Analysis for November 21st, 2014

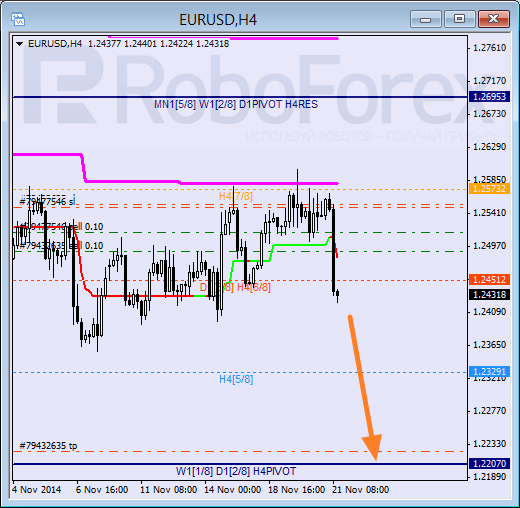

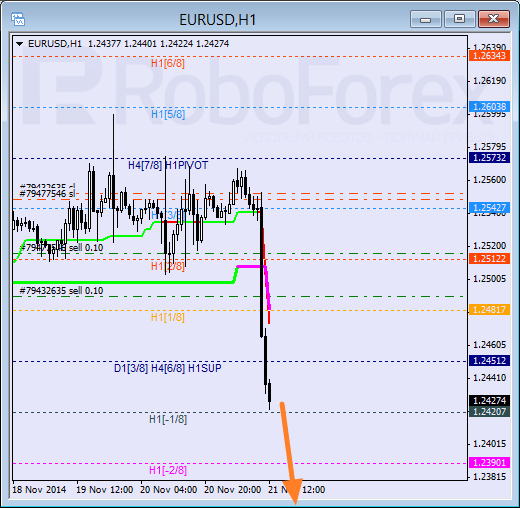

EUR USD, “Euro vs US Dollar”

Yesterday, after rebounding from the daily Super Trend several times, Eurodollar started falling again. Right now, the price is already moving below the H4 Super Trend, which means that bears may return to the market. In this situation, the pair is expected to continue falling towards the 4/8 level.

As we can see at the H1 chart, Super Trends have formed “bearish cross” and the price has been able to stay inside “oversold zone”. In the future, the market may form a correction towards the 0/8 level, but if later the pair rebounds from it, bears will continue pushing the price towards the -2/8 one.

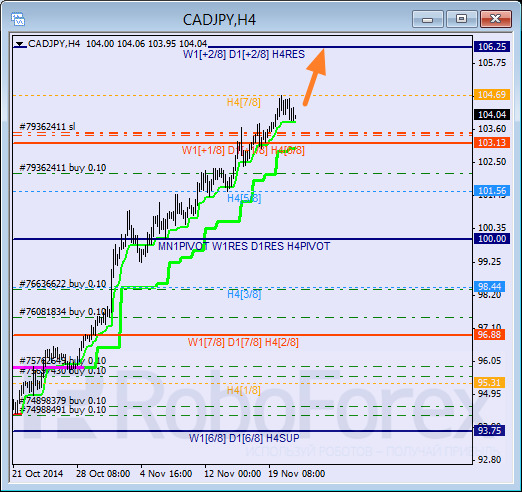

CAD JPY, “Canadian Dollar vs Japanese Yen”

Despite a rebound from the 7/8 level, I’m holding all my sell orders, because the price is moving above Super Trends. If the pair breaks them, I’ll close my orders “manually”, because the market may start a more serious correction.

The H1 chart also confirms the scenario according to which the price may continue growing. After rebounding from the 8/8 level, the pair was supported by the 6/8 one and right now is trying to rebound from it. Consequently, if later the price is able to stay above Super Trends, I’m planning to increase my long position.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.