Analysis for February 8th, 2016

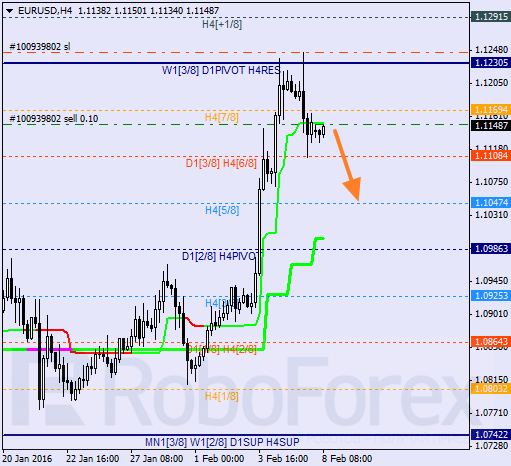

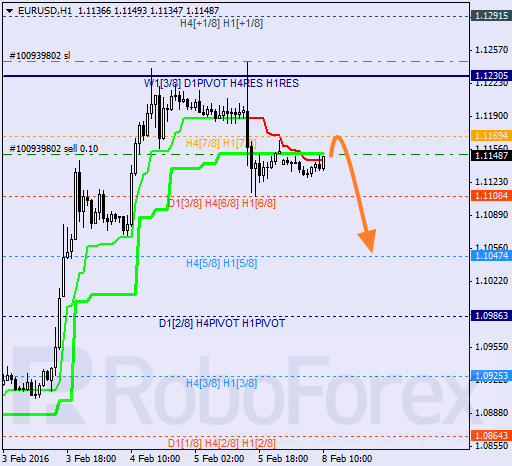

EUR USD, “Euro vs US Dollar”

Eurodollar has rebounded from the 8/8 level twice, which means that it may start a new descending correction. If the market is able to stay below the H4 Super Trend during the day, the price may continue falling towards the 5/8 level.

The lines at the H4 and H1 charts are completely the same. Super Trends have formed “bearish cross” and, as a result, the correction has started. It’s highly likely that on Monday the price will break Friday’s low.

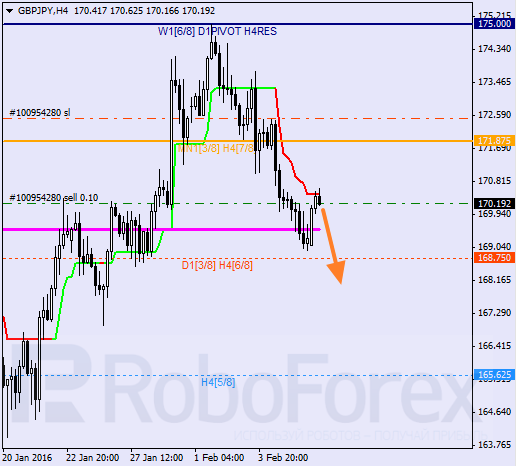

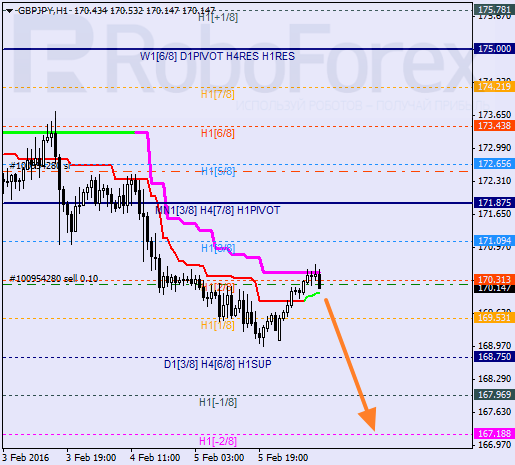

GBP JPY, “Great Britain Pound vs Japanese Yen”

The pair is moving between Super Trends. Earlier, the price rebounded from the 8/8 level and started a new descending correction. If the market is able to stay below the 6/8 level, it may resume its descending movement.

At the H1 chart, the local correction has been supported by the 2/8 level. If later the pair is able to stay under Super Trends, the price may continue falling and break the 0/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.