 120.64. After reaching it, the pair may fall towards 119.80 and then from another correction to reach 120.64. After that, the instrument may continue falling inside the downtrend towards 119.00.

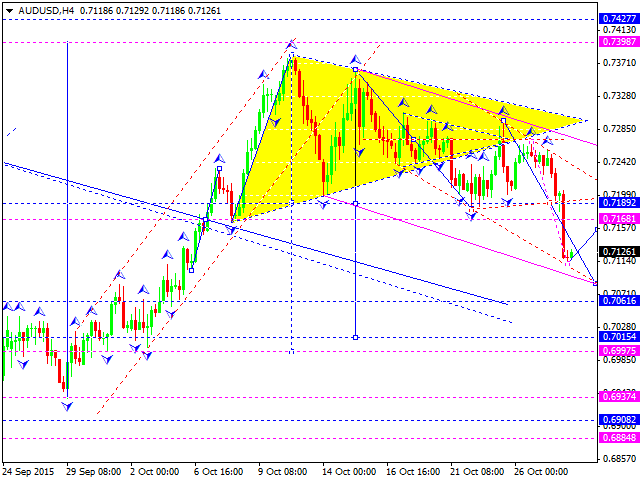

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has reached the minimum target of the correction and even formed an extension. Moreover, this structure may yet continue. We think, today, the price may return to 0.7189 to test it from below and then form another descending structure to reach 0.7085.

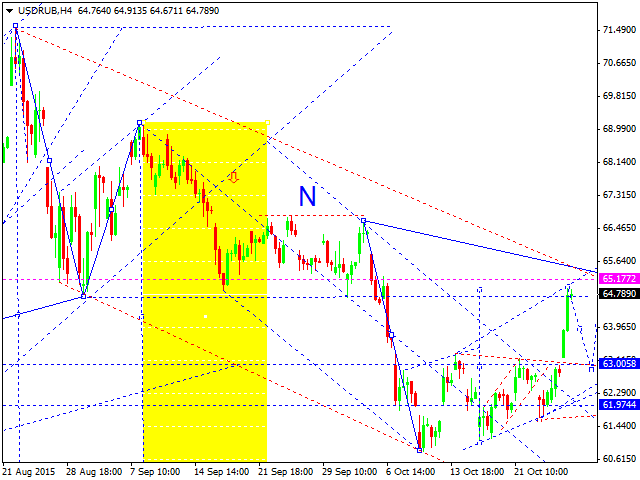

USD RUB, “US Dollar vs Russian Ruble”

Being under pressure because of the oil prices decline, Ruble is moving upwards. We think, today, the price may return to 63 to test it from above and then form another ascending structure with the target at 67. After that, the instrument may start falling inside the downtrend to reach 60.

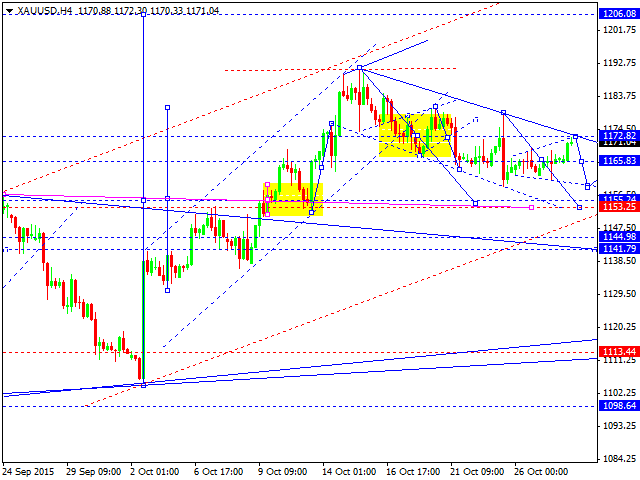

XAU USD, “Gold vs US Dollar”

Gold is moving upwards. We think, today, the price may test 1172.85 and then continue falling towards 1155.00, thus completing the correction. After that, the instrument may start growing to reach 1206.00.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.