Minister No More:

The big news overnight out of Europe was the resignation of Greek Finance Minister Yanis Varoufakis. You can read a short statement posted on his personal blog aptly titled Minister No More.

“Soon after the announcement of the referendum results, I was made aware of a certain preference by some Eurogroup participants, and assorted ‘partners’, for my… ‘absence’ from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement. For this reason I am leaving the Ministry of Finance today.”

Obviously nudged out of the job his ideals maybe never quite fit into. Varoufakis has earned the respect of his people for not backing down and resigning Greece to a tunnel of austerity with no light at the end.

“And I shall wear the creditors’ loathing with pride.”

Tell us what you really think Yanis!

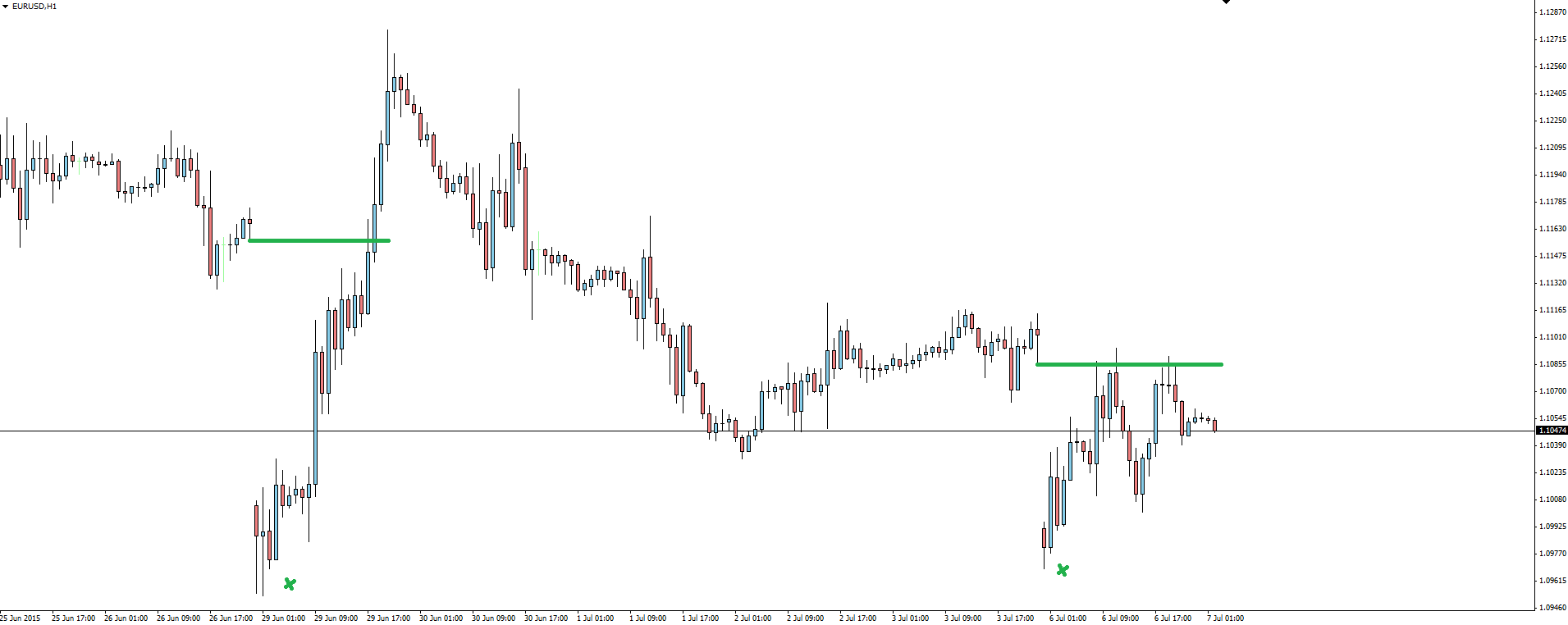

EUR/USD Hourly:

Click on chart to see a larger view.

Markets interpreted the news as Euro positive and the weekend panic gap was once again closed early in the week. These gap trades have been very quick and free of drawdown if you had the guts to trade against the consensus of panic.

Whether new man Euclid Tsakalotos, who is reportedly idealogically further left than Varoufakis and very much a believer of Greece’s place in the Eurozone will mean progress in negotiations is yet to be seen. I wish him luck.

RBA Tuesday:

The Reserve Bank hold their monthly Monetary Policy meeting in Sydney today with the cash rate expected to remain on hold. With the cash rate already having been cut by 25bp in both February and May, it now sits at a record low 2.00%. Is it too soon to cut again?

More interesting to today’s trading will be whether the easing bias will be made more explicit. With economic growth continuing to stagnate in Australia and Greek uncertainty pushing back the likelihood of the Fed doing some of the work for him, Stevens may feel pressured to give the Aussie a bit more of a nudge lower.

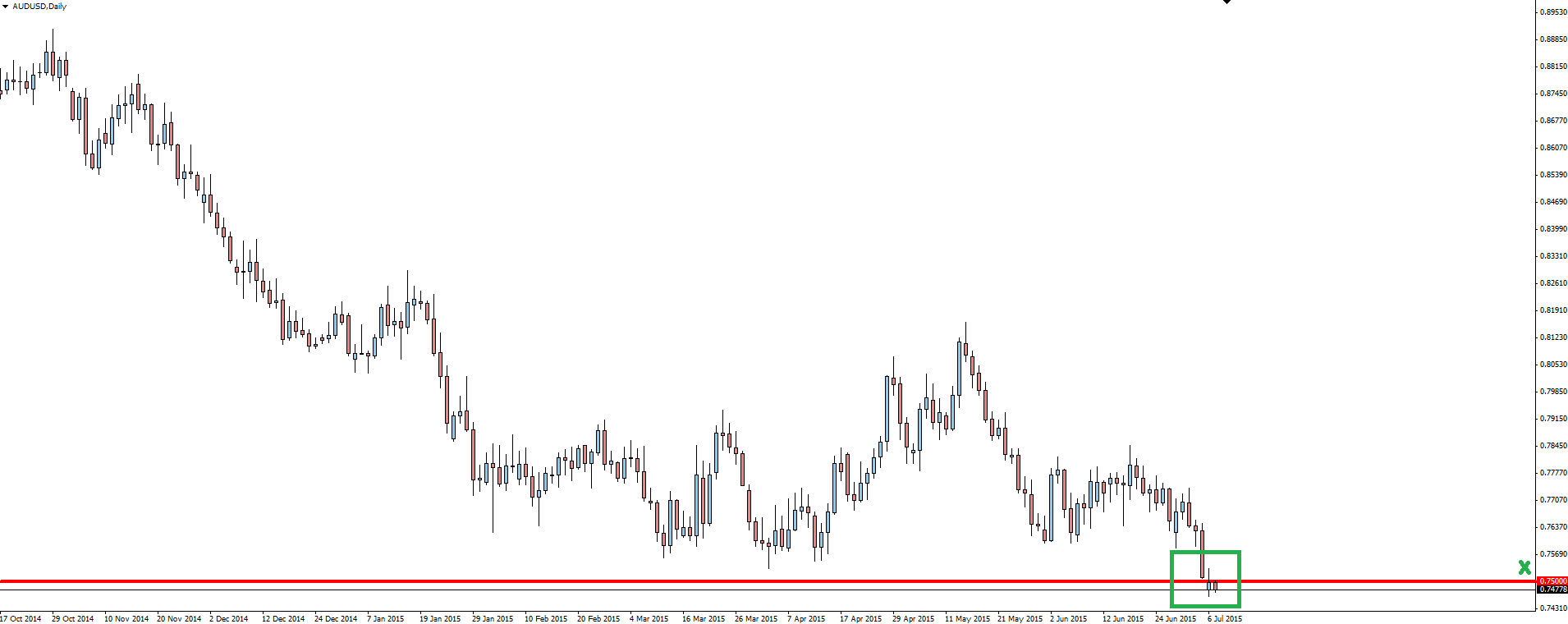

AUD/USD Daily:

Click on chart to see a larger view.

The fact that price is now testing (well broken but the gap down makes me wary) major 75 cent support heading into the decision has been talked about around Twitter as possible front running of a surprise cut, but consensus says Stevens will only look to give it a jawboning down today.

Elsewhere in Asian markets, China continues to attempt to boost it’s correcting stock market, this time with a new stock-stabilization fund, a moratorium on new issues and a liquidity pledge from the central bank.

With yet more fresh liquidity being pumped into the Chinese market, once the uncertainty settles down, this should be AUD positive. However, if investors choked up on margin debt start to see their positions all unwind at once, things could also get ugly fast.

A nice side narrative (for now) to follow which could potentially have FAR greater implications on markets than Greece.

———-

On the Calendar Today:

I’m very interested in watching price action heading into the RBA decision this afternoon. With this heavy price action leading into the decision, the old saying of where there’s smoke, there’s fire comes up. Aussie longs, take note.

Tuesday:

AUD Cash Rate

AUD RBA Rate Statement

GBP Manufacturing Production

EUR Eurogroup Meetings

EUR Euro Summit

CAD Trade Balance

USD Trade Balance

———-

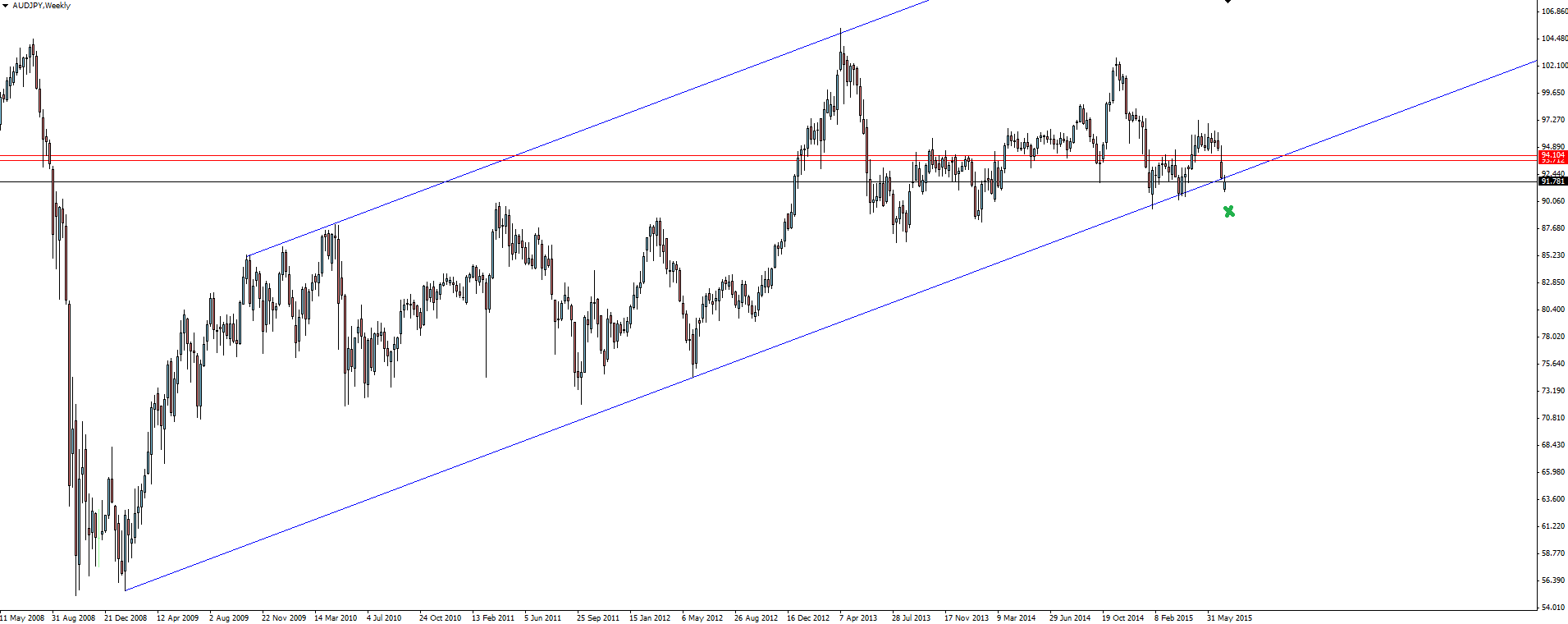

Chart of the Day:

On RBA Teusday, we take a look at one of the Aussie crosses sitting at major channel support level dating back to 2009.

AUD/JPY Weekly:

Click on chart to see a larger view.

Price has broken through weekly channel support on the weekly open but the fact it was a gap through the level doesn’t confirm the break for me. I instead see this as still sitting on support. Either way, today’s RBA decision will be the catalyst for a break or bounce.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.