A big week ahead as the central banks of advanced economies will disclose their March decisions and plenty of important economic data will be released this week. Before starting this week’s trading, you should take note that over the weekend, the Chinese central bank PBOC just cut its interest rate. It is the second move by the central bank towards easing in February after it reduced the required reserve ratio and first rate cut last November.

The annual National People’s Congress meeting will be held this week, during which Chinese lawmakers will approve the budget and announce their growth goals for China’s economy. The goal for 2015 is expected to be below 7% against a backdrop of weak domestic and foreign needs. The fast pace of easing infers that these policymakers of the second largest economy may publish more stimulus confronting economic weakness and deflation risk.

Back to Friday’s market, the USD retreated slightly against most major peers except the Euro and JPY. Commodity currencies are relatively stronger, but still under their resistance levels.

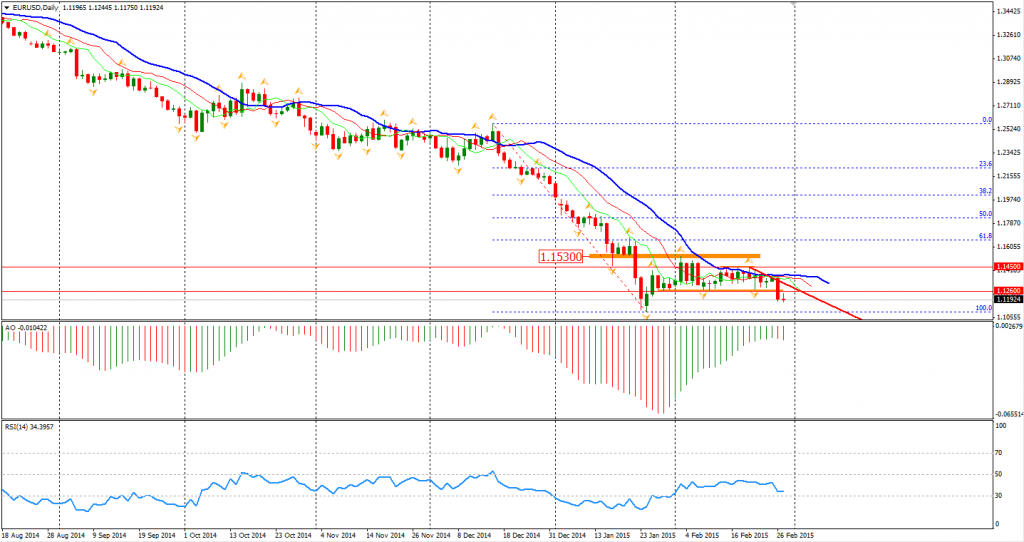

The Euro weakened before the ECB has started its new assets purchasing program. There has been $1.9 Trillion Euro regions’ government securities with negative yields but still more may be purchased by the central bank. This extraordinary market condition may make European institutions allocate more investments around the world instead of providing loans to local business due to lack of confidence. A new round of depreciation is on the front.

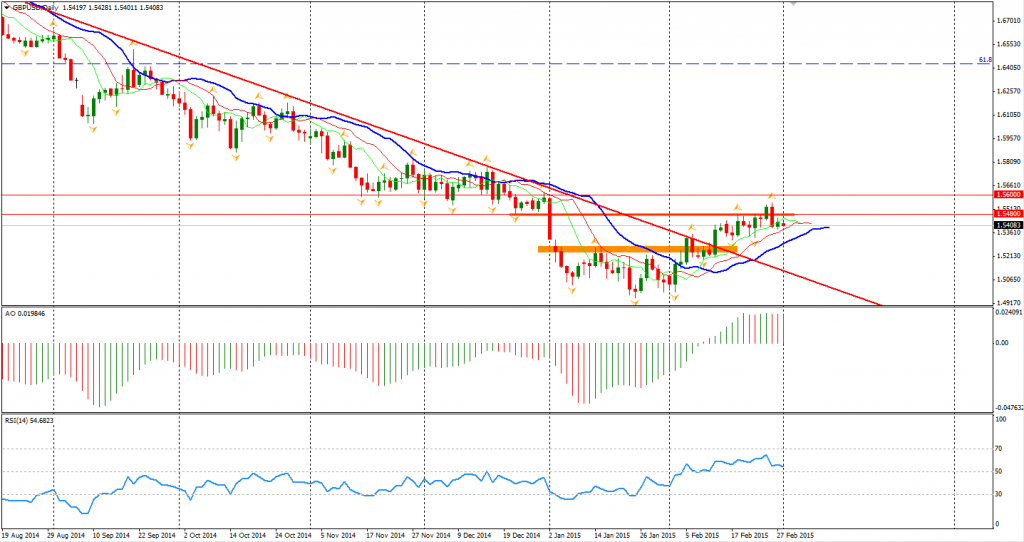

As there is no negative news yet for US, traders are reluctant to sell USD, keeping the strength of USD even many has warned the potential retracement. Sterling performed well in February. However, I am still waiting for the breakout of 1.5480 to confirm the intermediate-term trend of GBPUSD. The break may happen this week among the heating speculation of rate hike within this year as the Bank of England reiterated that UK was on the road towards higher interest rate.

As to the stock markets, Shanghai Composite rose by 0.36%. The Nikkei Stock Average gained 0.1%. Australian ASX 200 rebounded by 0.34% to 5929. In European markets, the UK FTSE was down 0.1%, the German DAX climbed 0.66% and the French CAC Index gained 0.83%. The US stock indices were dragged by technology stocks. The S&P 500 closed 0.3% lower at 2102. The Dow slid 0.45% to 18133, and the Nasdaq Composite Index fell touching the historical 5000 points and lost 0.49% to 4964 at close.

On the data front, China HSBC Final Manufacturing PMI will be released at 12:45 AEDST. UK and Euro-area Manufacturing PMI will be out tonight. US ISM Manufacturing PMI will be at 2 am AEDST after midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.