New technologies may raise demand for silver

Demand for silver may rise due to new industrial technologies, according to GFMS and The Silver Institute. Will silver edge up?

Demand for silver to produce the film tumbled 3 times in recent 10 years. At the same time, the demand for silver for photovoltaics soared roughly the same. It increased 23% last year compared to 2014. Global political and economic instability make people use silver for investment objectives. Thus, production of silver coins and bullions has increased from 10mln ounces to 300mln ounces in recent 10 years. The global increase in demand is being anticipated due to developing technologies of “Internet of things”, OLED sources of light, jewellery and clothing emblems production, in aerospace industry and in nanotechnologies. At the same time, global silver production steadied at +2% in recent 2 years having increased 38% in recent 10 years. Nevertheless, despite such a significant rise in production volumes, high demand for silver pushed its prices up almost twofold. Historically, silver prices copy gold price fluctuations. In 1975-2015 average ratio of gold to silver was 55.4. Now it reached 70.7, which may signify that silver is lagging behind.

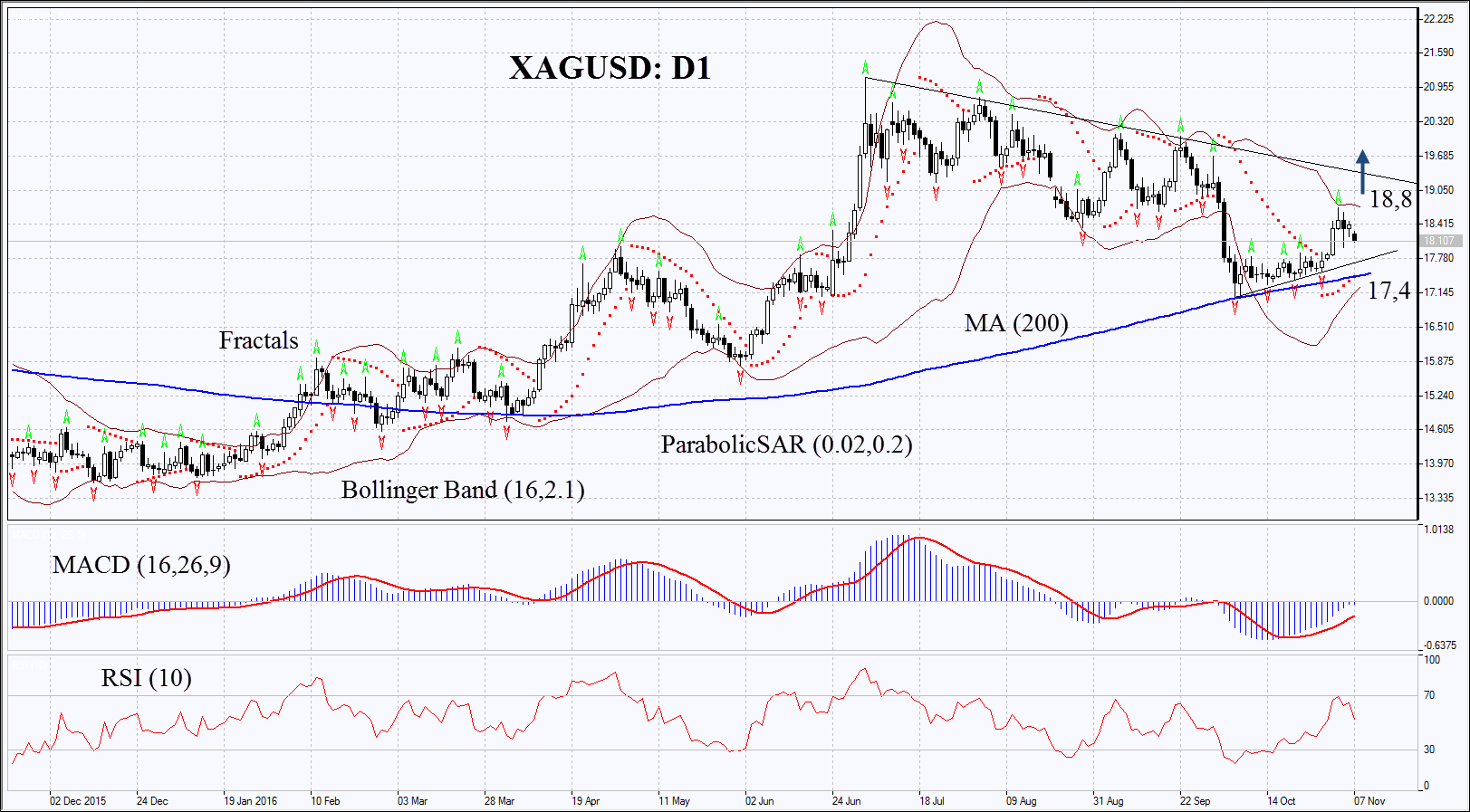

On the daily chart XAGUSD: D1 is rising from its 200-day moving average through which it failed to break down about a month ago. Further growth is possible in case of general increase in precious metals and gold prices as well as in case of higher demand from global industry and producers of solar batteries.

-

Parabolic gives bullish signals.

-

Bollinger bands have contracted which means lower volatility.

-

RSI is above 50. It has left overbought zone, no divergence.

-

MACD gives bullish signals.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.