Analysis for October 7th, 2015

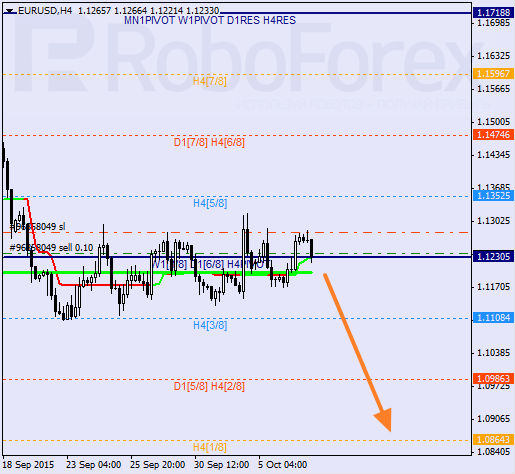

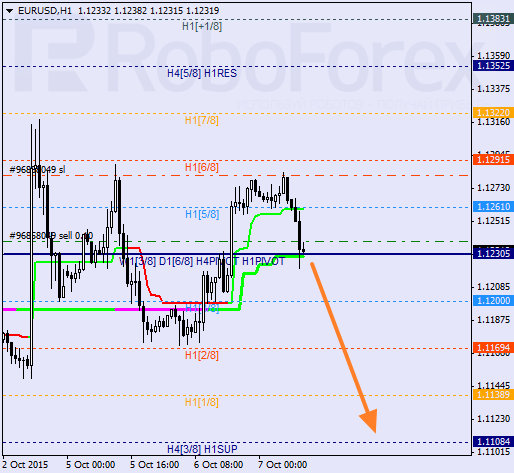

EURUSD, “Euro vs US Dollar”

Eurodollar is still consolidating. As soon as the price is able to stay under Super Trends, it will resume moving downwards. If later the pair breaks the 3/8 level and stays below it, the market will continue moving downwards to reach the 1/8 level or even the 0/8 one.

At the H1 chart, the pair also is moving in the middle. Possibly, Super Trends may form “bearish cross” during the day. I’m planning to open another sell order after the price breaks the 3/8 level and stays below it.

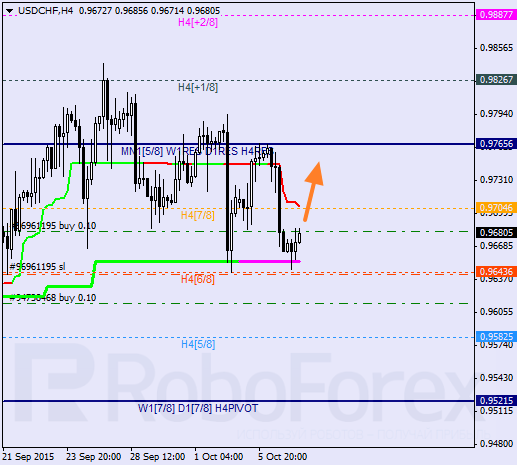

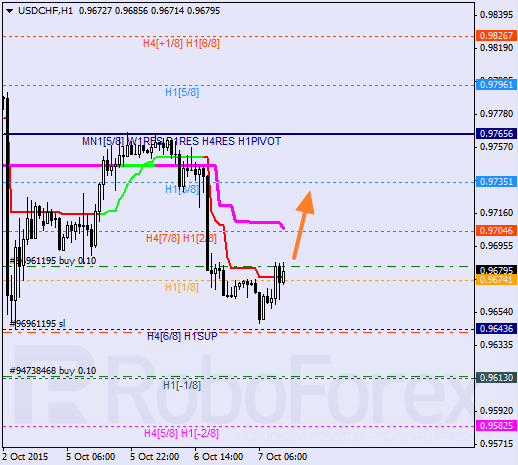

USDCHF, “US Dollar vs Swiss Franc”

Franc has rebounded from the daily Super Trend twice. In addition to that, the price has been supported by the 6/8 level, which means that it may resume moving upwards. I’m planning to increase my position after the price stays above Super Trends.

At the H1 chart, the pair is trying to rebound from the 0/8 level. If Super Trends form “bullish cross” in the nearest future, the market may resume growing. It’s highly likely, that the price may try to breaks the 4/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

GBP/USD drifts lower for the third straight day on Tuesday and drops to its lowest level since November 17 during the Asian session. Spot prices trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

EUR/USD falls toward 1.0600 on higher expectations of the Fed prolonging higher rates

EUR/USD continues to lose ground for the sixth successive session, trading near 1.0610 during the Asian hours on Tuesday. The elevated US Dollar is exerting pressure on the pair, potentially influenced by the higher US Treasury yields.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

The week ahead: Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.