Countdown to Liftoff:

Although the Federal Reserve didn’t give a clear signal on the timing of liftoff, the rhetoric of improving housing and labour markets shows that the countdown has at least begun.

Fed officials have indicated that a September rate hike is now a real possibility after citing that the economy has overcome its first quarter slowdown and despite external factors and energy market worries, that the economy has actually expanded moderately.

Here are a couple of key quotes indicating that confidence in the labour market is improving:

“On balance, a range of labor market indicators suggest that underutilization of labor resources has diminished since early this year.”

“The labour market continued to improve, with solid job gains and declining unemployment.”

This definitely indicates an improved outlook on the economy from the Fed, with last month’s statement saying that ‘some slack still remained’ in the labour market.

“Need to see “some” more improvement in the labor market.”

As always, it’s the little things that have a huge impact on traders mindsets. In today’s statement, by adding the word ‘some’, markets are interpreting the hurdle to a September rate hike as being lowered.

10… 9…. 8….

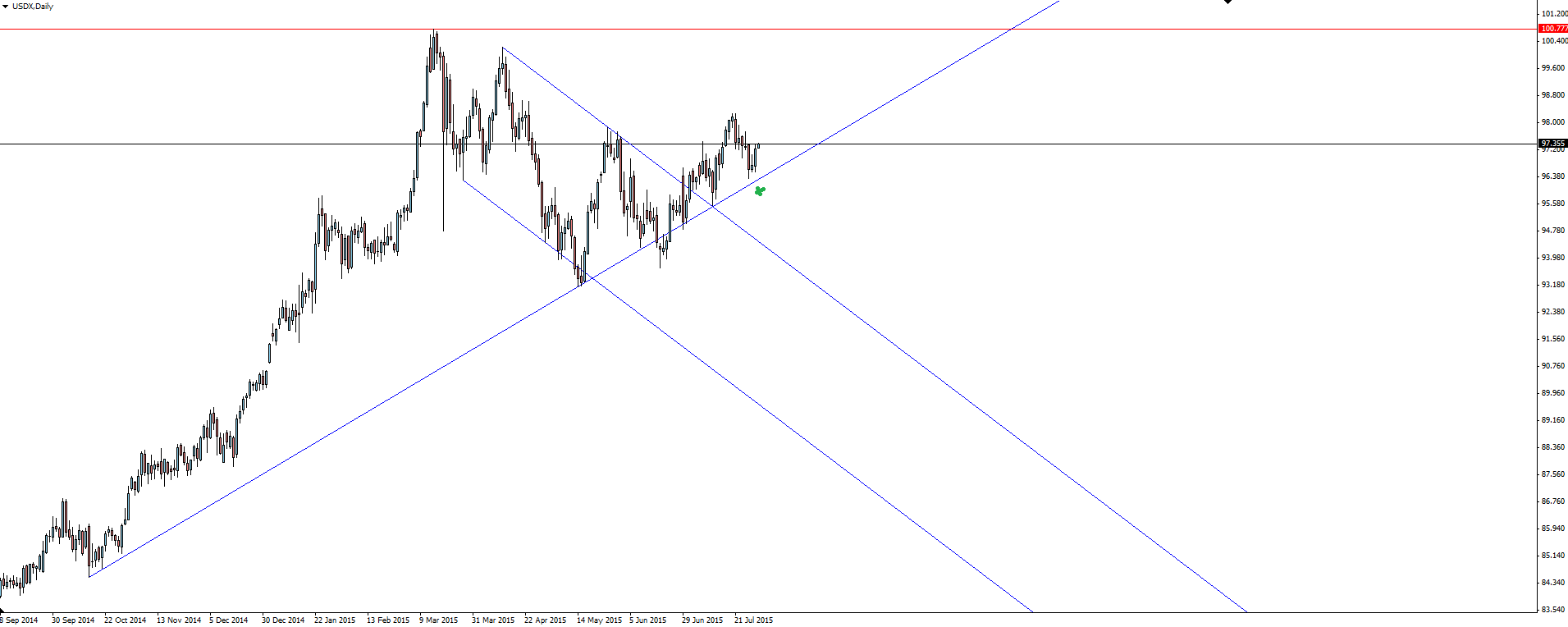

USDX Daily:

Click on chart to see a larger view.

The US Dollar Index rallied on the release, pushing out of trend line support and targeting new highs.

———-

On the Calendar Thursday:

AUD RBA Gov Stevens Speaks

AUD Building Approvals

USD Advance GDP

USD Goods Trade Balance

USD Unemployment Claims

———-

Chart of the Day:

With FOMC now in the rear view mirror, we this morning turn our attention to AUD/NZD and this chart from @shahzaddalal on Twitter shows the zone of interest perfectly.

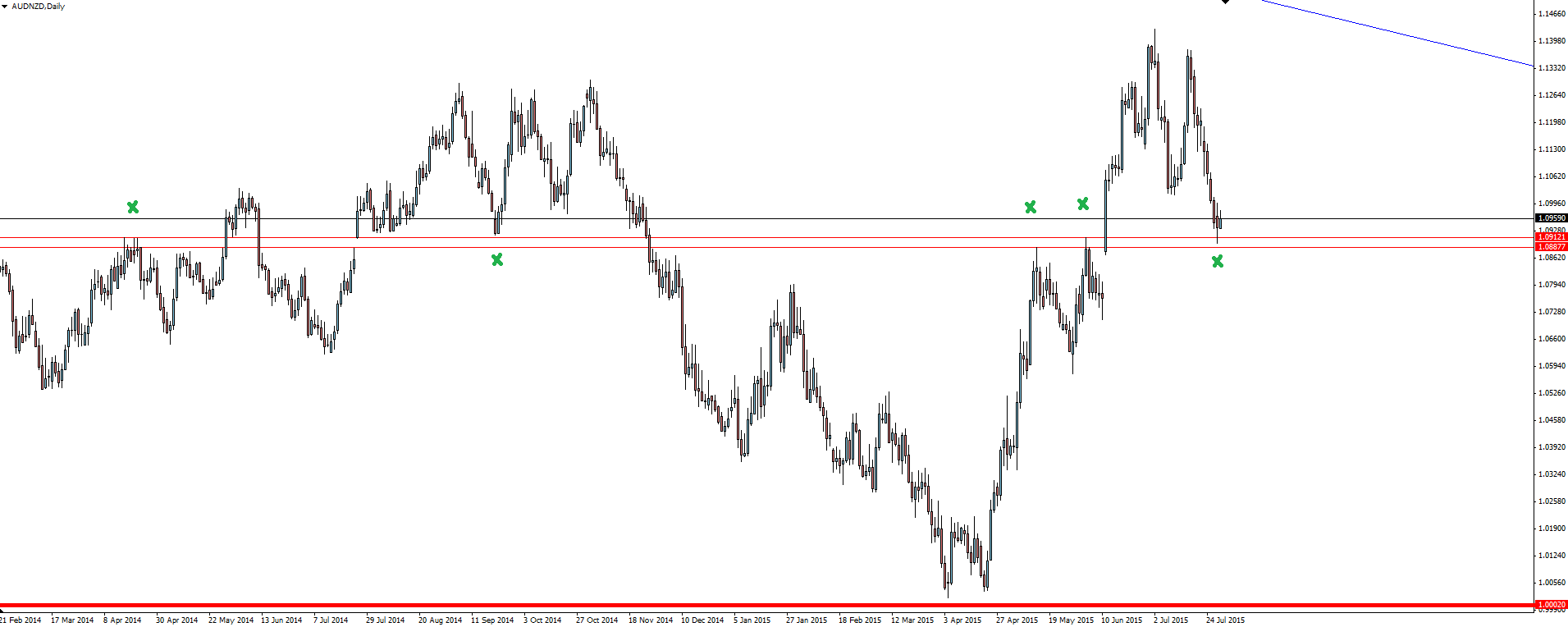

With the overall trend strongly bearish, the level I’ve highlight on the weekly chart shows price retesting broken support now as resistance. This is normal trend resumption price behaviour. The long term trend line resistance also gives extra insurance to a bearish trend trade.

AUD/NZD Weekly:

Click on chart to see a larger view.

However, the daily chart that Shahzad posted above, shows price hitting an important short term support/resistance level that has been tested and retested on multiple occasions over the last couple of years.

AUD/NZD Daily:

Click on chart to see a larger view.

Trading from the bottom side of this level is obviously the safer trade but with yesterday’s daily candle providing a long wick into the zone and then bouncing today, an argument could easily be made to trade the opposite direction.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.