Analysis for January 23rd, 2015

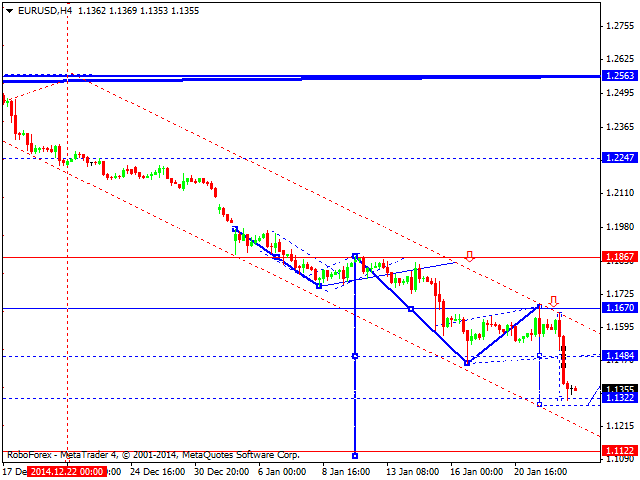

EUR USD, “Euro vs US Dollar”

As we can see at the H4 chart, after the start of the QE program, Eurodollar continued falling. We think, today the price may reach level of 1.1300 and then form another consolidation channel. Later, in our opinion, the market may continue moving downwards. The next target is at level of 1.1100.

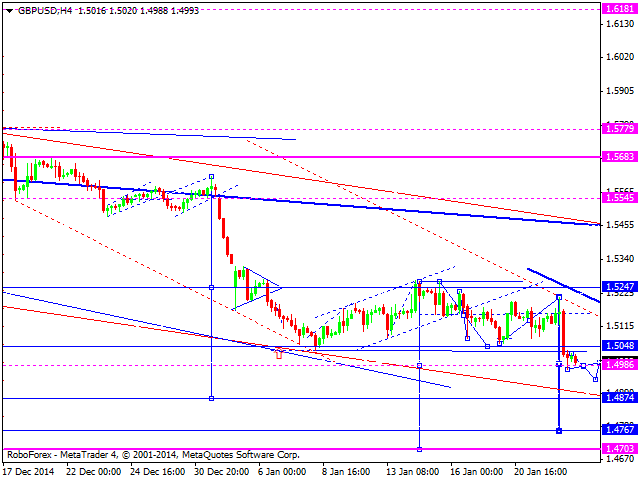

GBP USD, “Great Britain Pound vs US Dollar”

As we can see at the H4 chart, Pound has reached new lows. We think, today the price may form a narrow consolidation channel and then continuer falling to reach level of 1.4875. After that, the pair may continue falling towards the next target at level of 1.4770.

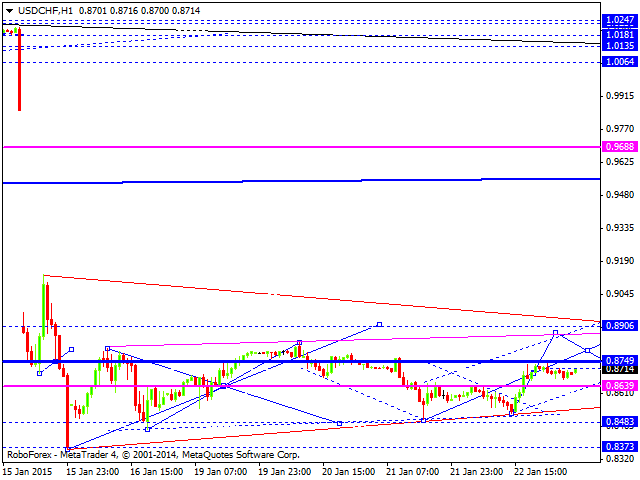

USD CHF, “US Dollar vs Swiss Franc”

As we can see at the H1 chart, Franc is still consolidating despite the decisions from the European Central Bank; the pair is moving upwards inside a consolidation channel to reach level of 0.8900. Later, in our opinion, the market may continue moving inside the downtrend. The next target is at level of 0.8200.

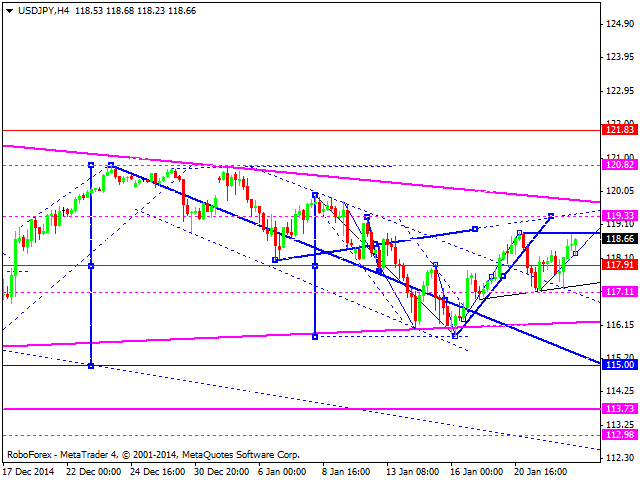

USD JPY, “US Dollar vs Japanese Yen”

As we can see at the H4 chart, Yen is attempting to form an ascending structure with the target at level of 119.30, thus following the growth on stock markets. However, considering the descending movement inside the third wave of the downtrend, this pair may fall fast to reach level of 115.00.

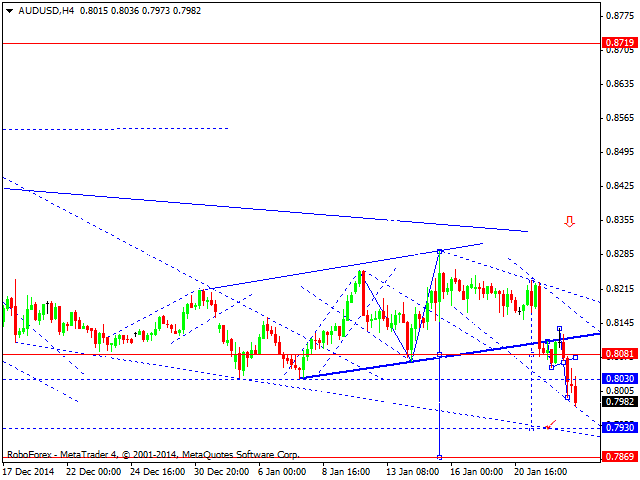

AUD USD, “Australian Dollar vs US Dollar”

As we can see at the H4 chart, Australian Dollar is still falling inside the downtrend. The target is at level of 0.7930. Later, in our opinion, the market may consolidate for a while and then continue moving inside the downtrend. The target is at level of 0.7870.

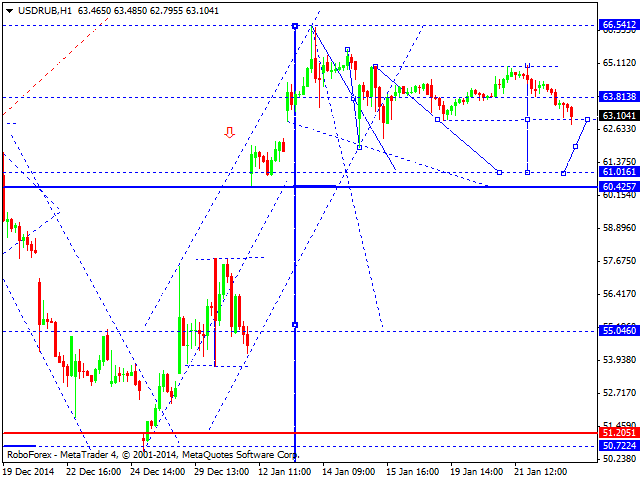

USD RUB, “US Dollar vs Russian Ruble”

As we can see at the H1 chart, Ruble continues moving downwards. We think, today the price may expand its consolidation range downwards to reach level of 61.00. Later, in our opinion, the market may return to level of 63.00 and then continue falling towards level of 55.00.

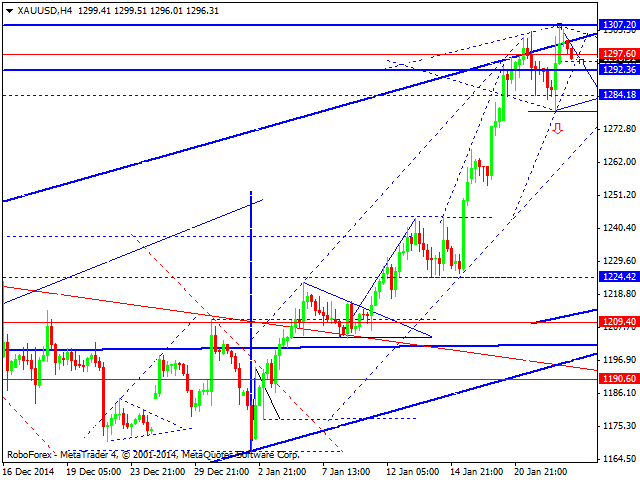

XAU USD, “Gold vs US Dollar”

As we can see at the H4 chart, Gold has reached a new high and now is back to its consolidation channel, which starts looking like diamond reversal pattern. Later, in our opinion, the market may form a descending wave towards its first target at level of 1209.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.