Euro-area unemployment decreased to a new five-year low in December, an unexpected bit of good news as the European Central Bank considers increasing its monetary stimulus next month to stave off deflationary threats.

The region’s jobless rate decreased to 10.4 percent from 10.5 percent in November, the European Union’s statistics office in Luxembourg said on Tuesday. That’s the lowest since September 2011. Economists forecast the rate to remain unchanged, according to the median estimate in a Bloomberg survey.

“The job market outlook in a nutshell is quite robust,” said Frederik Ducrozet, an economist at Banque Pictet in Geneva. “For the ECB it will have little influence on the very near-term decision, in my opinion. It’s more for the medium-term debate.”

Central bankers around the world are reaching into their armories in response to market tumult at the start of the year stemming from an emerging market slowdown and commodity slump. ECB President Mario Draghi said in January that the Governing Council will review its stimulus policies in March as collapsing oil prices risk pushing the region’s inflation rate back to zero.

Inflation hasn’t been near the ECB’s goal of just under 2 percent in almost three years. European sentiment indicators weakened in January in response to the global market turmoil, with Markit Economics’s Purchasing Managers Index declining and the European Commission’s index of economic sentiment dropping to its lowest in five months.

While the ECB forecasts euro-area unemployment will average 10.5 percent this year before dropping to 10.1 percent in 2017, Executive Board member Benoit Coeure on Monday called on governments to step up reforms.

“For the recovery to become structural, and thus to increase growth potential and reduce structural unemployment, monetary policy does not suffice,” he said.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

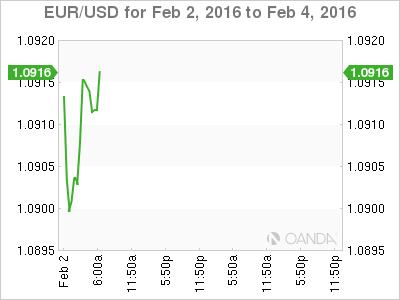

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.