Dollar Index surged to 96.60 during the US session as Euro Dollar tumbled to an 11-year low. Other majors also fell against the Dollar. US economic data performed slightly weaker than forecasted probably affected by the severe cold strong in the Northeast. The weekly unemployment claims rose to 320K. This marks the first time in nine months that the claim was higher than 300K. Also, factory orders fell by 0.2% versus an expected 0.2% expansion. It is the sixth consecutive contract of this data, showing how manufacturing activities are slowing.

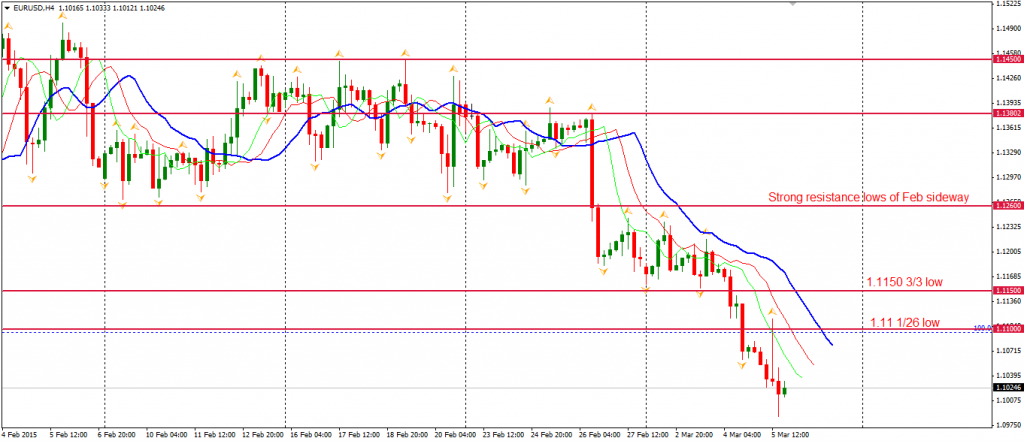

The Euro Dollar once fell below the 1.10 level – the lowest since September 2003. ECB held their benchmark interest rates unchanged in line with market expectation. President Draghi said in the press later, the bond purchase will start from 9th March and will continue if the inflation rate is still not satisfactory. The Euro once touched day highs of 1.11 during Draghi’s speech but quickly reversed all gains and refreshed the day low. The 1.10 integer level may provide some support in the short term and next support below may be September 2003’s low of 1.0760.

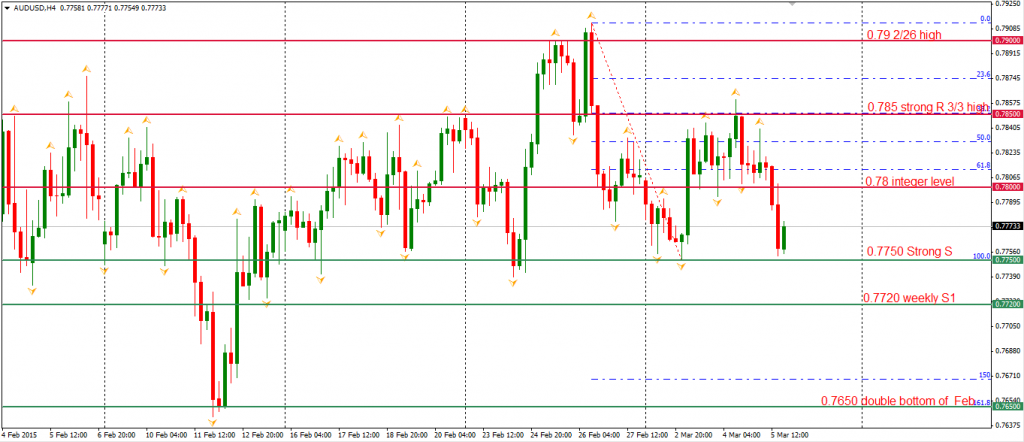

Australian Dollar broke the range between 0.78-0.7850 and fell to 0.7780 this morning, following the Euro’s falling. Beijing set its 2015 growth rate to 7% showing the Chinese leaders are accepting the ‘new normality’ of economic development. The short-run movement of AUDUSD may still be limited to the sideway range of 0.7750-0.79. A downward break will lead a fall to double bottom level 0.7650.

Back to stock markets, Shanghai Composite slumped by almost 1% to 3248 as the government set new growth target to 7%. The Nikkei Stock Average gained 0.26%. Australian ASX 200 closed as unchanged. European markets were supported by the beginning of QE, the UK FTSE was up 0.61%, the German DAX gained 1% and the French CAC Index rose 0.94%. The US stock indices’ rose slightly. The S&P 500 closed 0.12% higher at 2101. The Dow rose 0.21% to 18135, and the Nasdaq Composite Index gained 0.32% to 4983.

On the data front, Eurozone revised GDP will be released at 21:00 AEDST. US NFP report and unemployment rate will be out at 0:30 after midnight.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.