Analysis for July 2nd, 2015

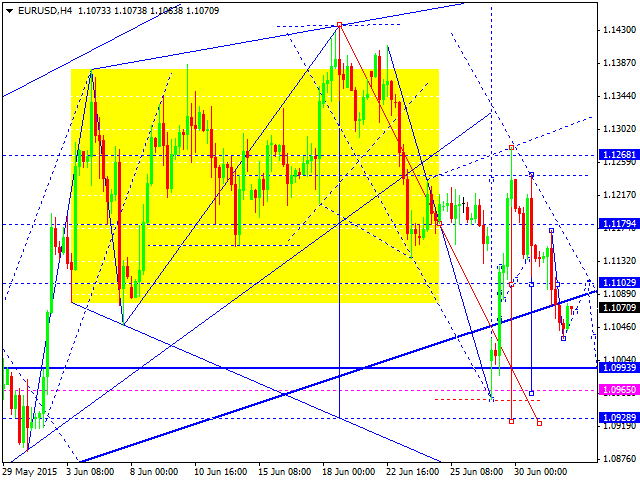

EUR USD, “Euro vs US Dollar”

Eurodollar is under pressure and continues falling; it has formed the central part of its continuation pattern. We think, today, the price may test level of 1.1100 from below and then fall towards level of 1.0965. After that, the pair may return to level of 1.1100 once again and then continue falling to reach level of 1.0930.

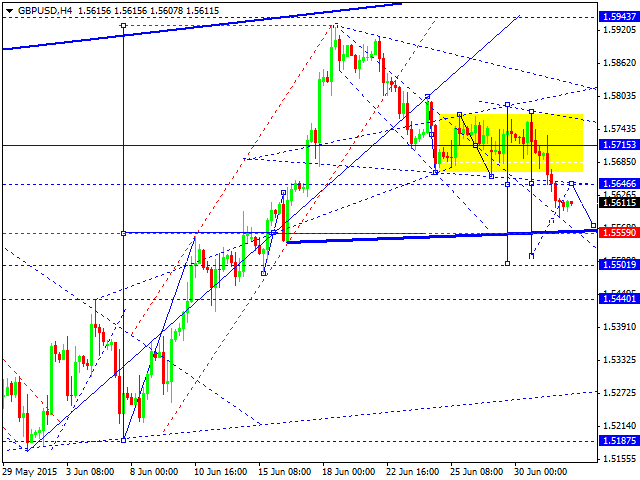

GBP USD, “Great Britain Pound vs US Dollar”

Pound has broken its consolidation channel downwards right now is extending this descending structure. We think, today, the price may reach level of 1.5560, at least. Later, in our opinion, the market may return to level of 1.5715.

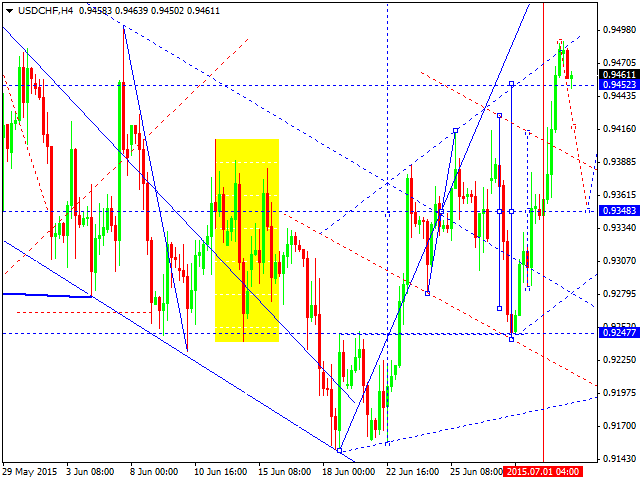

USD CHF, “US Dollar vs Swiss Franc”

Franc has reached its target inside triangle pattern. We think, today, the price may fall to reach level of 0.9350 and then grow towards level of 0.9545. Later, in our opinion, the market may return to level of 0.9350 again.

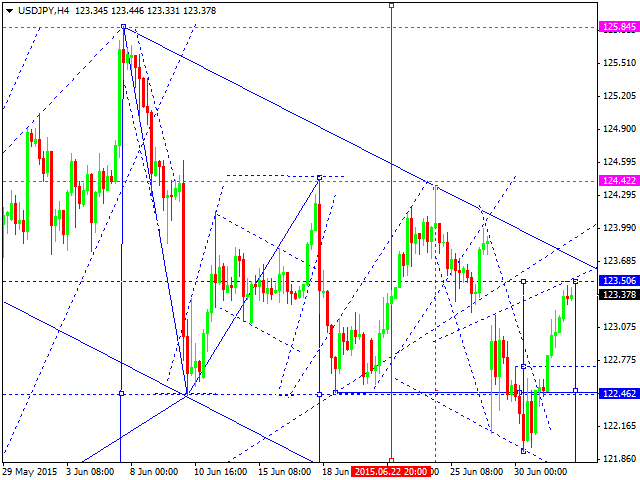

USD JPY, “US Dollar vs Japanese Yen”

Yen is moving to return to the center of its consolidation channel. We think, today, the price may continue forming the current descending wave to break the minimum and reach level of 120.60. Later, in our opinion, the market may grow to return to level of 122.22 to test it from below and then form another descending structure to reach level of 119.00.

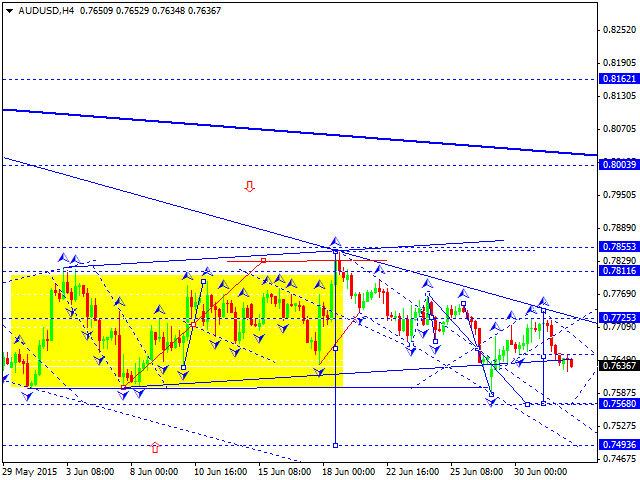

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another descending wave towards level of 0.7568. After that, the price may return to level of 0.7650 to test it from below and then continue falling to reach level of 0.7500.

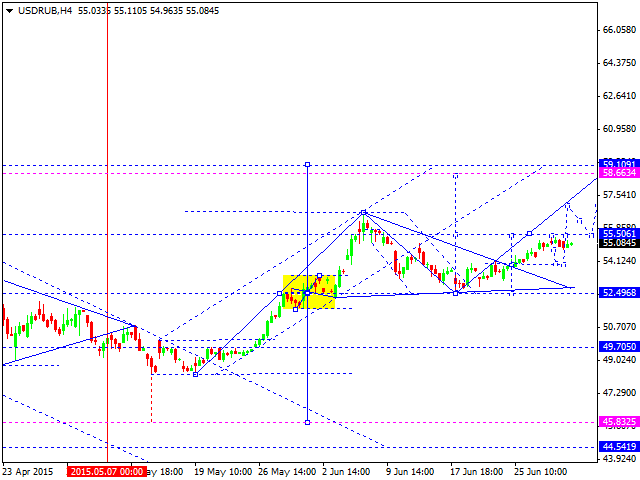

USD RUB, “US Dollar vs Russian Ruble”

Ruble is consolidating below level of 55.50. We think, today, the price may grow to break the channel upwards and then form another consolidation channel. After that, the pair may break this channel upwards as well and reach level of 58.50. Later, in our opinion, the market may start falling towards level of 52.50.

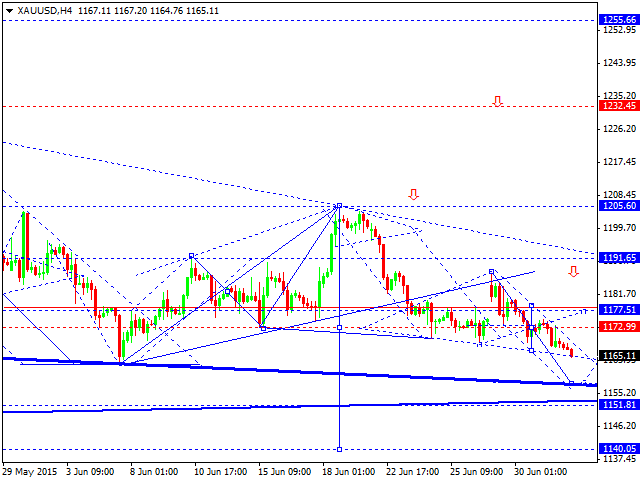

XAU USD, “Gold vs US Dollar”

Gold is still falling towards level of 1150. After reaching it, the price may form a correction towards level of 1173 to test it from below. Later, in our opinion, the market may continue falling with the target at level of 1140.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

US stock continue to stumble as traders rethink rates

US stocks grappled with uncertainty on Wednesday in the wake of a cautious string of commentary from the US Federal Reserve officials. The S&P 500 is currently experiencing its longest non-bullish streak in months.