US data released last night all missed market expectations. The ISD February manufacturing PMI fell for the fourth consecutive month to 53, showing the US manufacturing expansion is slowing. Also, personal spending has contracted by 0.2% implying that US families are still careful on consumption even when job market has been improving and oil prices have fallen significantly. The January PCE price index remains lower than the Fed’s target rising by 1.3% YoY, pared to USD intraday gains and supported US stocks.

However, the major peers have yet to take opportunity to bounce against the Dollar. This is most probably due to China’s rate cut reminding the market of the monetary policy discrepancy between the US and other economies.

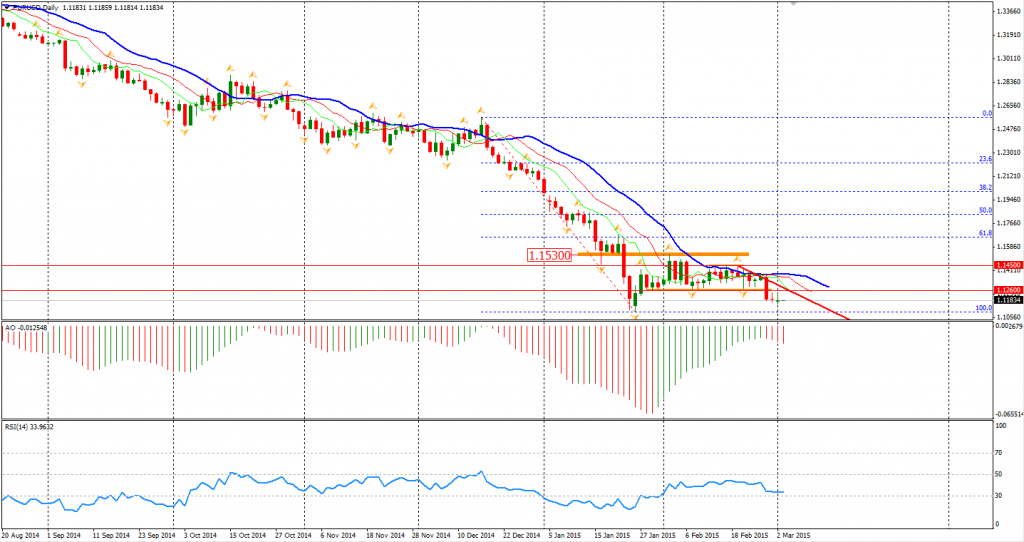

Looking across the seas, the Euro Dollar fluctuated around the 1.12 level yesterday on improving Euro-area data. Unemployment rate fell to 11.2% and deflation slowed to 0.3%. However, if 1.1260 cannot be retaken within the next trading days, the Euro will probably hit a new low in the short term.

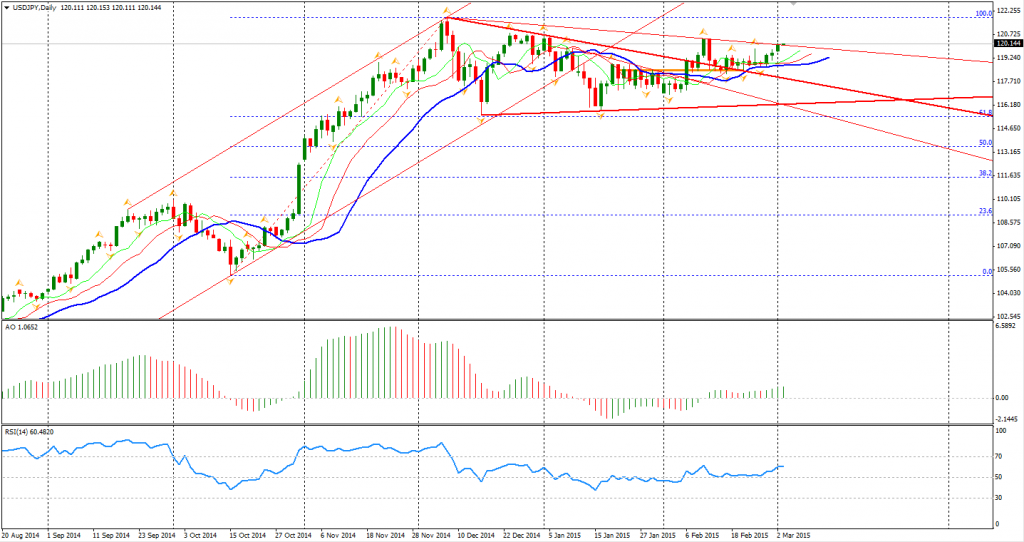

The Dollar Yen rose above the 120 mark as participants again increased their speculations on further easing coming from the Bank of Japan. Japanese economist Yuji Shimanaka, who successfully predicted BOJ’s easing in last October, warned that BOJ may surprise the market again in April as inflation level falls to zero. A confirmed breakout of the 3-month consolidation wedge will imply a significant rise of USDJPY. Former highs of 120.50 will be watched.

As to the stock markets, Shanghai Composite rose by 0.78% on rate cut. The Nikkei Stock Average gained 0.15%. Australian ASX 200 rebounded by 0.51% to 5959. In European markets, the UK FTSE was down 0.1%, the German DAX climbed 0.1% and the French CAC Index lost 0.69%. The US stock indices gained as inflation level was lower than expected with Nasdaq hitting 5000 for the first time since March 2000. The S&P 500 closed 0.6% higher at 2117. The Dow rose by 0.86% to 18289, and the Nasdaq Composite Index climbed 0.9% to 5008.

On the data front, Australia Building Approvals and Current Account will be released at 11:30 AEDST. The most focused event during the Asian session will be the RBA rate decision at 14:30 AEDST – the market has priced it for another rate cut. Canada GDP will be out at 0:30 AEDST after midnight.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.