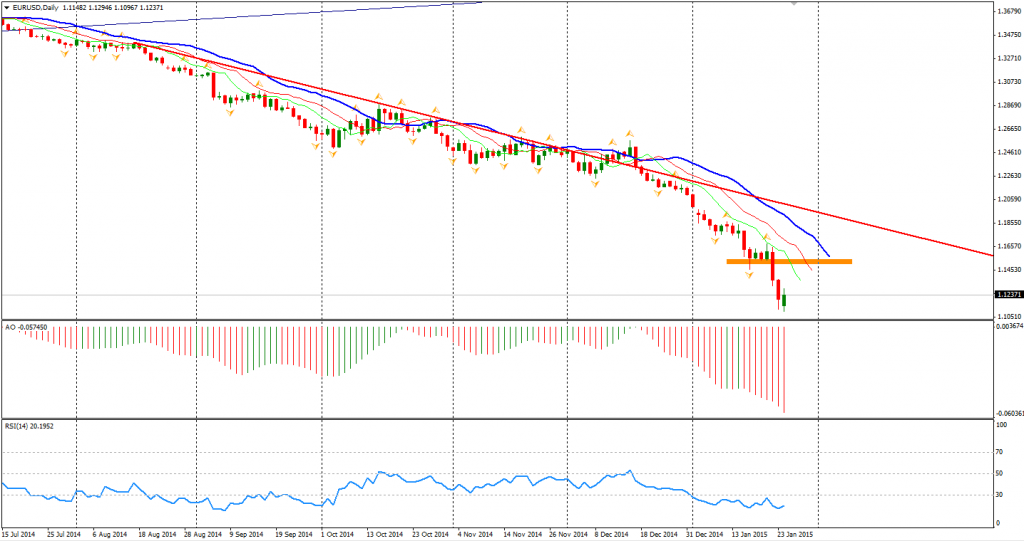

The result finally came out as Greek anti-austerity party Syriza won the election, making the outlook for the country’s political situation and economic future murkier. The Euro dropped refreshing its 11-year low again to 1.1097 at the beginning of Monday’s session. However, profit-taking helped the Euro rebound to 1.13 as most participants had expected the outcome. The Euro has lost over 500 pips against the Dollar after the release of 1.1 trillion Euro QE program.

No matter how we look at the Eurozone, from an economic prospect or from interest differences, the outlook of the Euro is still bearish. Even though, the Euro Dollar has fallen 19.4% since its high in May 2013 and technical indicators show extremely bearish signs on this currency, would it still be wise to short the Euro? Traders should be alert as most market expectations have been realized and an adjustment may be right before us.

Gold prices slumped 1.4% from the day high of $1298.9 to $1280 per ounce yesterday as two major events – Eurozone-edition QE and Greek election were over and the safe-haven demands now fades. A short-term top seems to be under way as the $1300 resistance blocked the rally of gold prices.

Back to stock markets, the Shanghai Composite rose 0.94% to 3383. The Nikkei Stock Average lost 0.28%. In European markets, the UK FTSE was up 0.29%, the German DAX gained 1.40% and the French CAC Index rose 0.74%. The US market rose slightly in a light trading day due to the heavy snow storm. The S&P 500 closed 0.26% higher to 2063. The Dow closed flat at 17672, and the Nasdaq Composite Index gained 0.29% to 4772.

On the data front, Australian NAB Business Confidence will be released at 11:30 AEDST. The UK Prelim GDP will be at 20:30 AEDST and US durable Goods Orders will be at midnight.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.