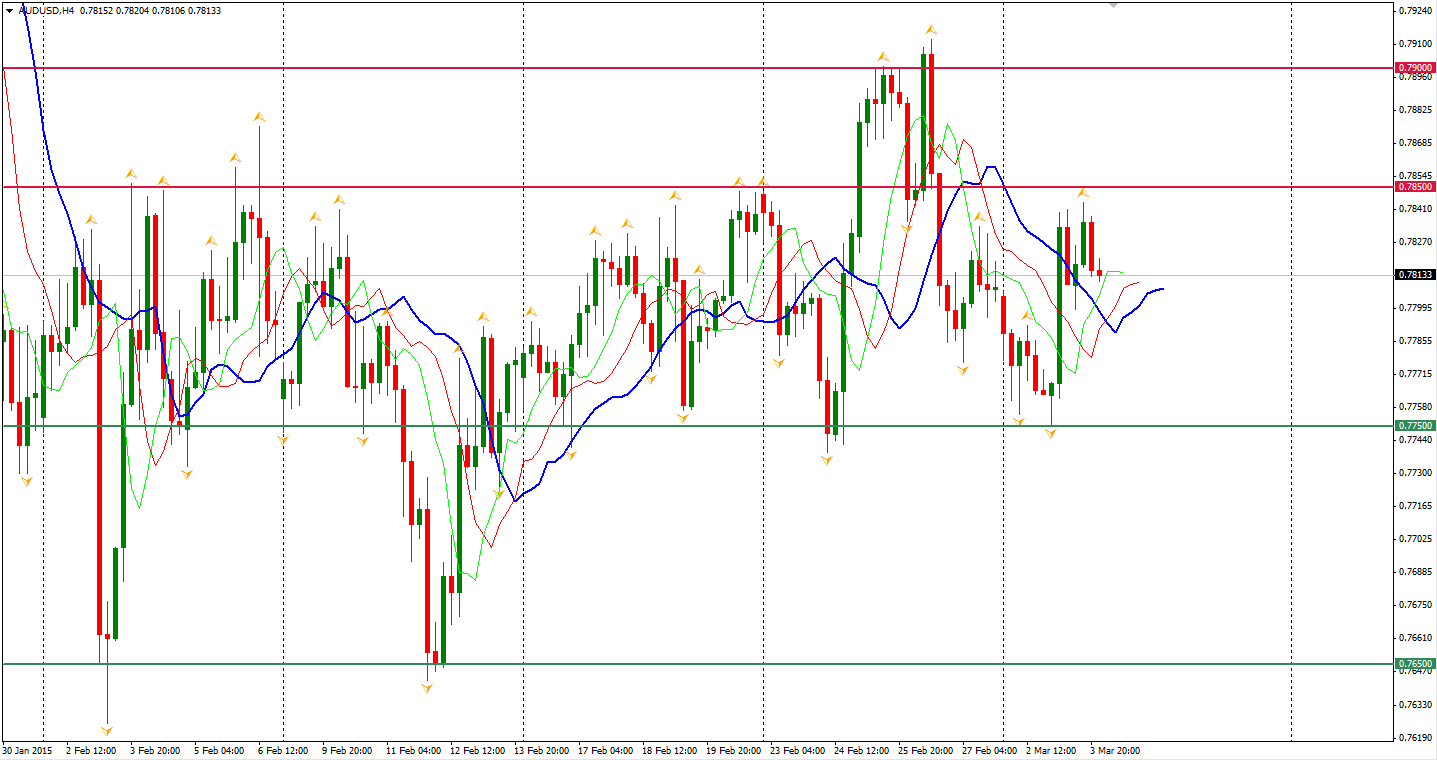

The Aussie Dollar rebounded to a day low of 0.7750 as the RBA paused its rate cutting as announced in the March meeting. This challenged the market expectation which projected over 60% possibility of a cut. Disappointed traders bought back their bearish positions and pushed AUDUSD to an area near 0.7850 which thwarted the pair’s further rally. The wide consolidation continues between 0.7650 and 0.7900. The medium-run outlook is still bearish as the RBA reiterated that ‘a further reduction in cash rate was appropriate’.

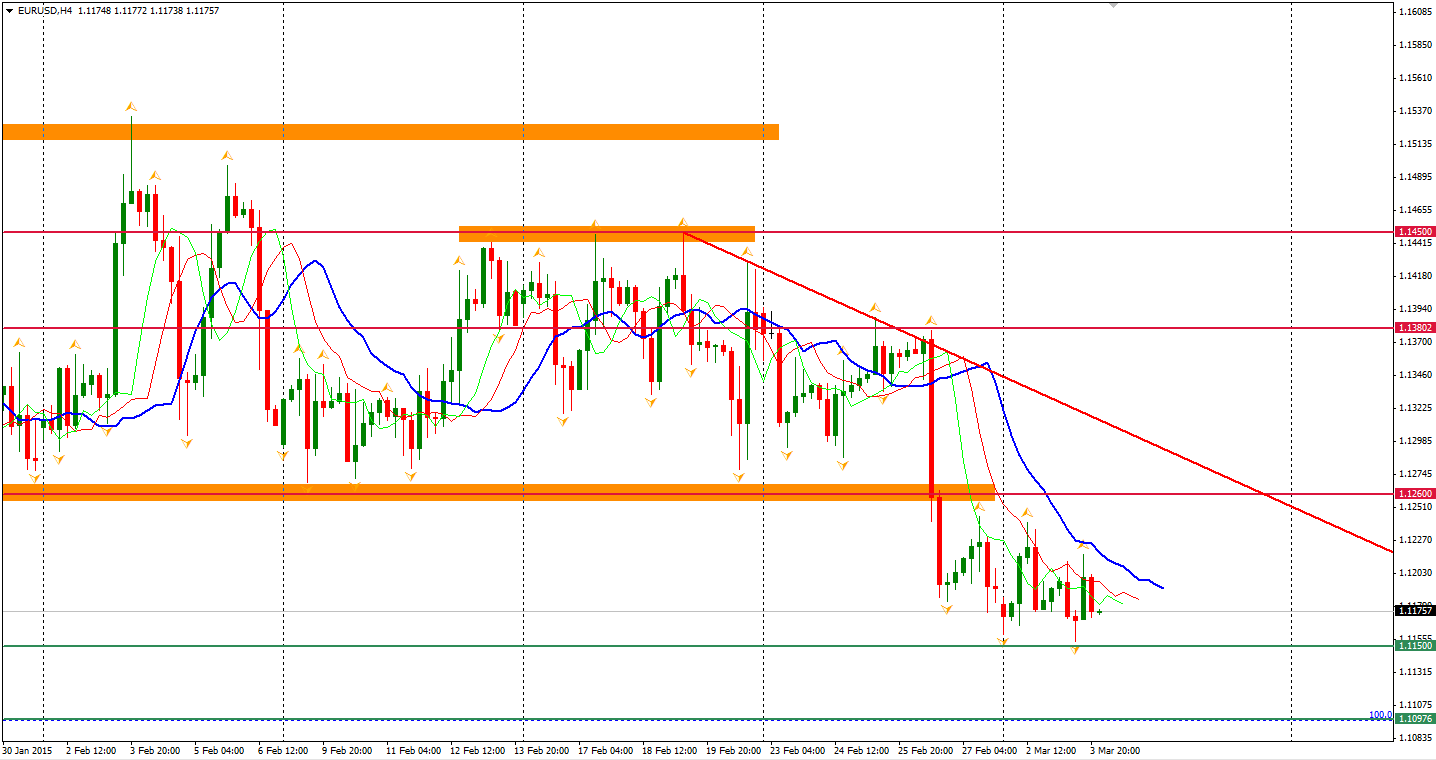

The Euro Dollar maintains its weakness under the 1.12 level. It once refreshed recent lows of 1.1155, but was supported by buying orders around 1.1150. German Retail Sales expanded by 2.9% and Spanish unemployment count decreased by 13,500. Both data results were better than expected. The resistances above are 1.1260, 1.1380 and 1.1450; the support below is 1.1150 and former low around 1.11. The outlook of EURUSD is still bearish as participants have no intention to push the pair back to 1.1250.

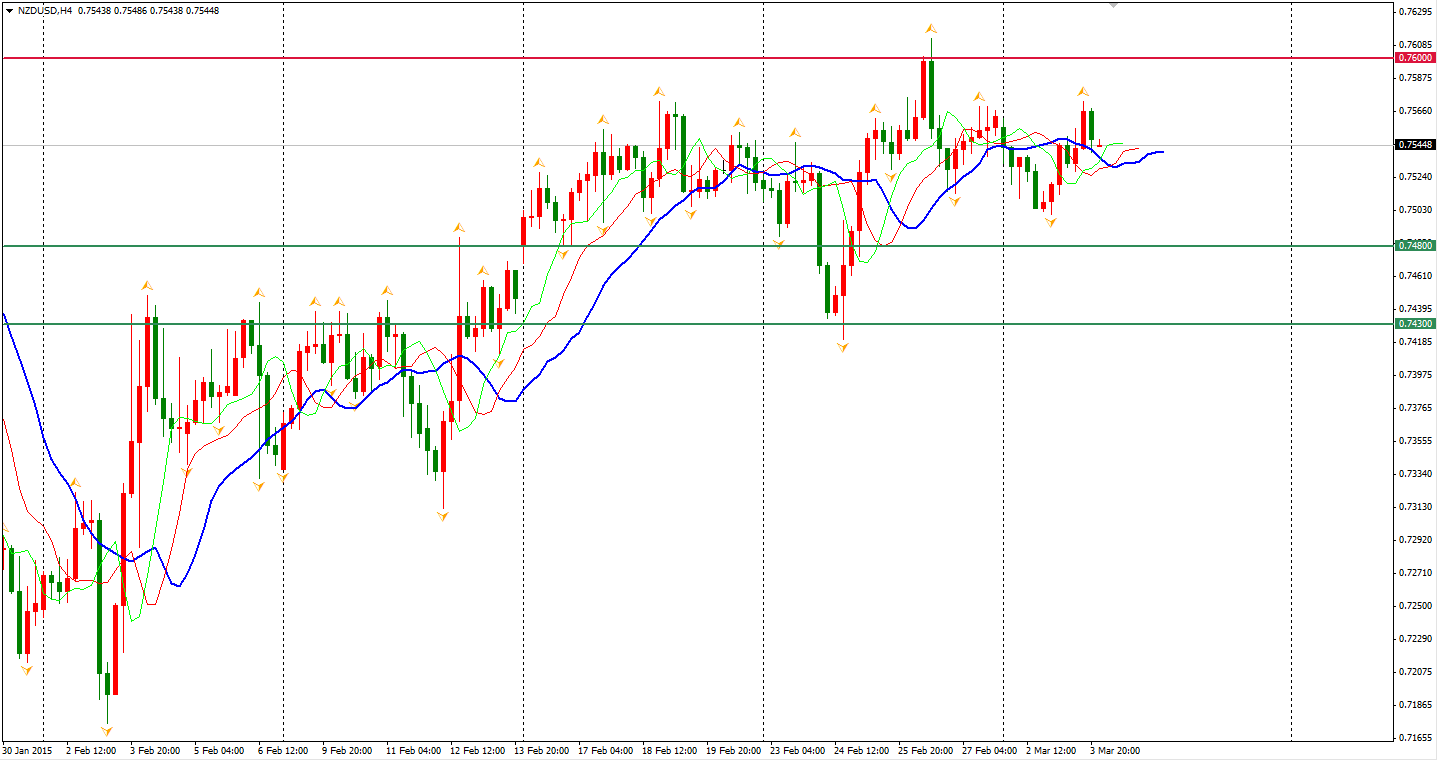

The New Zealand Dollar also bounced with its neighbour but with limited gain. The 0.7600 resistance seems to be strong enough to smash intentions of upward breakouts in short term unless some changes happen from a fundamental aspect. The supports below are 0.7480, 0.7430.

As to stock markets, Shanghai Composite slumped 2.2% to 3263. The Nikkei Stock Average slid by 0.1%. Australian ASX 200 lost 0.42% to 5934. In European markets, the UK FTSE was down 0.74%, the German DAX fell by 1.14% and the French CAC Index lost 1%. The US stock indices retreated from Monday’s gains. The S&P 500 closed 0.45% higher at 2108. The Dow slid 0.47% to 18203, and the Nasdaq Composite Index fell 0.56% back below 5000 and closed at 4980.

On the data front, Australia GDP will be released at 11:30 AEDST. Service PMI of major economies will be released throughout the day today. The most focused attention will probably be on the ADP Non-Farm Employment Change at 0:15 AEDST. Canada’s rate decision will be out at 2:00 AEDST.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.