Analysis for December 26th, 2014

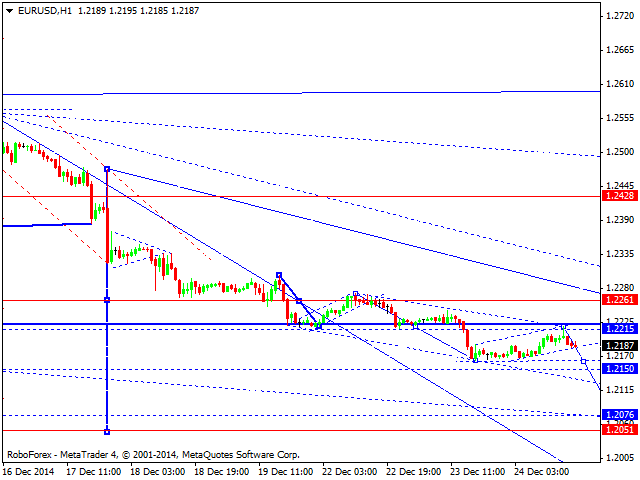

EURUSD, “Euro vs US Dollar”

Eurodollar is moving close to the upper border of its consolidation channel. We think, today the price may continue falling to reach a new low. The next downside target is at level of 1.2100. Later, in our opinion, the market may return to level of 1.2150 and then continue falling to reach level of 1.2050.

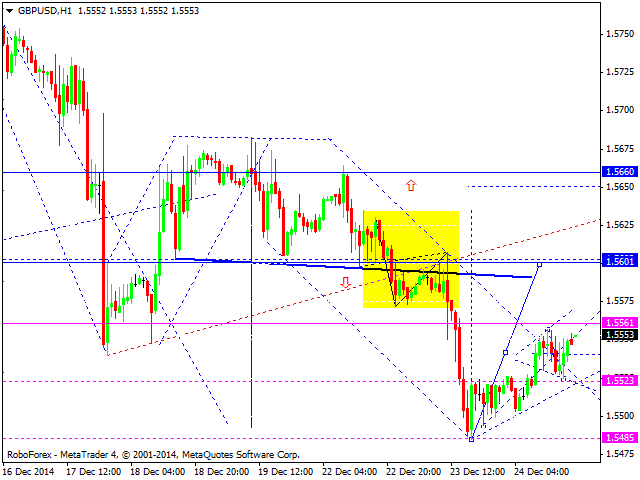

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is moving upwards. We think, today the price may form an ascending wave with the target at 1.5600 and then fall towards level of 1.5523. After the pair completes this pattern, we’ll estimate if such structure may continue growing.

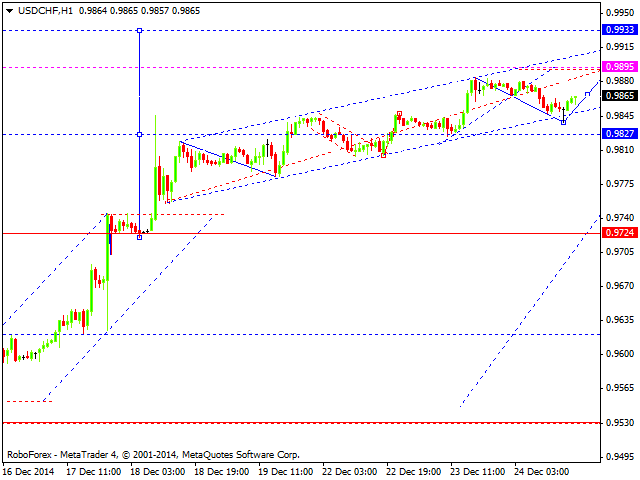

USDCHF, “US Dollar vs Swiss Franc”

Franc is still consolidating below level of 0.9827. The target of this ascending wave is at 0.9895. Later, in our opinion, the market may return to level of 0.9827 and then start a new ascending movement to reach level of 0.9930.

USDJPY, “US Dollar vs Japanese Yen”

Yen is forming a correction with the target at 119.78. After reaching it, the price may grow towards level of 120.98 and then return to level of 120.00. Later, in our opinion, the market may continue moving upwards with the target at level of 121.70.

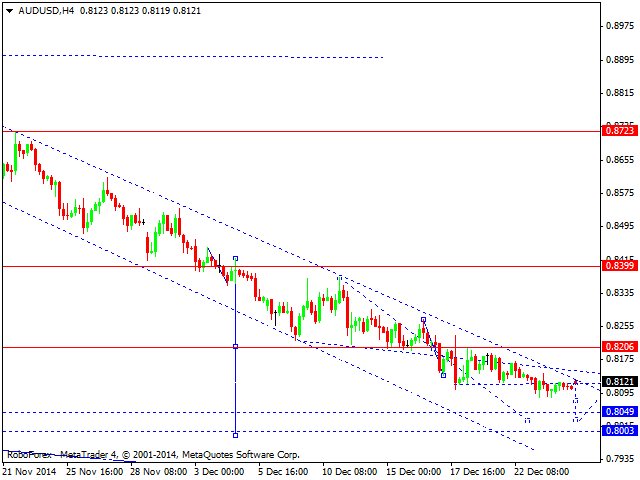

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is still falling inside the downtrend. We think, today the price may reach level of 0.8050. Later, in our opinion, the market may form a consolidation channel and break it downwards. The next target is at level of 0.8000.

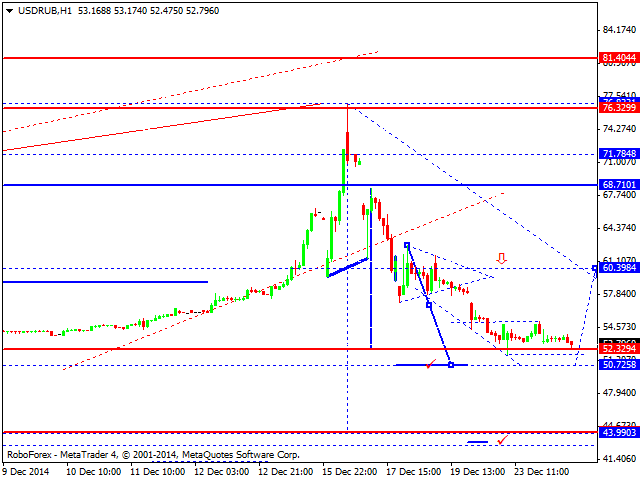

USDRUB, “US Dollar vs Russian Ruble”

Ruble is consolidating. Later, in our opinion, the market may fall towards level of 50.00 and then start a correction towards level of 60.00. After that, the pair may continue falling with the target at level of 45.00.

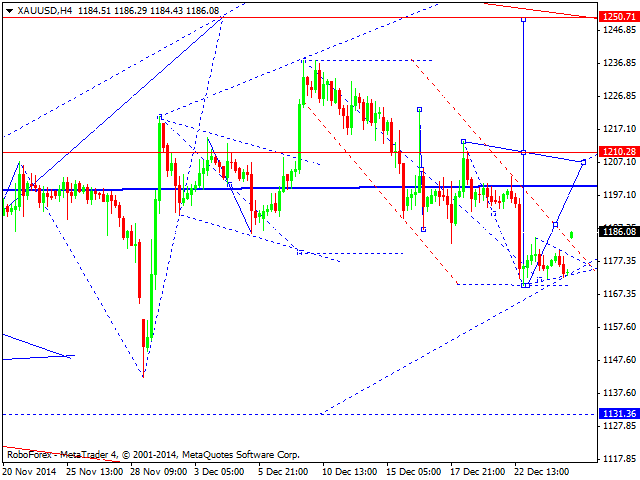

XAUUSD, “Gold vs US Dollar”

Gold is moving upwards, the market is expected to continue forming an ascending wave with the target at level of 1250.00. We think, today the price may form the first ascending structure of this wave to reach level of 1207.00.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.