Major currencies continued their bounce against the Dollar yesterday with the Aussie Dollar and Sterling Dollar breaking out of their previous important resistance. Fed Chairwoman Yellen maintained her dovish position in the testimony to the House Financial Services Committee. The USD retreated during the Asian trading hours and the European morning, but calmed itself later as Yellen’s testimony was recognised as fairly similar to her last one to the Senate.

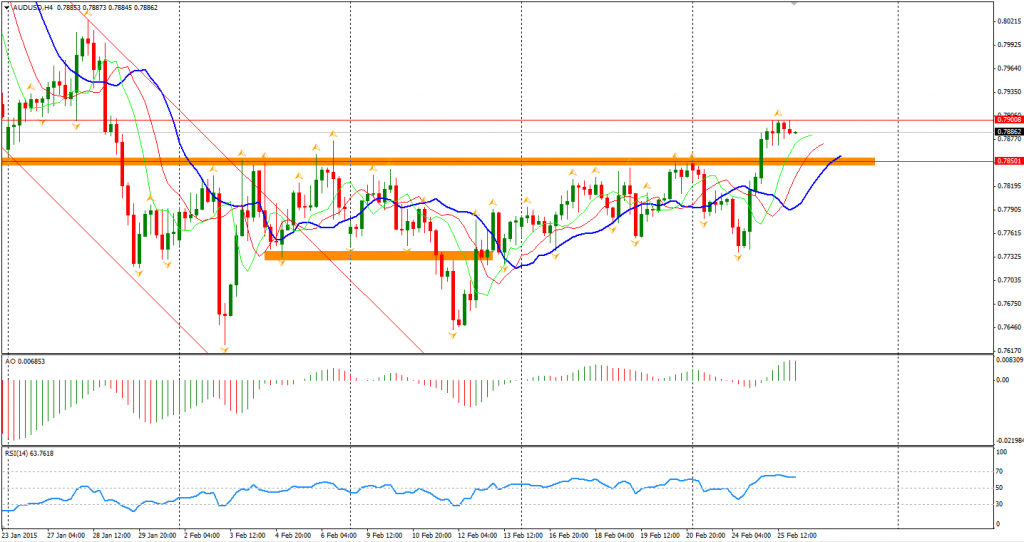

As I have mentioned a couple of times before, 0.7850 is the critical resistant level to the AUDUSD. It thwarted many times of bulls’ attacks in the recent four weeks, but now the level has been broken out. The Australian Dollar has maintained its strength after Yellen’s first slight-dovish statement during the last day’s trading. Now the AUDUSD has stopped at 0.79 – another strong resistance. News outlets have reported that real-money buy orders had supported the AUD. However, the outlook of this currency pair is still bearish as there is no sign of rebound commodity prices and domestic economic activities remain weak. The above bull target is 0.80 and sell orders will resume if the pair falls back below 0.7850.

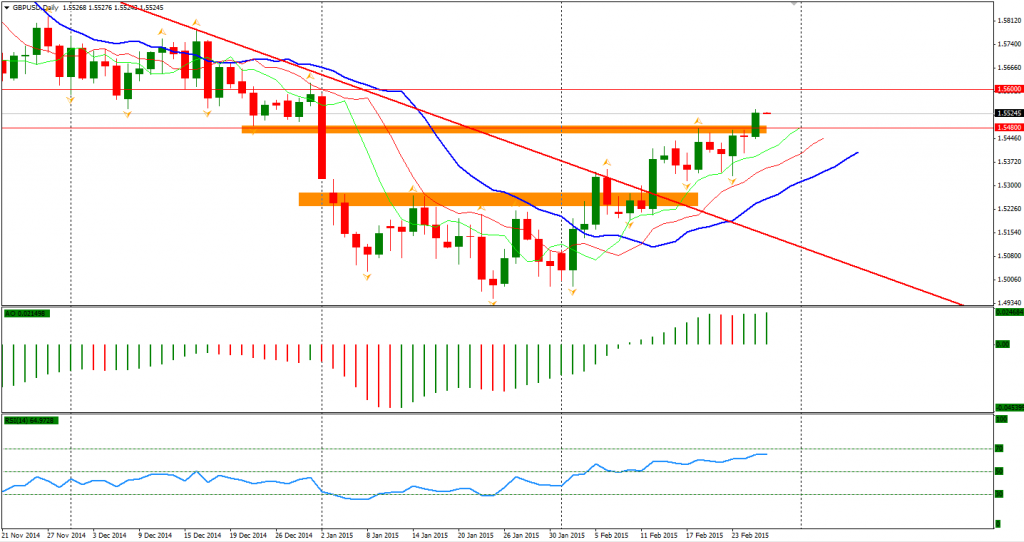

The Pound/Dollar also made its breakthrough in the early European morning, which is fairly in line with expectations that the recovery of the UK economy is relatively strong and the UK is expected to be the second advanced nation to raise the interest rate. The next mark for bulls is 1.56, but traders should keep caution as selling pressure above is still heavy.

More articles have been published, warning an immediate-term retracement of the US Dollar. The rise of majors led by the GBP and commodity currencies has added to the supporting evidence. The long-term bullish trend USD is unchanged, but when all players are betting on one side of the table and some starts to move toward another side, the game will change quickly.

Turning to the stock markets, the China markets ended its 7 winning streak yesterday by dropping 0.56% in its first trading day after the holiday. The Nikkei Stock Average gained 0.1% to 18585. The Australian ASX 200 rebounded by 0.3% to 5945. In European markets, the UK FTSE was down 0.21%, the German DAX climbed 0.1% and the French CAC Index lost 0.1%. The US stock indices remained mostly unchanged. The S&P 500 closed 0.1% lower at 2114. The Dow gained 0.1% to 18225, and the Nasdaq Composite Index closed at 4967.

On the data front, Australian Private Capital Expenditure will be released at 11:30 AEDST. UK Second Estimate GDP will be at 20:30 AEDST. US and Canada CPI data will be out at 0:30 AEDST with US weekly unemployment claims.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.