Analysis for August 22nd, 2014

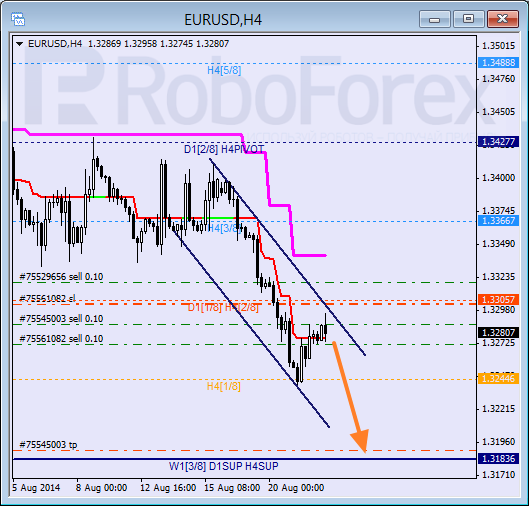

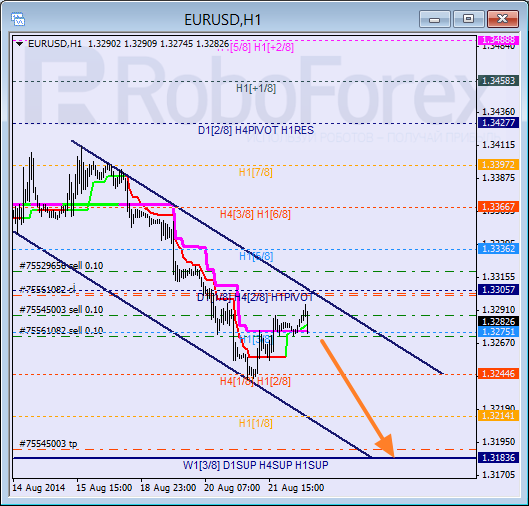

EURUSD, “Euro vs US Dollar”

Despite the fact that Euro rebounded from the 1/8 level and started a new correction, the main trend remains bearish. Considering that the market is moving between Super Trends, the risks are rising, that’s why I decided to decrease the total volume of my position and recorded the profit for my very first sell orders. If later bears are able to regain the initiative and keep the price below the H1 Super Trend, I’ll increase my short position.

As we can see at the H1 chart, the current correction started after rebounding from the 2/8 level, which means that the market may start a new descending movement, although reverses hardly ever occur here. If later bears are able to keep the price below the 3/8 level, the pair may start falling towards the 0/8 one.

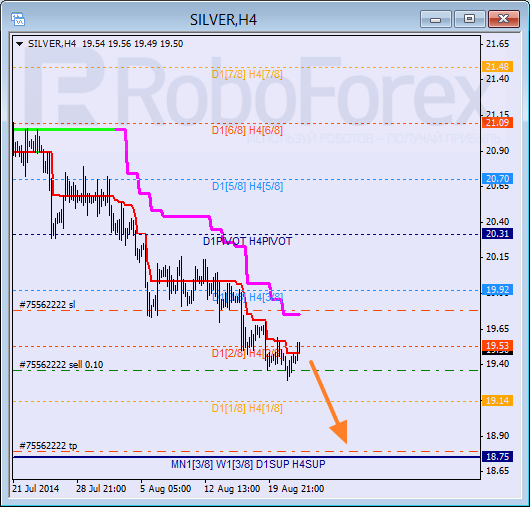

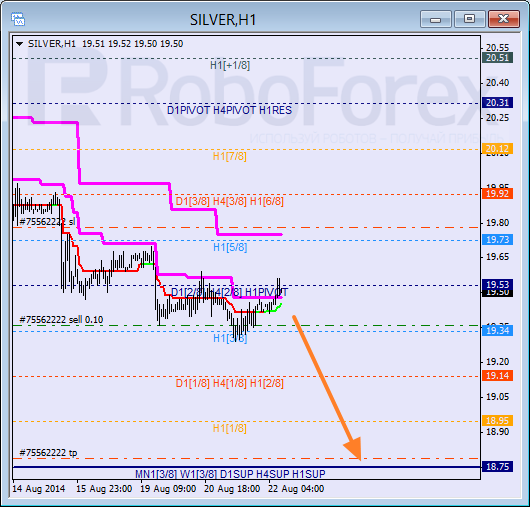

XAGUSD, “Silver vs US Dollar”

Silver is still supported by H4 Super Trend. If bears are able to rebound from it again this time, the price may reach the 0/8 level and then start a new and deeper correction.

As we can see at the H1 chart, the market got very close to the 4/8 level and now the future scenario depends on how it will move near this level. Taking into account that Super Trends are still influenced by “bearish cross”, the current downtrend is expected to continue. But if the market breaks the 5/8 level, it will be a disastrous for sellers – in this case the price is very unlikely to reach the 0/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.