Analysis for January 27th, 2015

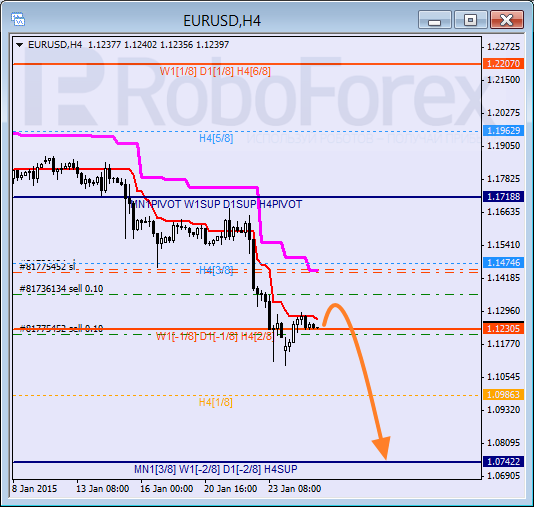

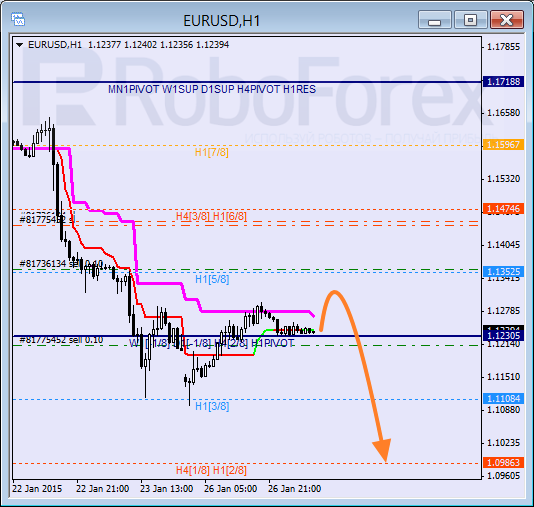

EURUSD, “Euro vs US Dollar”

The lines at the H4 chart have been redrawn. The price is still supported by Super Trends. Probably, after completing a local correction the market may be able to stay below the 2/8 level and continue falling towards the 0/8 one.

The price is moving in the middle of the H1 chart. Probably, in the nearest future the price may try to test the 5/8 level. If the market rebounds from it, the pair will continue falling. I’m planning to open one more sell order after the market stays below Super Trends.

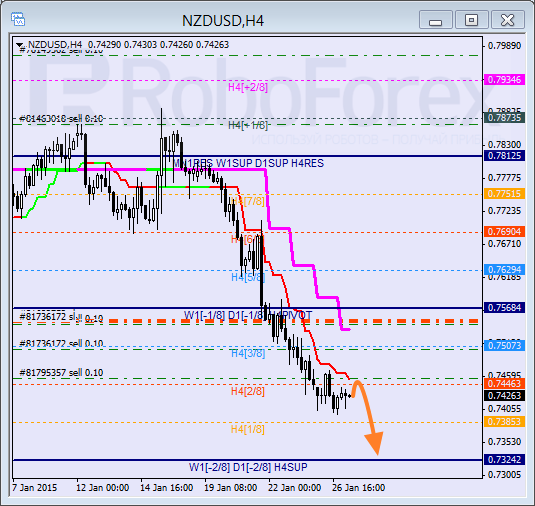

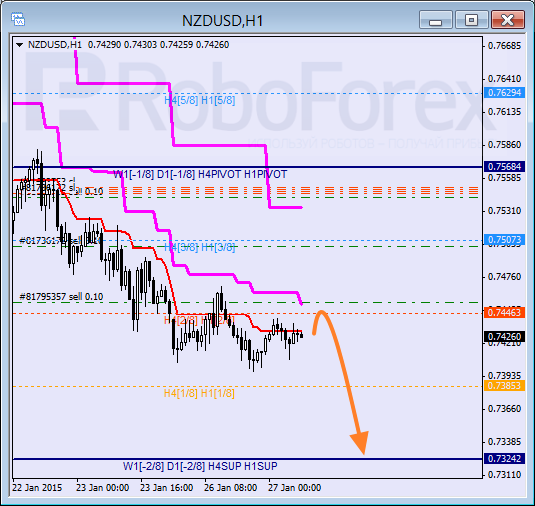

NZDUSD, “New Zealand Dollar vs US Dollar”

Day after day, New Zealand Dollar reaches new lows. Earlier Super Trends formed “bearish cross”. Considering that the market is already moving below the 3/8 level, later it is expected to reach the 0/8 one.

The lines at the H4 and H1 charts are completely the same. Possibly, the pair may break its local minimum during the day. I’m planning to open another sell order when the pair rebounds from Super Trends.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.