Analysis for April 18th, 2014

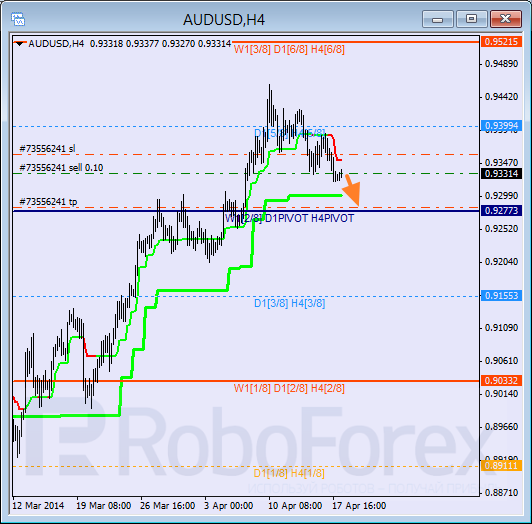

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is moving below H4 Super Trend, which means that current correction may yet continue. Possibly, in the nearest future price may test the 4/8 level. If market breaks this level, it may continue falling down.

As we can see at H1 chart, Super Trends formed “bearish cross”; price is supported by the 2/8 level, from which it rebounded earlier. Most likely, in the nearest future pair will fall down towards the 0/8 level, where I placed Take Profit on my sell order.

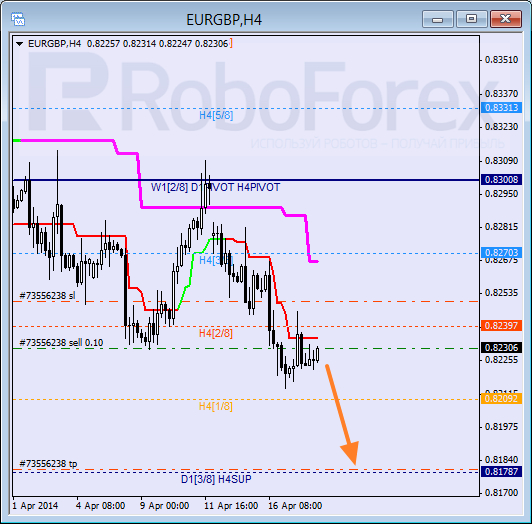

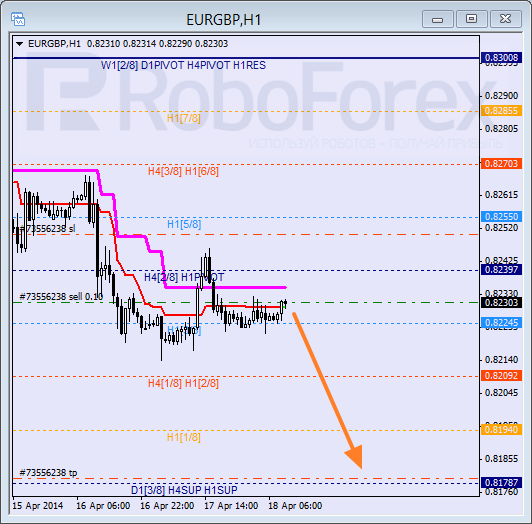

EUR GBP, “Euro vs Great Britain Pound”

It’s quite interesting that the lines at H4 chart of EUR GBP are the same as the lines at H4 chart of AUD USD. Earlier pair rebounded from the 4/8 level and started new descending movement. Target for the next several hours is at the 0/8 level.

At H1 chart, price is trying to stay below the 3/8 level. If it succeeds, pair will continue falling down towards the 0/8 level. If later market rebounds from it, pair may start more serious correction.

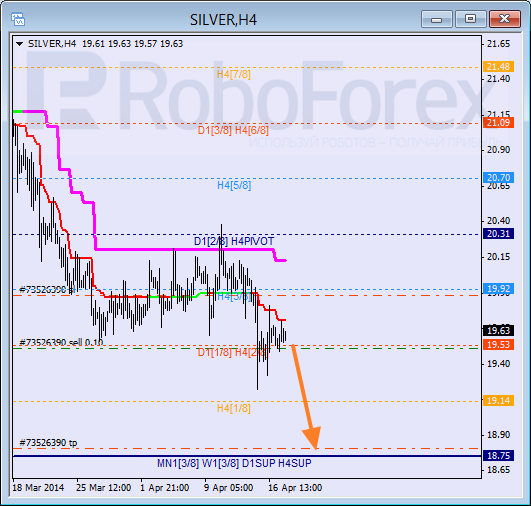

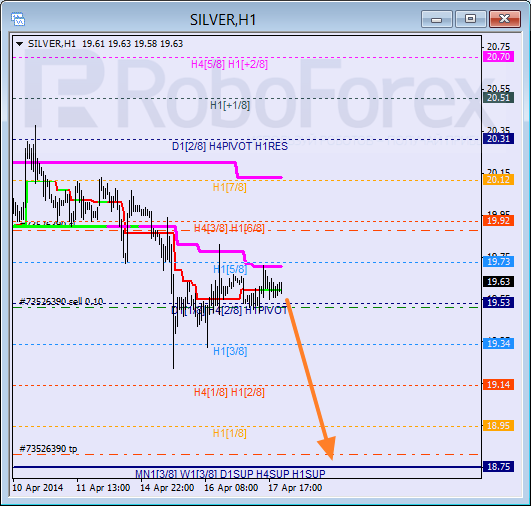

XAG USD, “Silver vs US Dollar”

After rebounding from the 4/8 level and daily Super Trend, Silver started falling down again. Most likely, market will continue moving downwards after completing local correction. Target for the next several days is at the 0/8 level.

Instrument is moving in the middle of H1 chart. If later Silver is able to stay below the 3/8 level, price will continue falling down and may reach the 0/8 one in the nearest future.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.