New Years Eve:

Well Financial New Years Eve anyway!

Just like today’s featured image, we should get some fireworks over Athens as the June 30 deadline passes and Greece officially defaults on its €1.6 billion debt to the IMF tonight.

With many European policymakers trying to downplay the impact of a Greek default on markets, the fact of the matter is we still just don’t know what the effect is going to be and how far the toxic damage will spread.

After gapping down 200 pips on the Asian open, price immediately set out to fill the gap, achieving that goal and then managing to squeeze up to 1.1270. Yes the Euro managed to recover all of its early losses and then actually added to its rally!

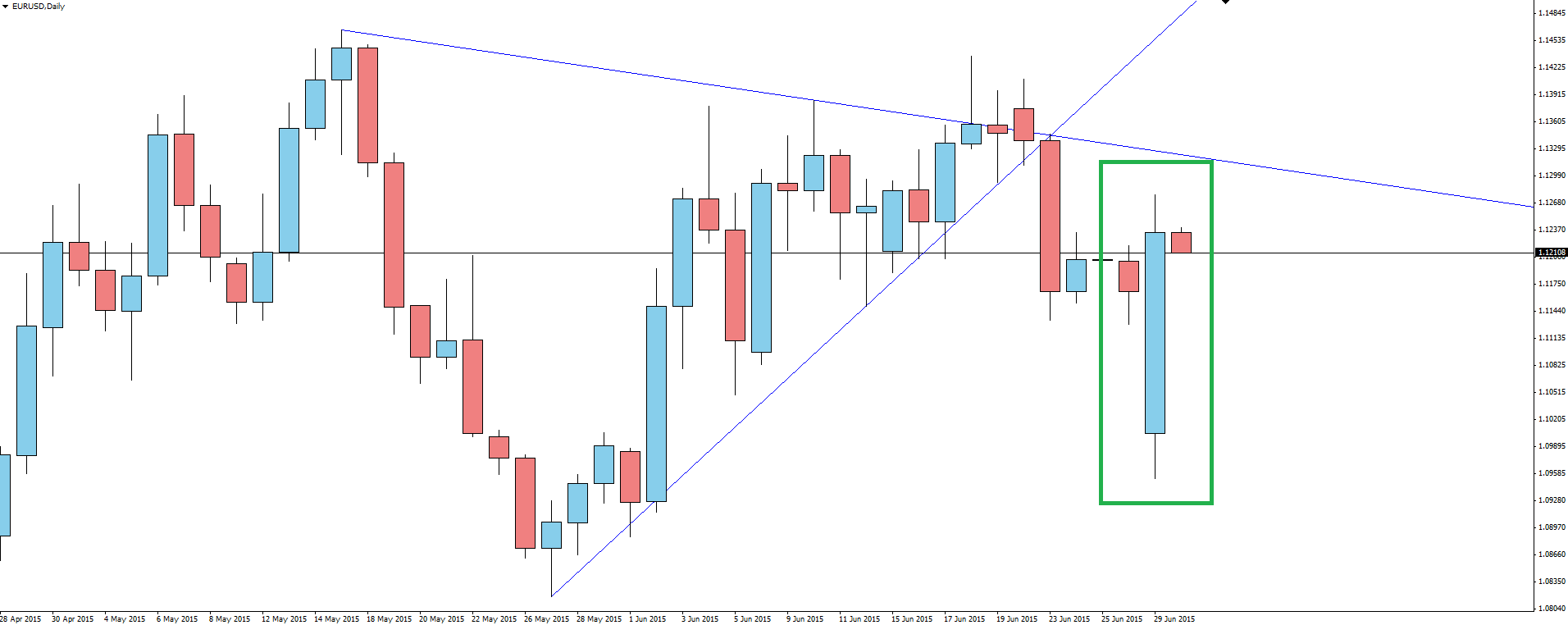

EUR/USD Daily:

Click on chart to see a larger view.

As I asked on Twitter this morning, what sort of candle pattern is that? I’ve seen it described as one hell of a bullish engulfing candle? Honestly, it just shows how technicals go out the window when trading becomes irrational on the back of this type of event risk.

So Why is the Euro rallying?

First of all it’s just a simple short squeeze. The dumb money is being absorbed by the smart and price is being pushed up with no clear news to yet sell off on.

Secondly, with interest rates in Euro at record lows (featuring a negative deposit rate where it COSTS YOU to park YOUR money in the bank), money flows from the Euro zone in a cliche carry trade. In times such as this, that carry trade has to be unwound and we are seeing the effects of that as that money comes back into the Eurozone.

Lastly, and this to me is the most important one, yet seems to have been forgotten among the headlines. Will the Fed still be in a rush to raise rates? In times of uncertainty, a wait and see approach carries the least risk and Yellen could choose to take this path. Watch the Euro squeeze run if we get a terrible NFP miss come Friday!

With the ‘dumb money’ getting short on Monday, it’s one of those times where it looks as though the squeeze has more legs in it and new swing highs are in sight. But with today being deadline day, I can’t lean either way with any sort of conviction.

———-

On the Calendar Today:

The only tier 1 data release this morning is out of New Zealand and with a weak Kiwi sitting at support, it will be interesting to see what happens. At this level the greater risk seems to be to the short side, but it’ll be interesting to see how the level reacts if the number misses.

Later on in the evening, RBA Governor Stevens is speaking at the Official Monetary and Financial Institutions Forum in London followed by US Consumer Confidence. It is NFP week after all!

And of course Greek default headlines once again trump data releases when it comes to event risk.

Tuesday:

NZD ANZ Business Confidence

GBP Current Account

AUD RBA Gov Stevens Speaks

CAD GDP

USD CB Consumer Confidence

———-

Chart of the Day:

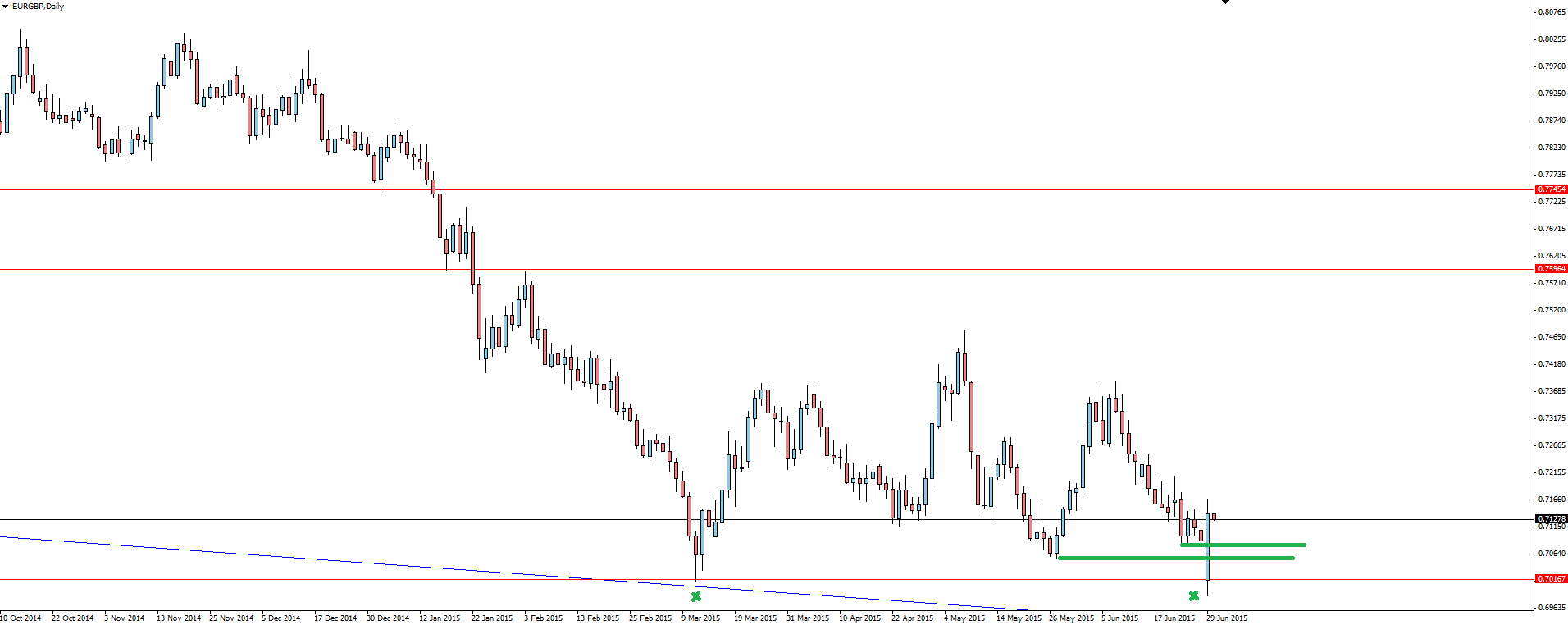

Keeping with the Euro theme, we take a look at the EUR/GBP cross with a weekly channel that has been in play for a couple of years now.

EUR/GBP Weekly:

Click on chart to see a larger view.

As with all channels, the lower support line is a little subjective as it is just a parallel line drawn from trend line resistance that price has bounced off nicely. The fact that in February price obeyed the lower line as support and spiked up off it to me shows that the level is active.

EUR/GBP Daily:

Click on chart to see a larger view.

With the Euro weakness theme hovering about, the pair wasn’t able to bounce off lows and following the weekend gap down, opened right on top of hourly swing lows. The fact price kicked off this level as well as it did is a technical move as much as anything and with a potential double bottom now in play, you have a clear zone to manage your risk around with plenty of upside potential.

If price moves back above the short term broken support lines on that chart, watch for buying to intensify.

Recommended Content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.