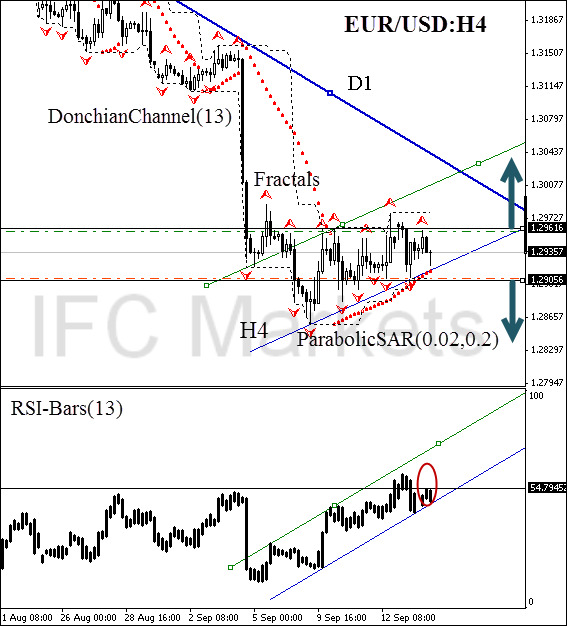

After opening the position we move the stop to the zone of next fractal minimum (long position) following the Parabolic indicator, or to the zone of fractal maximum (short position). It is sufficient to do daily resetting after the formation of 5 new 4-hour candles, which are necessary for the formation of Bill Williams’ fractal. Thus we change the possible profit/loss ratio in the direction of no loss state.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.