Analysis for February 18th, 2016

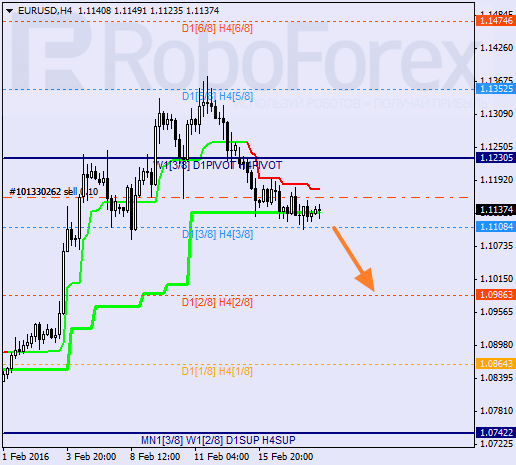

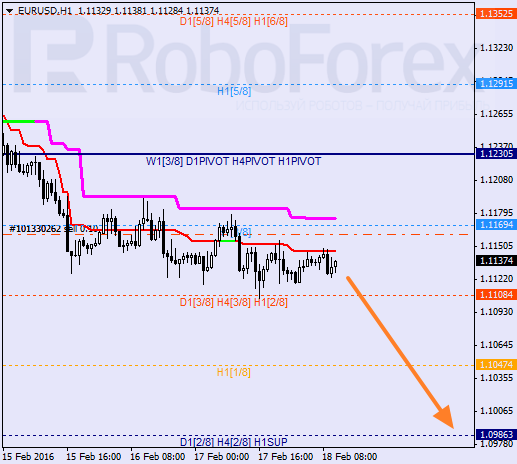

EUR USD, “Euro vs US Dollar”

At the H4 chart, Eurodollar is moving between Super Trends. If later the price breaks the 3/8 level and stays below it, the market may continue falling. However, if the pair stays above the 4/8 level, it may resume moving upwards.

At the H1 chart, the current decline is supported by Super Trends, which earlier formed “bearish cross”. It’s highly likely that in the nearest future the price may resume falling and break yesterday’s low. The closest target is at the 0/8 level.

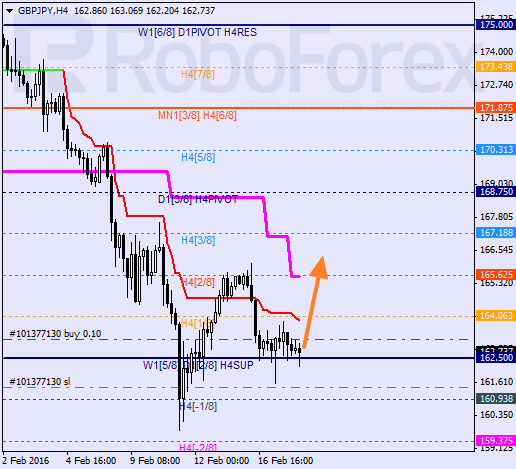

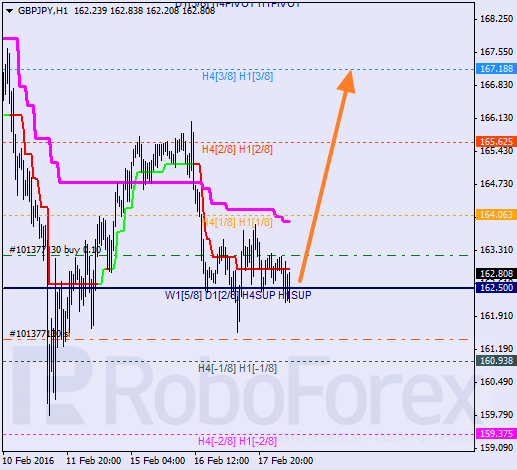

GBP JPY, “Great Britain Pound vs Japanese Yen”

The pair hasn’t been able to stay below the 0/8 level and right now is being corrected. The closest target for bulls is at the 2/8 level and the daily Super Trend. After the price is able to stay above the H4 Super Trend, the market will resume its growth.

The lines at the H4 and H1 charts are completely the same. The pair has rebounded from the 0/8 level one more time, which means that it may resume its growth. It looks like the market may try to stay above the 1/8 level during the day.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.