FOMC Day:

The day has arrived. While economic factors have pushed back the earliest possible liftoff month to September or December, it’s the tone of tonight’s FOMC statement that will have the most significant impact on Forex markets.

With the odds of a rate hike in September now priced in at 50/50, I am of the opinion that they are more likely to move using a policy of stabilisation rather than being forced into hitting the market hard with multiple hikes clumped together. It’s all about beginning the normalisation process after rates have been at zero for so long and hiking early in September is conducive to this train of thought.

The fact that Yellen has persistently said that the Fed favours moving gradually over a longer period of time is pushing the point that September is in play.

Wheeler Speaks:

Reserve Bank of New Zealand Governor Wheeler this morning delivered a speech titled ‘Monetary policy supporting growth and inflation goal’ at the Tauranga Chamber of Commerce. With the few key points taken out below.

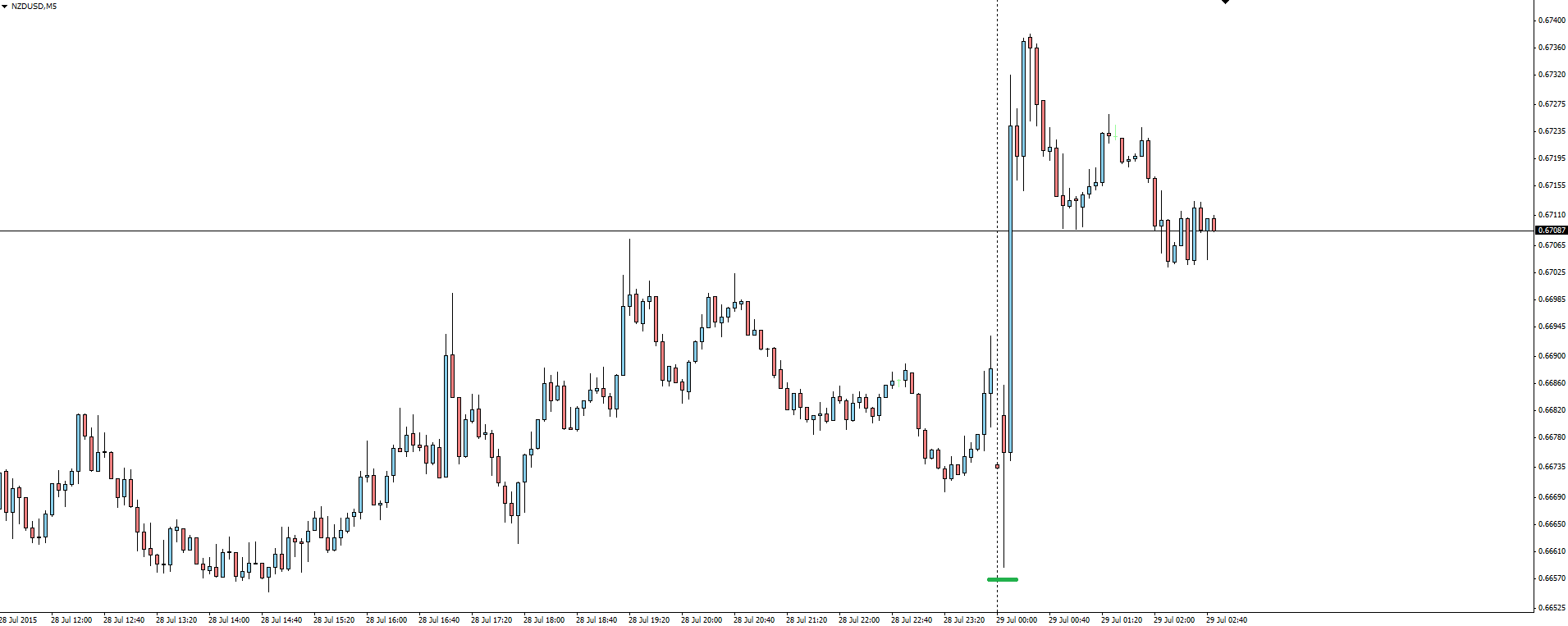

NZD/USD 15 Minute:

Click on chart to see a larger view.

“Some further easing seems likely.”

“Further NZD depreciation necessary.”

“Several risks around inflation outlook.”

3 statements that have become fairly standard from the RBNZ. The market instead choosing to rally on the final, positive point.

“Several factors are supporting economic growth.”

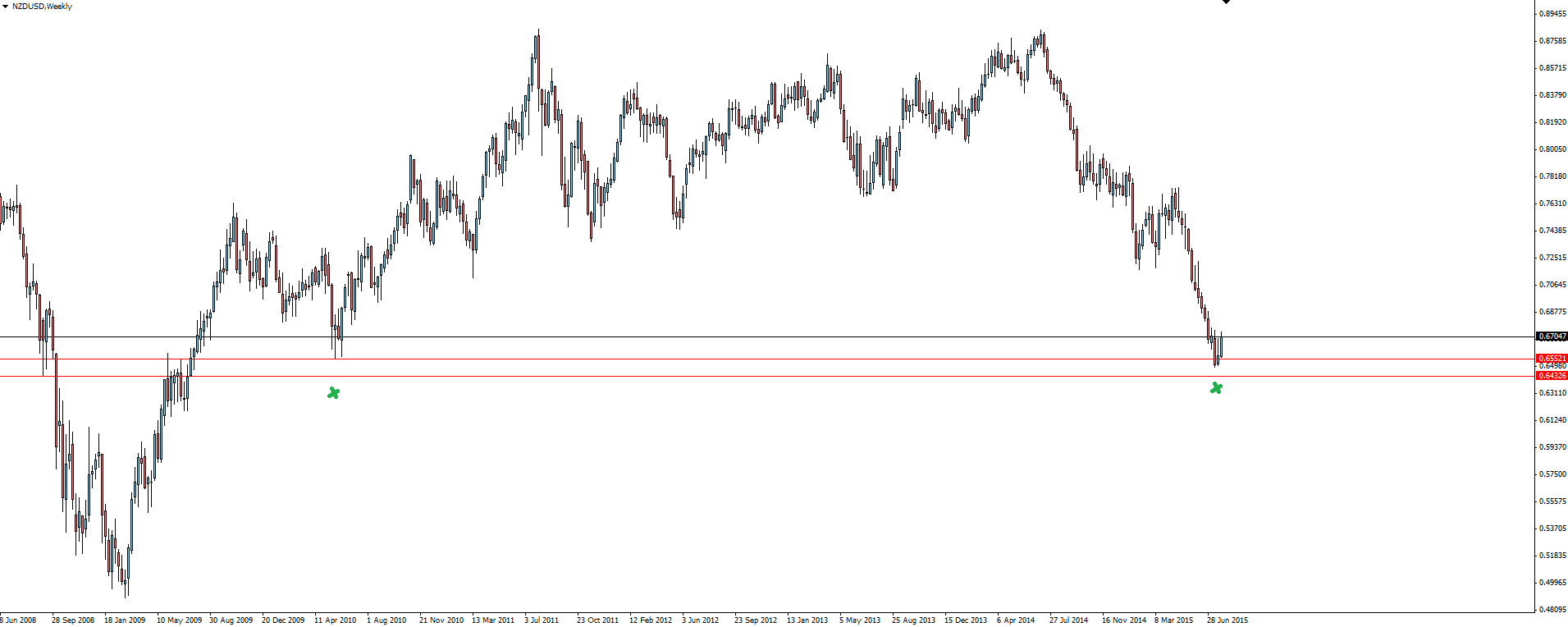

NZD/USD Weekly:

Click on chart to see a larger view.

Most interesting to me as a primarily technical trader, is that heading into the speech, the Kiwi bounced off the above weekly support zone. Very clean!

———-

On the Calendar Wednesday:

NZD RBNZ Gov Wheeler Speaks

JPY Retail Sales

USD FOMC Statement

USD Federal Funds Rate

———-

Chart of the Day:

As its FOMC week, we have been looking at the majors heading into tonight’s meeting. This morning we take a look at Cable and how its been behaving.

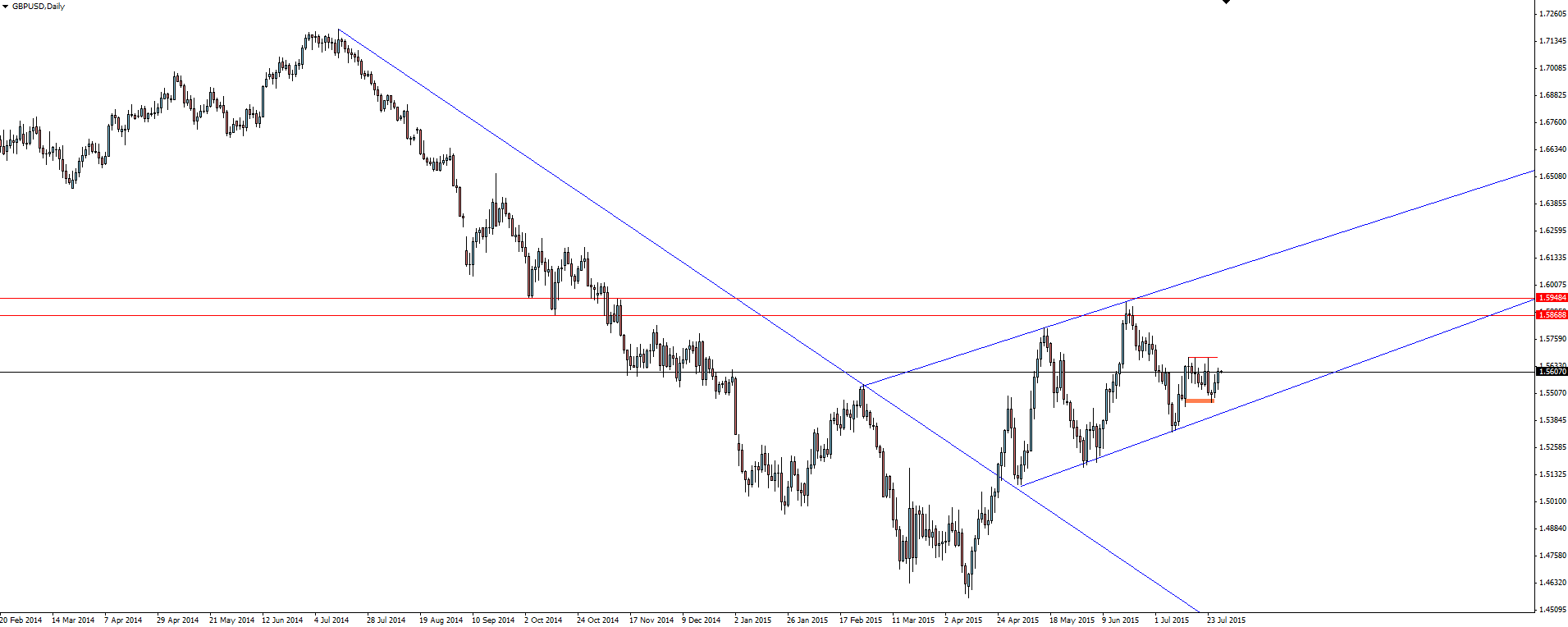

GBP/USD Daily:

Click on chart to see a larger view.

The Cable daily chart shows the change in trend once price broke the major bearish trend line, settling into a short term bullish channel that has now taken a front seat.

This chart shows the divergent monetary policies between the Bank of England who are looking to hike and for example the Reserve Bank of Australia or the ECB who are still easing or maintaining an easing bias, with Cable the only major pair that is now in a bullish trend.

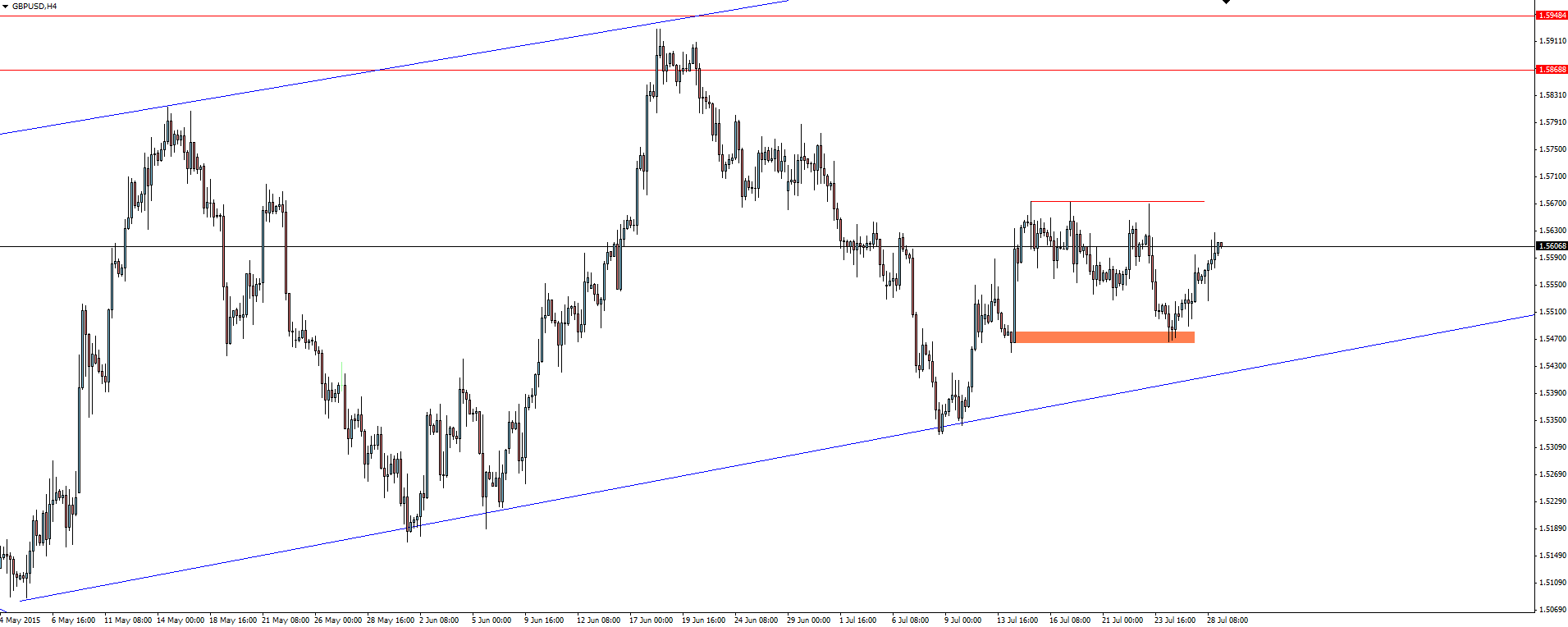

GBP/USD 4 Hourly:

Click on chart to see a larger view.

Looking a little closer on the 4 hour chart, going with the trend you can see that price pulled back into a demand zone where price had previously kicked out of, touching it with wicks and moving higher. The fact that it was with the trend and its proximity to channel support provided traders who want a wider stop a bit more breathing room.

From here, stops above the short term resistance at 1.56700 are in play. It will be interesting to see if they act as a magnet heading into FOMC.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.