Good day, dear traders. Today the Scotland independence referendum will be held, which may lead to the formation of a new state on the territory of the EU. The voting will last till 23:00 (CET) and the outcome is not certain yet. The final results will be announced on Friday between 07:30 and 8:30 (CET). The results of the survey by YouGov, a British public polling service, conducted on 7 and 12 September with a 5 day interval, indicated an unsettled public opinion. Thus, while on September 7 51% of respondents answered they would vote for independence, on 12 September the ratio changed – only 48% would vote for independence. Taking into account the statistical margin of error, which is no less than 1 %, the vote outcome is not clear. We expect that the results of the referendum will affect the Forex market, especially the British pound. Let us remind that the Scotland GDP accounts for 9.2% of the GDP of the United Kingdom and amounts to 186 billion Euros annually. Therefore the separation may have a significant negative impact on investors’ attitude toward British pound.

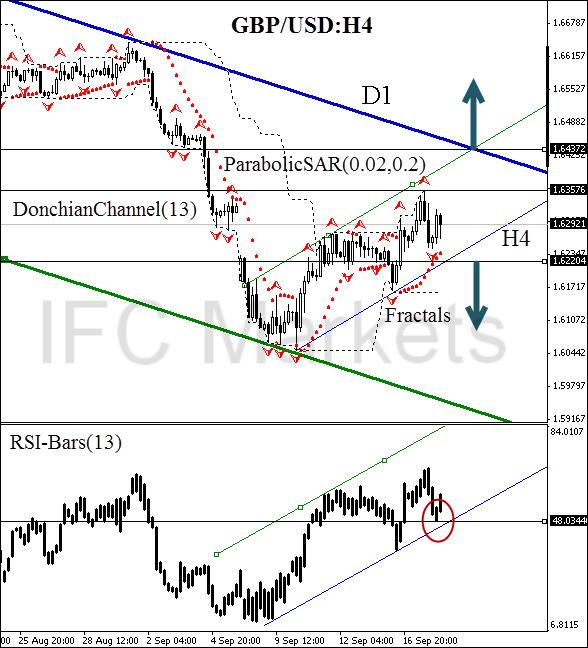

Let us consider the 4 hour price chart of the currency pair GBP/USD. The price is moving within the rising channel H4, which is confirmed by the RSI-Bars oscillator. There are no contradictions with the Parabolic and Donchian Channel trend indicators either. Unfortunately, the price line runs into the natural obstacle in the form of a bearish resistance line. In order for the ratio of profit to risk (the rentability) to exceed 100%, it is recommended to open a long position only after the daily resistance level of 1.64372 is breached. If this happens, we will stay within the weekly rising trend and will wait for the formation of a new model on H4 chart. The risks can be limited by the level 1.62204, which lies below the last fractal support and historical reading of the Parabolic SAR indicator.

In case a strong daily resistance turns out to be steady, we expect a trend reversal into the red zone. The change in signals for both trend indicators is possible if a breach of the resistance line at 1.62204 happens. In this case the conservative traders should wait for confirmation by oscillator to record the breach at the 48.03% level. When setting the position the risks can be limited by the fractal resistance at the 1.63576 level, which is confirmed by the upper Donchian Channel. We place both pending orders simultaneously. It doesn’t pay to pressure the market – it will make its own decision. After opening the position we move the stop to the zone of next fractal minimum (long position) following the Parabolic indicator, or to the zone of fractal maximum (short position). It is sufficient to do daily resetting after the formation of 5 new 4-hour candles, which are necessary for the formation of Bill Williams’ fractal. Thus we change the possible profit/loss ratio in the direction of no loss state.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.