Analysis for July 28th, 2015

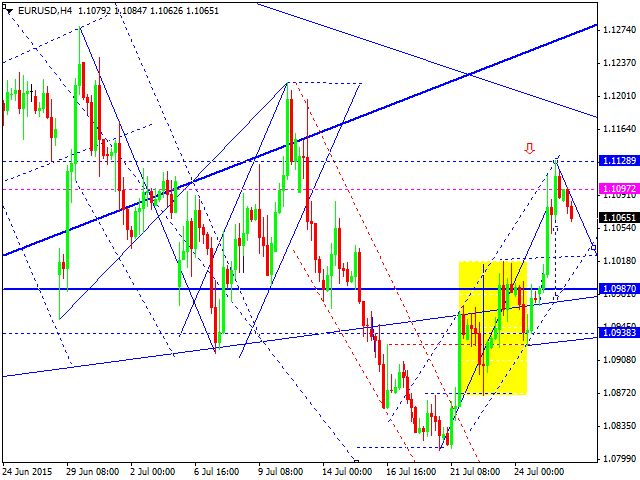

EUR USD, “Euro vs US Dollar”

Eurodollar is under pressure and continues falling. We think, today, the price may form a descending wave to reach 1.0938 and then grow to return to 1.1040.

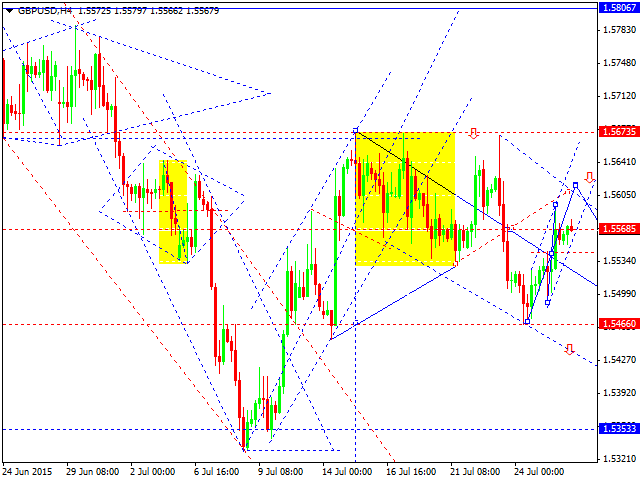

GBP USD, “Great Britain Pound vs US Dollar”

Pound is moving inside the descending structure towards 1.5466. Right now, the pair is forming the fourth structure of this wave. We think, today, the price may reach 1.5620 and then fall towards the above-mentioned target.

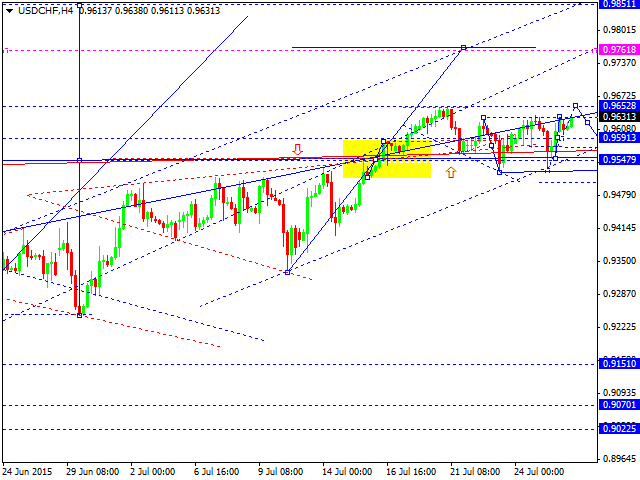

USD CHF, “US Dollar vs Swiss Franc”

Franc is forming an ascending structure to break its consolidation channel upwards. We think, today, the price may reach 0.9652 and then fall to return to 0.9592. After that, the market may start another growth to reach 0.9762.

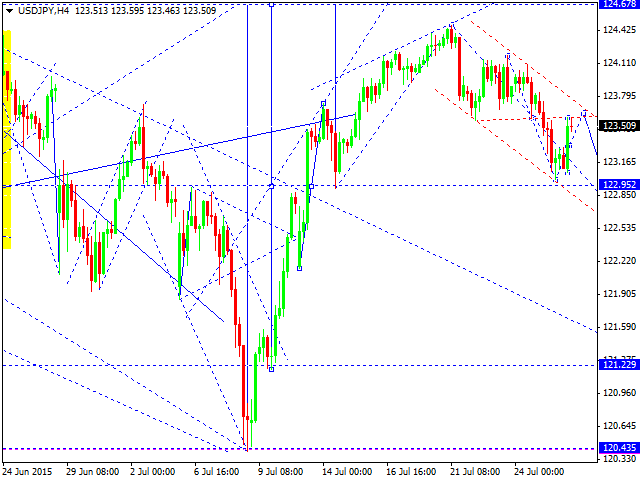

USD JPY, “US Dollar vs Japanese Yen”

Yen is moving inside the descending wave towards 122.95. We think, today, the price may compete the fourth structure of this wave. After that, the pair may start falling towards the above-mentioned target and then grow to reach 124.67.

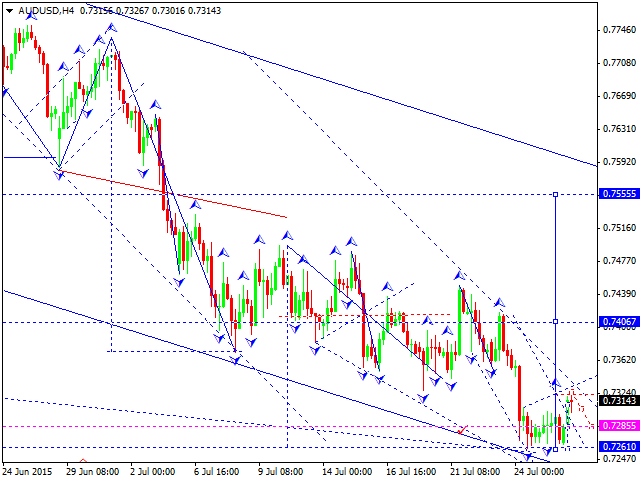

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has formed the ascending impulse and right now is correcting it towards 0.7285. After that, the market may grow to break the top of the first impulse and form another ascending wave to reach 0.7406.

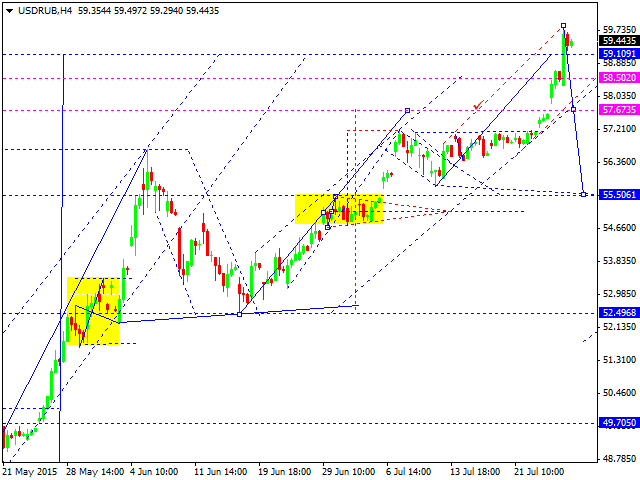

USD RUB, “US Dollar vs Russian Ruble”

Ruble is still under pressure and continues growing. We think, today, the price may form a consolidation channel at the current tops. After that, the market may form a reversal pattern to break the ascending channel and start falling towards 52.50.

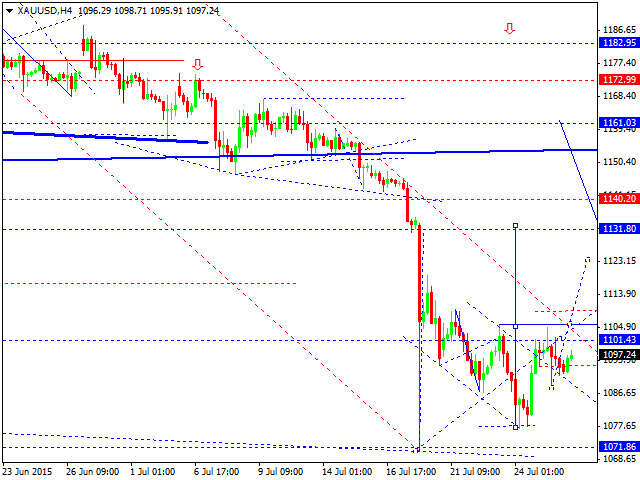

XAU USD, “Gold vs US Dollar”

Gold is still consolidating. We think, today, the price may break this channel upwards and continue growing to reach 1131. After that, the market may start a correction towards 1101.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.