Analysis for October 22nd, 2015

EURUSD, “Euro vs US Dollar”

Eurodollar is falling to break the ascending channel downwards at 1.1330. The predicted downside target is at 1.1170. The closest target is at 1.1242. After that, the instrument may return to the broken ascending channel and then start another descending movement to reach the above-mentioned predicted target (at least).

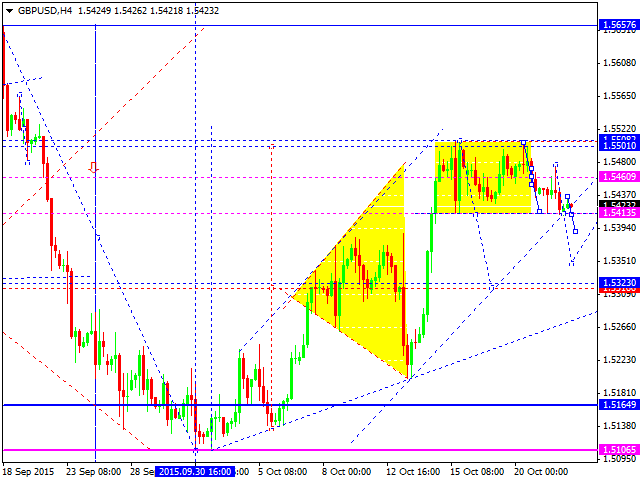

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has rebounded from the center of the consolidation channel and returned to the lower border. We think, today, the price may break the border and the ascending channel as well. The downside target is at 1.5320. After that, the instrument may return to the broken ascending channel at 1.5410.

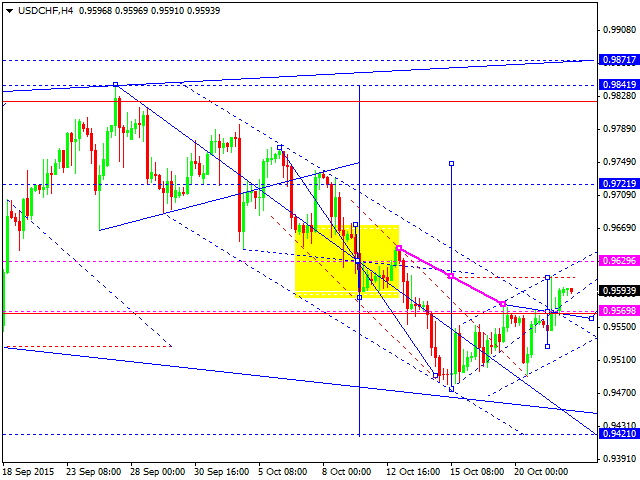

USDCHF, “US Dollar vs Swiss Franc”

Franc has broken its descending channel. The predicted upside target is at 0.9660. After that, the instrument may return to the broken descending channel at 0.9570 and then continue moving upwards to reach 0.9870.

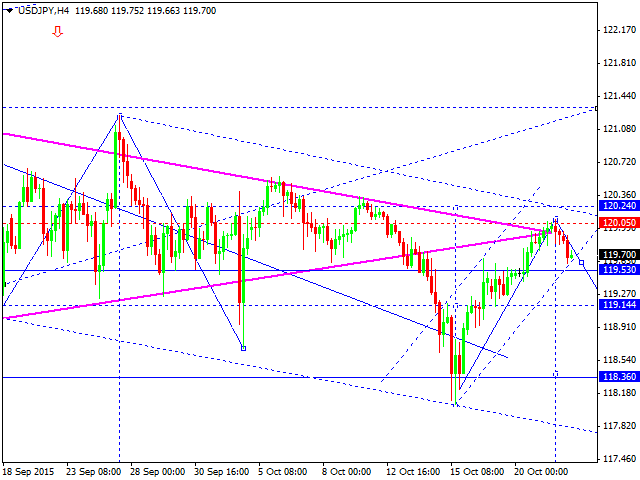

USDJPY, “US Dollar vs Japanese Yen”

Yen is rebounding from 120.00. The downside target is at 119.10. After that, the instrument may return to 119.50 to test it from below and then continue falling inside the downtrend to reach 117.00.

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar has formed another descending structure, which may be considered as a half of the third structure of the correction. We think, the price may consolidate at the current lows and try to grow towards 0.7270. After that, the instrument may continue falling to reach the local target at 0.7150.

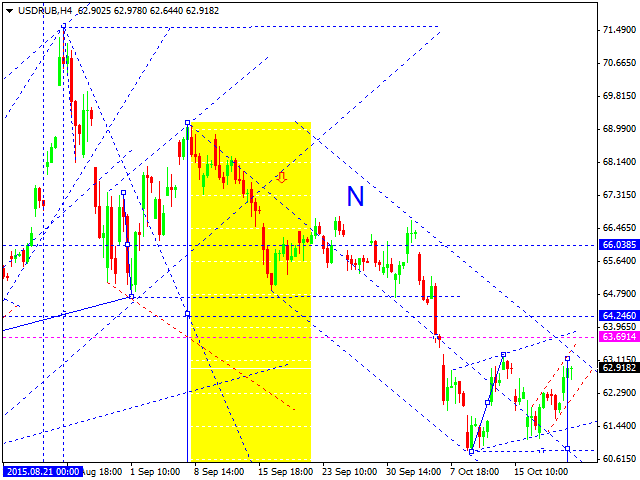

USDRUB, “US Dollar vs Russian Ruble”

Ruble is still moving in the center of its consolidation channel. We think, today, the price may continue falling towards the channel’s lower border. After breaking it, the instrument may reach the local target at 60.00.

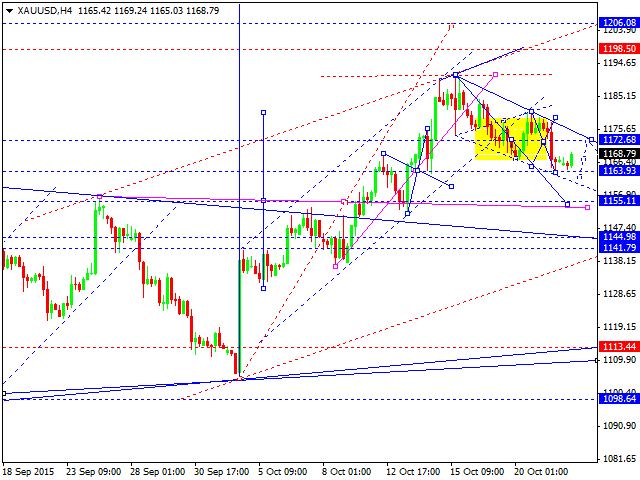

XAUUSD, “Gold vs US Dollar”

Gold has expanded its trading range downwards and is trying to break the ascending channel. The main scenario implies that the price may form another structure to reach 1155.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.