Analysis for July 29th, 2014

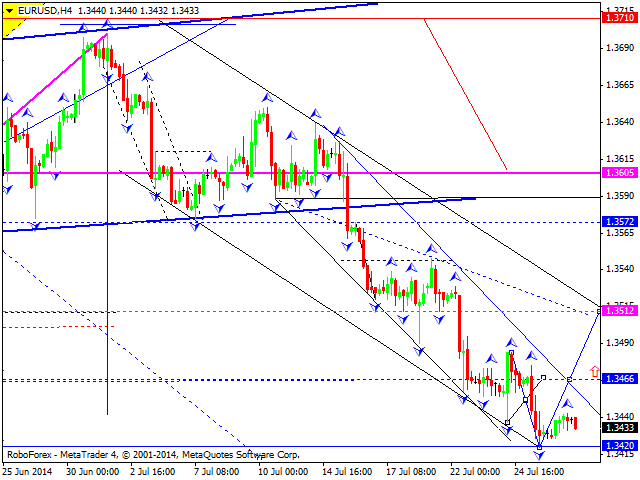

EUR USD, “Euro vs US Dollar”

Pair continues consolidation at current minimums. In our opinion, descending structure is being formed. Double inverted top may be formed. The basic scenario for this currency pair is the forming of ascending structure towards level of 1.3510. Then, the price may start falling down towards level of 1.3470. After reaching it, another ascending structure may be formed and price may reach level of 1.3590.

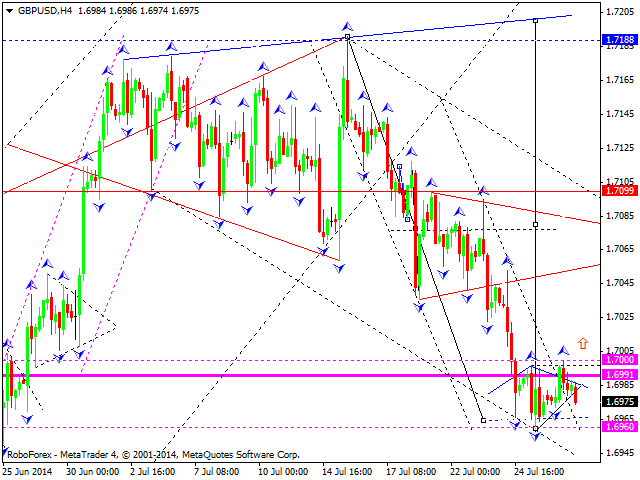

GBP USD, “Great Britain Pound vs US Dollar”

Pound continues moving in consolidation channel. The basic scenario is that price will be moving upwards inside ascending wave with target at level 1.7500.

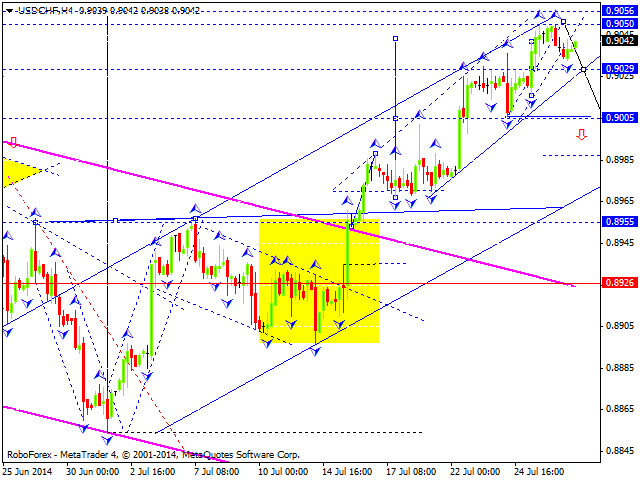

USD CHF, “US Dollar vs Swiss Franc”

Pair continues consolidation near its maximums. The ascending structure is forming. We think that slight changes near maximums may occur. Today the descending structure may be formed and price may reach level of 0.9000. Then, we think price may resume moving upwards towards level of 0.9030. After reaching it, price may resume descending movement towards level of 0.8955.

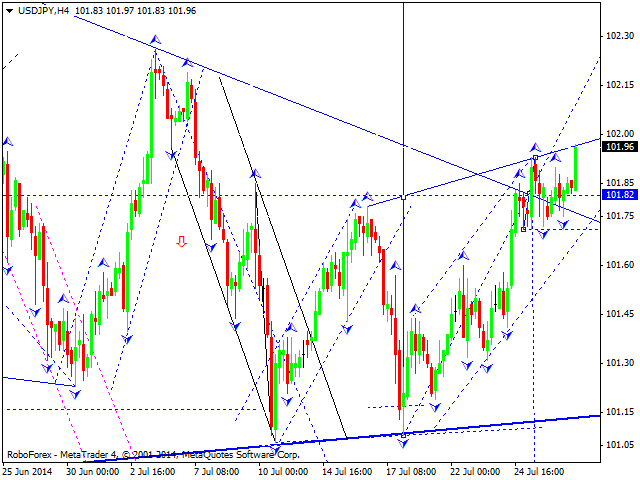

USD JPY, “US Dollar vs Japanese Yen”

Yen broke its consolidation channel upwards. The third wave may be formed, after it, price may start moving towards level of 102.60. Thus, market is forming daily consolidation triangle that is considered as a pattern of downtrend continuation towards level of 99.30.

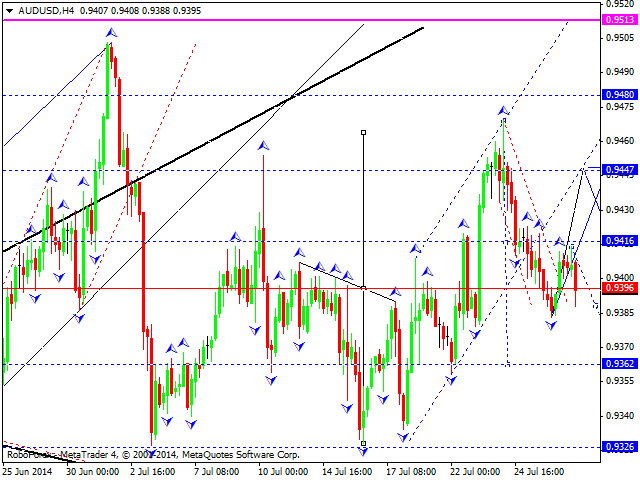

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still moving inside descending structure as correction. Today ascending wave may be formed and price may reach level of 0.9510. As an alternative scenario, in our opinion, price may start falling down towards level of 0.9370. After it, we expect the ascending wave again.

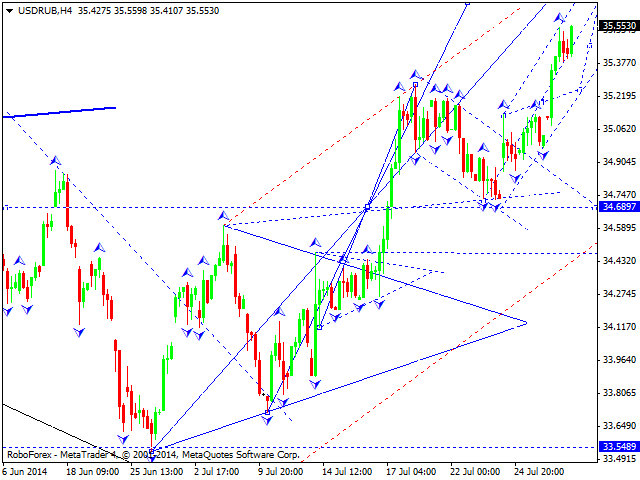

USD RUB, “US Dollar vs Russian Ruble”

Ruble is still moving in the ascending channel. Price is expected to reach level of 35.66 due to the extension. Then, this growth stage will be completed. After it, we expect correction towards level of 34.68. Then, the fifth wave may be formed inside this correction and price may reach the level of 35.85.

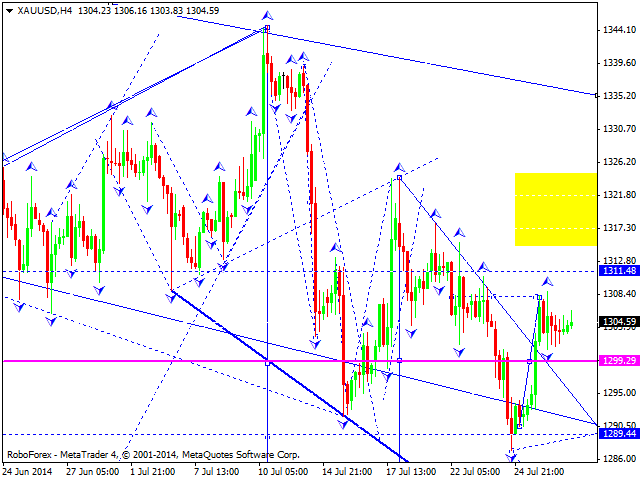

XAU USD, “Gold vs US Dollar”

Gold continues its recovery pattern. We expect price may try to reach level of 1311. Then, descending wave may be formed and level of 1290 may be broken. We expect the third descending wave. The target is level of 1275.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.