Morning Recap:

Here we are already at the end of our Good Friday shortened week!

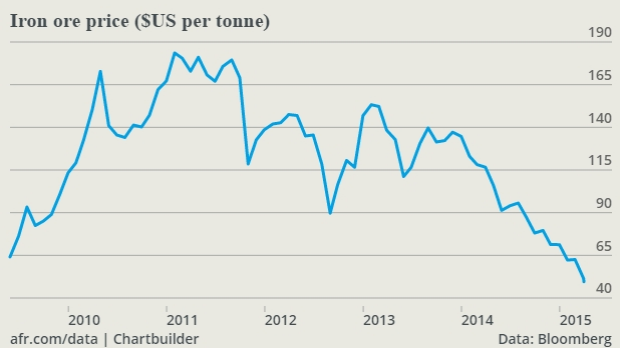

First up, overnight the price of Iron Ore was still the big issue for Asian traders. Markets are still concerned about growth in the Chinese economy and compounded by over an over supply of Iron Ore, the price of the commodity was again hammered. As you can see in the data below from Bloomberg, it’s been almost all downhill for the last couple of years, with falls exaggerated more recently:

The supply issue isn’t going anywhere and the big players still have room to move on price, as Westpac’s Justin Smirk notes:

“As noted, BHP and Rio Tinto can deliver into the Chinese market for around $US40 per tonne and have an objective to drive costs even lower.”

It’s tough for the junior miner’s but it’s good business if you’re BHP or Rio…

On the back of this, combined with the general market consensus that the RBA will cut rates next week, the Aussie was one of the hardest hit. The bears are fully in control here. Be careful swimming against the tide in this sort of environment.

Heading to the US, the overnight fall in the ADP Employment Change and Manufacturing ISM indicate that the risk is more so to the downside for Good Friday’s NFP. It’s also another miss on a key economic growth indicator while the FED is still considering the issue of when to raise rates.

Neither of these data releases were huge market movers, with ranges of only around 50 pips on the majors. Price is also still capped inside the FOMC bar I was speaking about on Twitter earlier in the week. It’s all about NFP tomorrow night.

Make sure you have your seat belts on, it’s going to be a wild one!

On the Calendar Today:

Light one during Asia but we are starting to ramp up the US releases into NFP tomorrow. I’m thinking that like yesterday, we aren’t going to get huge swings on the back of these pre-NFP numbers and it could be a good opportunity to position yourself heading into tomorrow.

Thursday:

AUD Trade Balance

GBP Construction PMI

USD Trade Balance

USD Unemployment Claims

Chart of the Day:

Click on chart to see a larger view.

We were talking about this candle yesterday on Twitter after the Chinese Manufacturing data release and AUD/USD sold off from there. Price spiked back up on the US data misses overnight, but with NFP tomorrow, it’s the domestic and Chinese issues that are keeping it well offered.

So long as price is at lows like it is now, it’s always a risk to be a seller. But getting in early and playing for the break lower could be the play if you believe in the Iron Ore and RBA stories above.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.