Analysis for September 1st, 2015

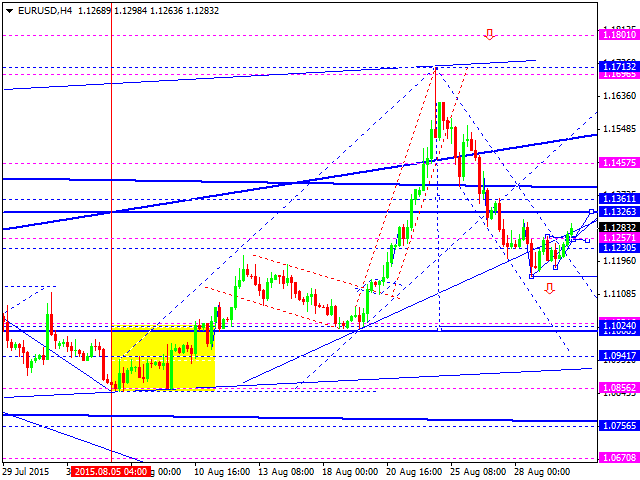

EUR USD, “Euro vs US Dollar”

Eurodollar has broken its consolidation channel upwards. We think, today, the price may grow to reach 1.1360 and then fall towards 1.1020 at least, or even continue deeper to 1.0800.

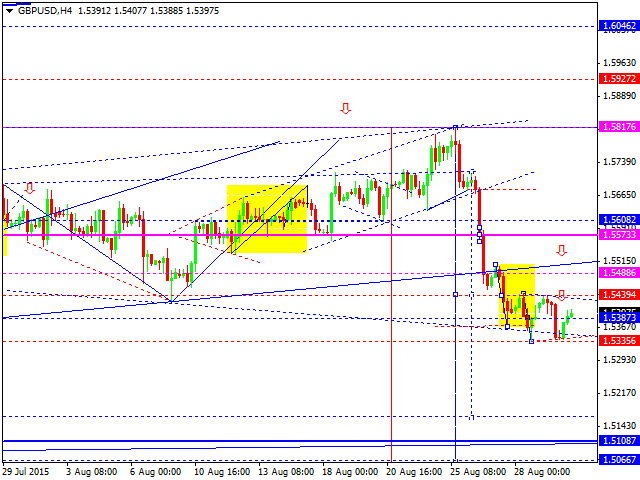

GBP USD, “Great Britain Pound vs US Dollar”

Pound is consolidating at the lows of its descending wave. This structure may be considered as the downside continuation pattern. If the price breaks this consolidation channel, it may continue falling to reach 1.52140 (at least). The final target of this descending movement is at 1.5060. If the channel is broken upwards, we can expect the correction towards 1.5573.

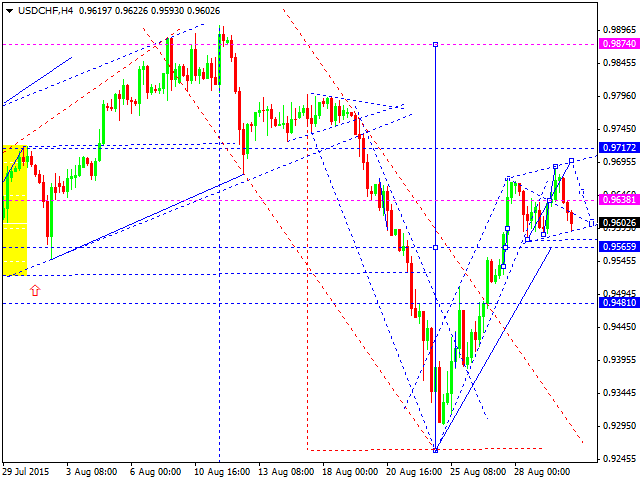

USD CHF, “US Dollar vs Swiss Franc”

Franc is consolidating at the top of its ascending structure. Possibly, the price may test 0.9567 from above and then grow towards the upper border of the daily triangle pattern to reach 0.9874. If the channel is broken downwards, we can expect the correction towards 0.9481.

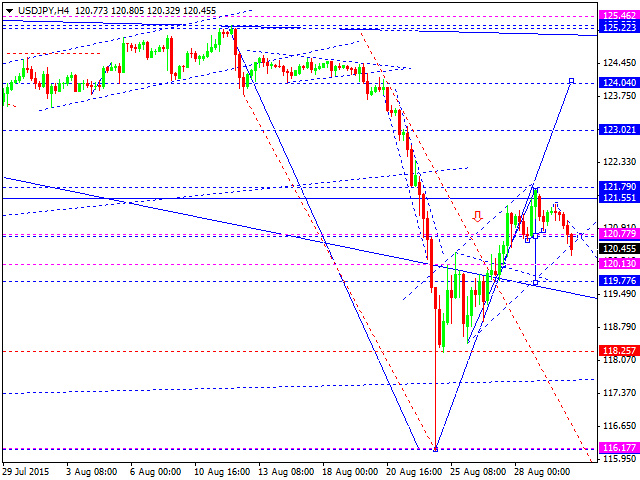

USD JPY, “US Dollar vs Japanese Yen”

Yen has broken its consolidation channel downwards and may form the correction towards 119.77. After that, the pair may break the channel upwards and expand it towards 124.04.

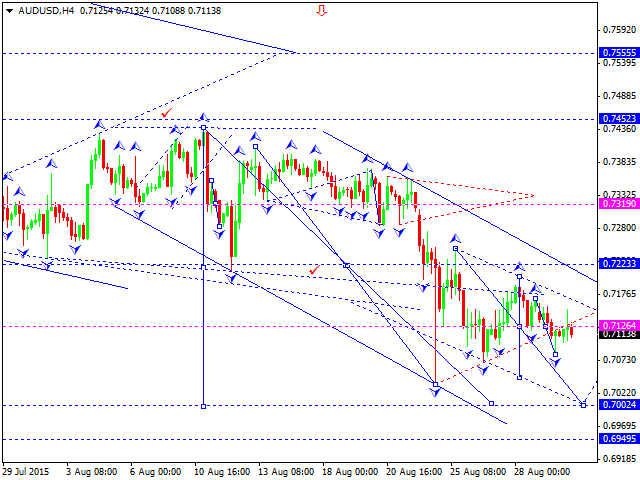

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is falling. We think, today, the price may reach 0.7000 and then grow towards 0.7126.

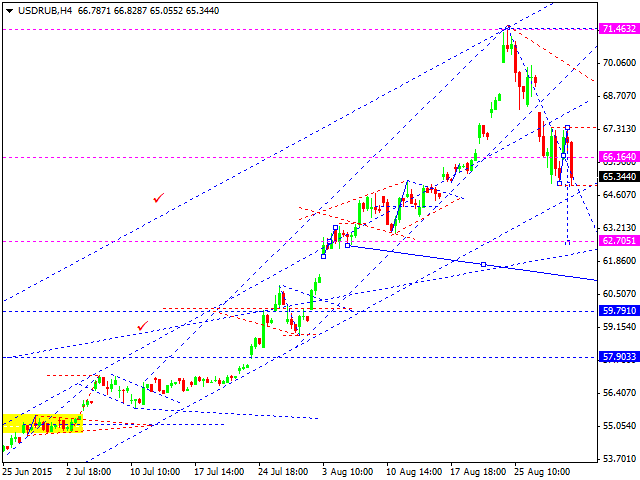

USD RUB, “US Dollar vs Russian Ruble”

Ruble is still consolidating. The structure may be considered as the downside continuation pattern; the target is at 61.00. After that, the market may return to 66.00 to test it from below and then, following the oil market, continue moving inside the downtrend. The target of this wave is at 52.20.

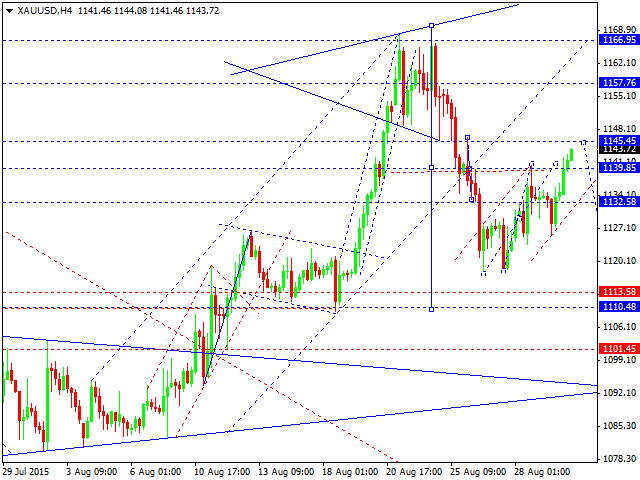

XAU USD, “Gold vs US Dollar”

Gold is still being corrected and extending the fifth structure. Possibly, the price may test 1145 and then continue falling to reach 1110.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Will Gold reclaim $2,400 ahead of Powell speech?

Gold price consolidates the rebound below $2,400 amid risk-aversion. Dollar gains on strong US Retail Sales data despite easing Middle East tensions. Bullish potential for Gold price still intact on favorable four-hour technical setup.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.