Analysis for October 31st, 2014

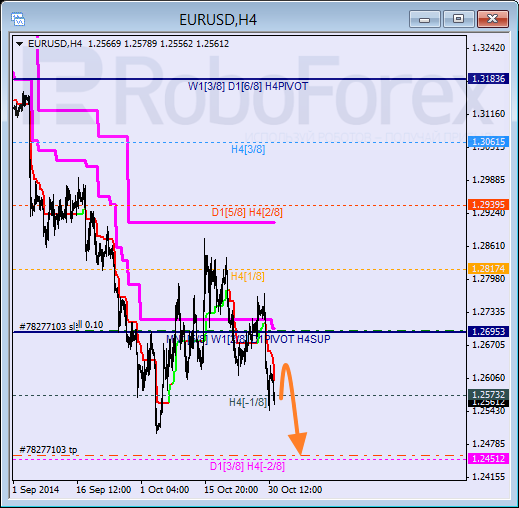

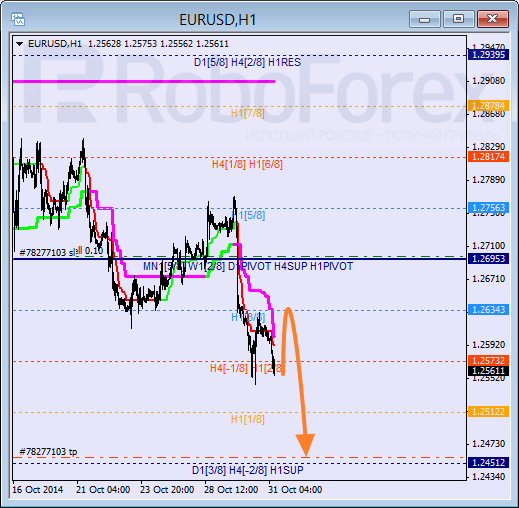

EURUSD, “Euro vs US Dollar”

Eurodollar is attempting to rebound from the -1/8 level. If it succeeds, the pair may start a short-term correction. The price is unlikely to move far away from the H4 Super Trends, but we shouldn’t rule out the possibility that it may try to test the 0/8 level. The target for the next several days is at the -2/8 level.

At the H1 chart, the price is trying to rebound from the 2/8 level; Super Trends are still influenced by “bearish cross”. Considering that the market is already moving below the 3/8 level quite steadily, the next target is expected to be at the 0/8 one.

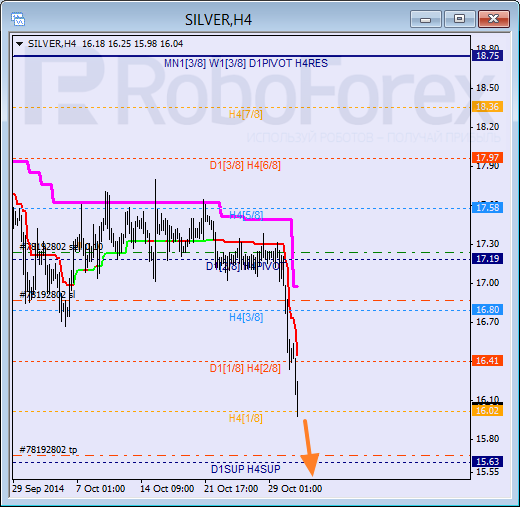

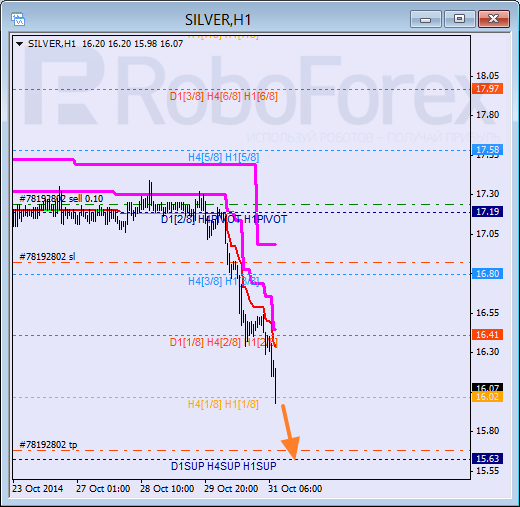

XAGUSD, “Silver vs US Dollar”

Silver has started a fast descending movement. If the price doesn’t rebound from the 1/8 level in the nearest future, it may reach the 0/8 one and then start a correction. On the other hand, if bears aren’t able to break the 1/8 level, I’m planning to close my order.

At the H1 chart, the situation is similar. The market is falling and supported by Super Trends, from which it has already rebounded several times. The stop loss on my sell order is already a bit profitable, but all attention now is drawn to the way the price will behave at the 1/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.