Default:

With Eurozone finance ministers refusing to budge on any last minute extensions of the Greek bailout program, Greece this morning became the first ‘advanced economy’ to default and is the first country to miss an IMF loan payment since Zimbabwe in 2001. Not exactly illustrious company there.

From The Associated Press this morning:

“BREAKING: Greece’s international bailout formally expires, country loses access to existing financing.”

“BREAKING: IMF confirms debt due by Greece has not been paid, Greece officially in arrears.”

“MORE: IMF: Greece misses $1.8 billion payment, becomes first advanced economy to default on IMF loan.”

Ratings agency Fitch, slashed Greece’s already junk status from CCC to CC. With some debate and questions still about on what officially constitutes an official ‘default’, this CC rating is only a single notch above the level where the ratings agency says default is inevitable.

“The breakdown of the negotiations between the Greek government and its creditors has significantly increased the risk that Greece will not be able to honour its debt obligations in the coming months, including bonds held by the private sector.”

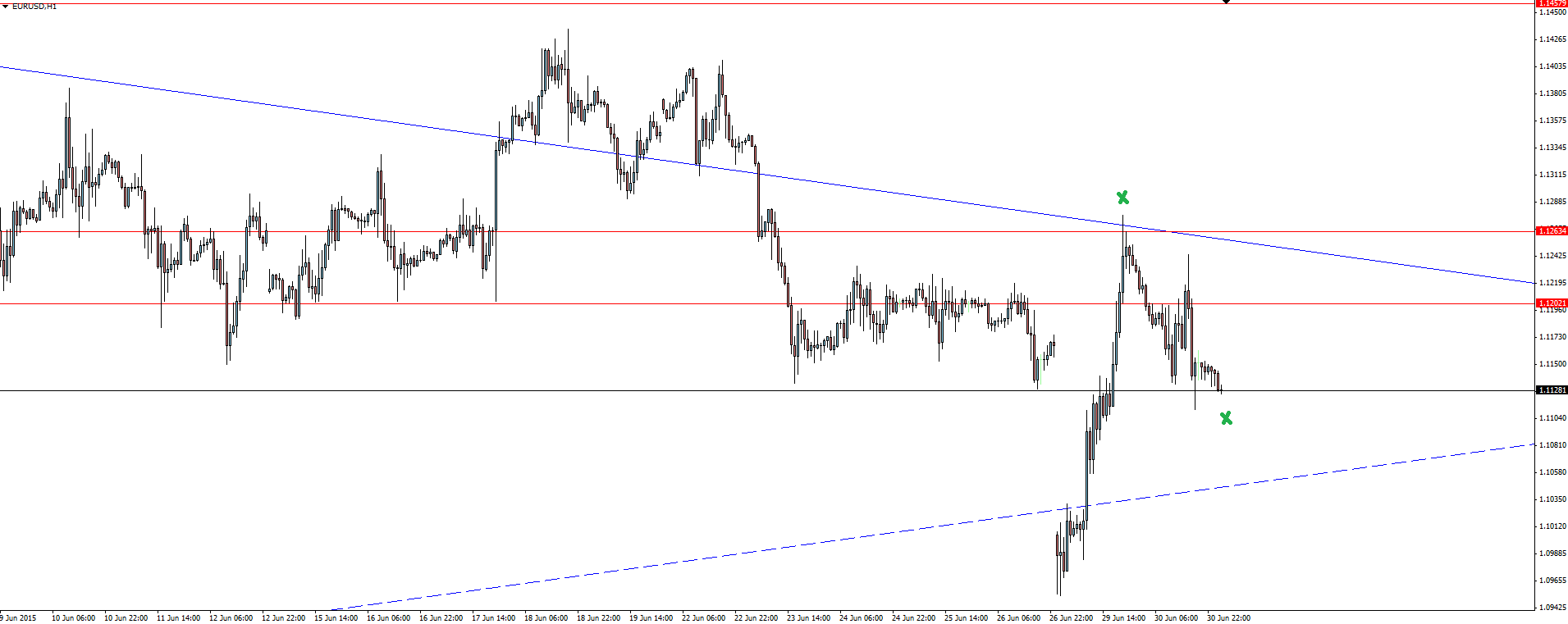

EUR/USD Hourly:

Click on chart to see a larger view.

The Euro received an injection of end of month short covering after it’s questionable rally to open the week, pulling back to the 50% fib level of the move. I still think that this could have more to run on the long side but I can’t play it with conviction so I’ll step aside again.

All we can now do is wait for the Greek referendum on their presence in the Eurozone and go from there.

———-

On the Calendar Today:

A busy one on the data front today with a flood of news releases throughout the 3 major sessions.

Also wishing a happy Canada Day to all our Canadian traders out there. Enjoy your day off!

Wednesday:

CNY Manufacturing PMI

AUD Building Approvals

CNY HSBC Final Manufacturing PMI

EUR Eurogroup Meetings

GBP Manufacturing PMI

GBP BOE Gov Carney Speaks

CAD Bank Holiday

USD ADP Non-Farm Employment Change

USD ISM Manufacturing PMI

———-

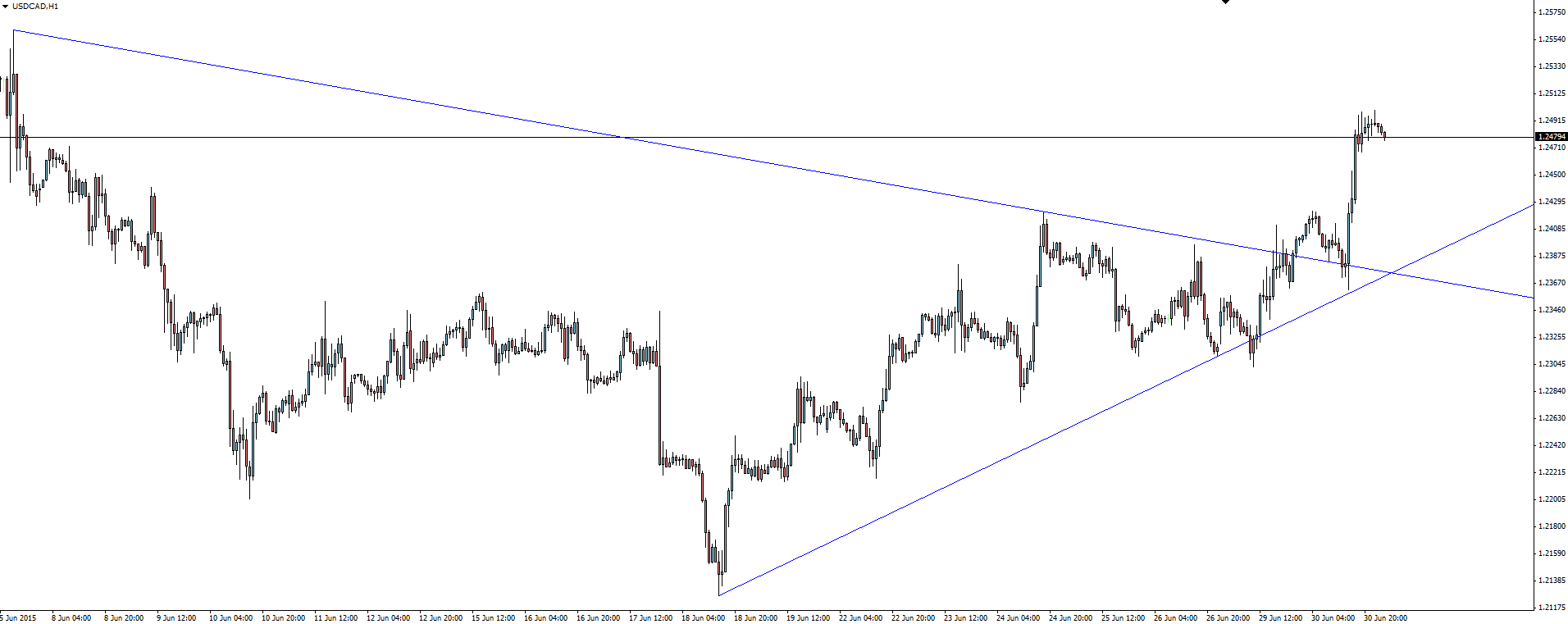

Chart of the Day:

We couldn’t pass up having a look at USD/CAD on Canada day, could we?

USD/CAD Daily:

Click on chart to see a larger view.

The daily chart has price testing and at least starting to break out of it’s short term flag and possibly resuming it’s major bullish trend. I say starting to break out because the long wicks at the previous test of this level shows that sellers will look to take back control in this zone.

USD/CAD Hourly:

Click on chart to see a larger view.

Drilling down to the hourly chart, the short term structure of the break out was very textbook with a break out of resistance followed by a retest of previous resistance as support before price took off.

At this stage, it’s a setup to add to your trading journal and a pattern to keep an eye on for next time.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

GBP/USD posts modest gains above 1.2450, BoE policymaker dampens hopes of summer rates cut

The GBP/USD pair recovers to 1.2450 during the early Wednesday. The downbeat US April PMI data and increasing appetite for the risk-linked space exert some selling pressure on the US Dollar.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.