Atlanta Fed’s Lockhart Speaks:

A hump day interview with the Federal Reserve Bank of Atlanta President Dennis Lockhart gave USDX bulls something to cheer about, indicating that the US economy is ready for its first increase in interest rates for nearly 10 years.

After St Louis Fed President James Bullard said on Monday that “We’re in good shape to lift rates in September”, Lockhart has added to the chorus of Fed officials calling for a September liftoff. Lockhart is especially important as he is considered a ‘centrist’ among Fed officials, making his often swinging opinion all that the more important.

“It will take a significant deterioration in the economic picture for me to be disinclined to move ahead.”

“My priors going into the [September] meeting as of today are that the economy is ready and it is an appropriate time to make a change.”

You can read more of the WSJ article from Hilsenrath here. (And remember if it comes up gated, just copy and paste the headline into Google News.

RBA Holds Strong:

The ‘no change’ in yesterday’s Cash Rate was widely expected, but it was the removal of the ‘jawboning’ or talking down the Aussie Dollar and rates that kicked AUD/USD into gear. The Aussie rallied over 100 pips yesterday on the back of better than expected Retail Sales and Trade Balance data, with the removal of the easing bias from the RBA’s statement the kicker.

In our RBA Preview yesterday morning, we spoke of what could be considered ‘fair value’ for AUD/USD as well as how tiresome the jawboning from Stevens has become. At these levels and with economic data starting to pick up again, the threats have been hollow and we’ve even seen the Aussie spike up on any attempt to jawbone it down. The market called the RBA’s bluff and they duly conceded.

Stevens is surely sitting back in his big leather office chair with one leg crossed looking out over Martin Place in Sydney saying ‘Over to you now Janet’. Probably.

Lastly on the Aussie, I know a few of you love to hate anything Terry McCrann writes after his seemingly arrogant, inside knowledge reported a few months ago. Here’s T-Dogs’ latest piece for the Herald Sun. Personally, I liked him more when he was making outlandish predictions (that were on the money mind you) about the direction of Australian monetary policy.

———-

On the Calendar Wednesday:

NZD Employment Change q/q (-0.3% v 0.5% expected)

NZD Unemployment Rate (5.9% v 5.9% expected)

CNY Caixin Services PMI

GBP Services PMI

USD ADP Non-Farm Employment Change

CAD Trade Balance

USD Trade Balance

USD ISM Non-Manufacturing PMI

———-

Chart of the Day:

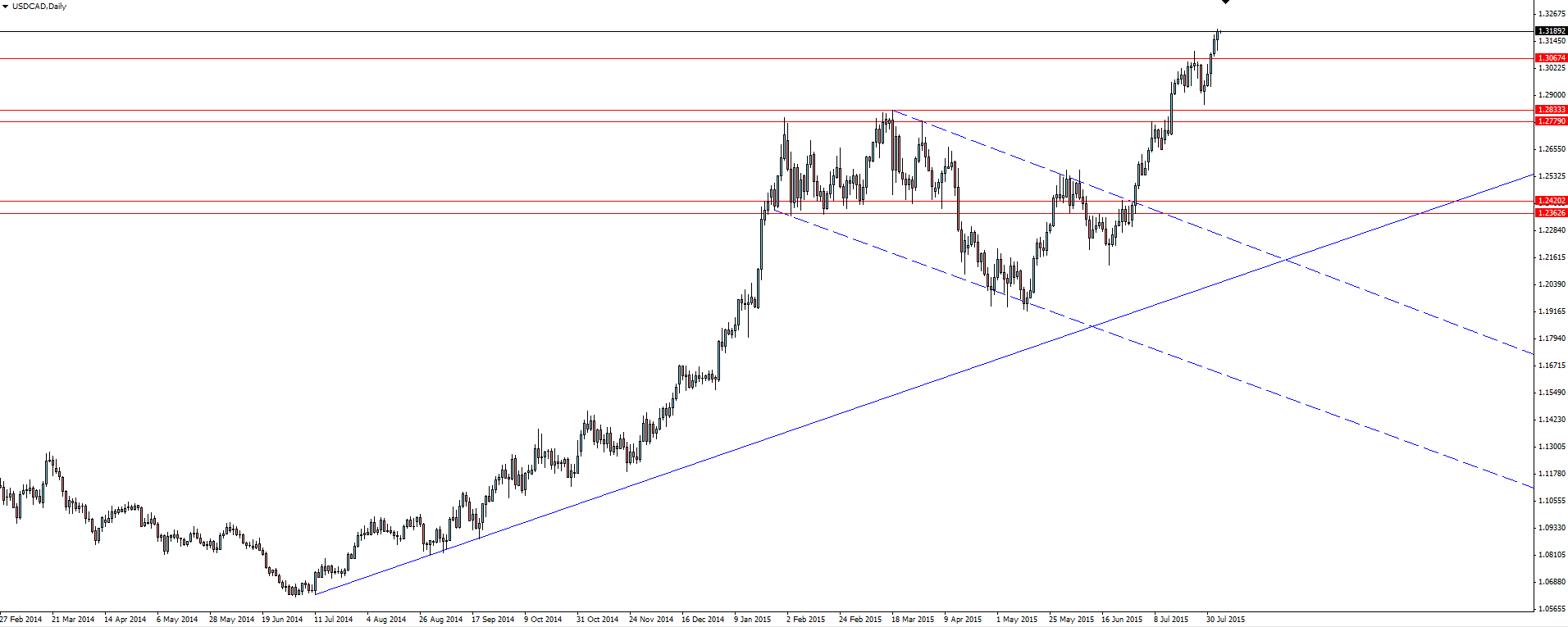

Yet more fresh new highs for USD/CAD. This thing has gone completely parabolic with no sign of slowing down.

USD/CAD Daily:

Click on chart to see a larger view.

This chart shows the power of Forex trading in giving you the ability to let your winners ride. If you remember back to April, in the Vantage FX News Centre we were discussing buying at good levels over 1000 pips ago. If you were following on Twitter, we took it up to our target at the top of the short term channel/flag for 500 pips, but look at what was possible if you had left even a single lot open.

So many Forex traders fail because they don’t have the discipline to compound winning positions or let a portion of them ride. Do some study on this USD/CAD move and try to identify key areas where you could have added to your position, either risk free or keeping your risk the same as when you made your original entry.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.