Analysis for March 26th, 2015

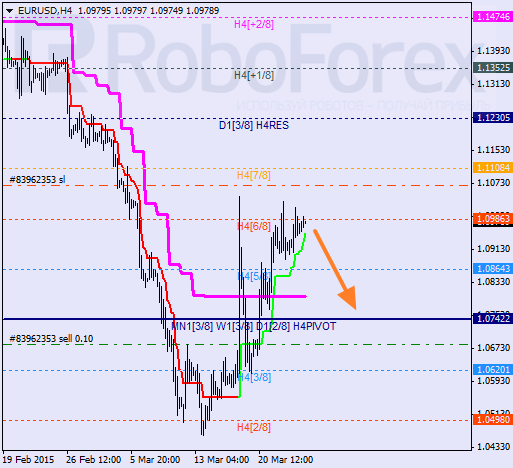

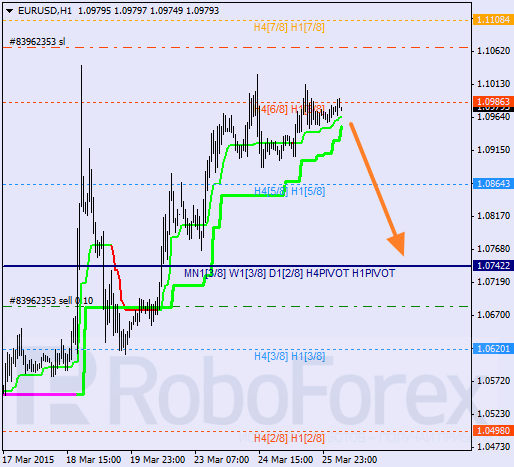

EUUSD, “Euro vs US Dollar”

The market continues testing the 6/8 level. Earlier the price started a correction from the 2/8 level, which means that the market may resume moving downwards. This is why I keep holding my sell order.

The lines at the H4 and H1 charts are completely the same. The pair hasn’t been able to stay above the 6/8 again. I’m planning to open another sell order as soon as the price breaks Super Trends and stays below them.

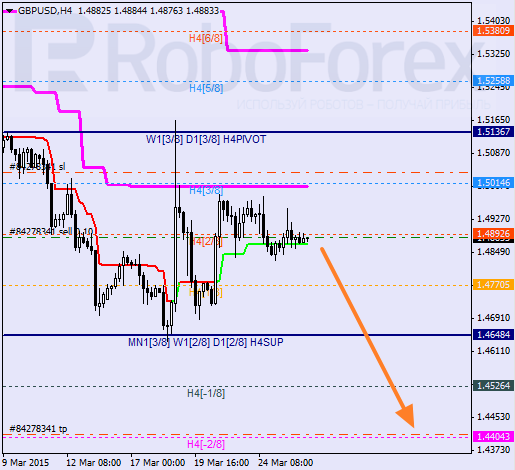

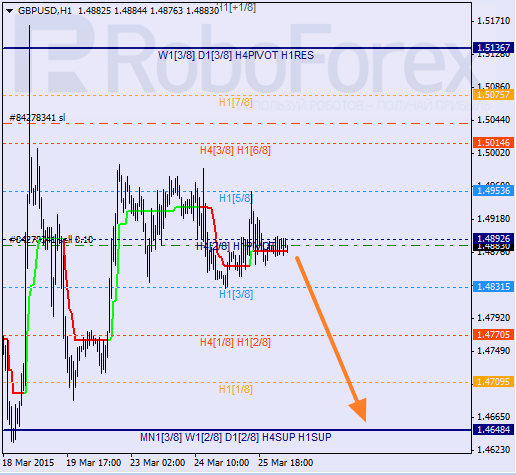

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is still consolidating. Earlier the price rebounded from the 4/8 level and right now is moving between Super Trends. If the market is able to stay below the 2/8 level, it may continue falling to break the 0/8 one.

The par is moving in the middle of the H1 chart close to the 4/8 level. It bears are able to break the 3/8 level and keep the price below it, the next target will be at the 0/8 one. I’m planning to move the stop loss to breakeven when the pair breaks a local low.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.