RBNZ Cuts Rates:

As expected, the Reserve Bank of New Zealand cut interest rates by 0.25% from Wellington this morning. I know that I’ve used the Auckland skyline as my cover photo for today’s blog, but how good does it look! …I apologise to any readers from Wellington that I may have upset.

The market was however looking for a much more dovish tone from Wheeler but with the jawboning toned down and the now standard line of:

“Some further easing seems likely.”

The Kiwi Dollar actually rallied quite hard across the board after the cut.

With NZD/USD having come off as much as it has over the last few months, the RBNZ was happy to remove the phrase:

“The level of the New Zealand Dollar is unjustified.”

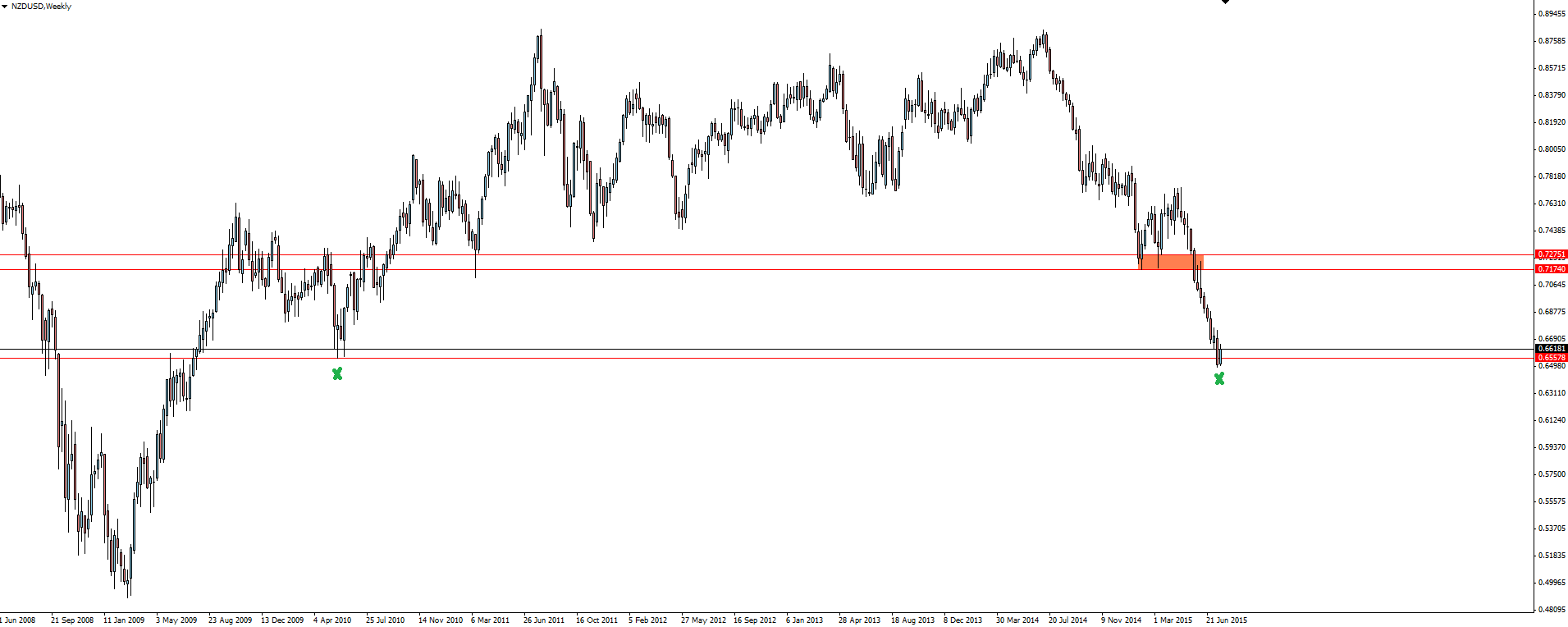

NZD/USD Weekly

Click on chart to see a larger view.

Just how much the Kiwi has come off its highs is highlighted by the above weekly NZD/USD chart. The drop between the previous 2 support/resistance levels has been basically vertical!

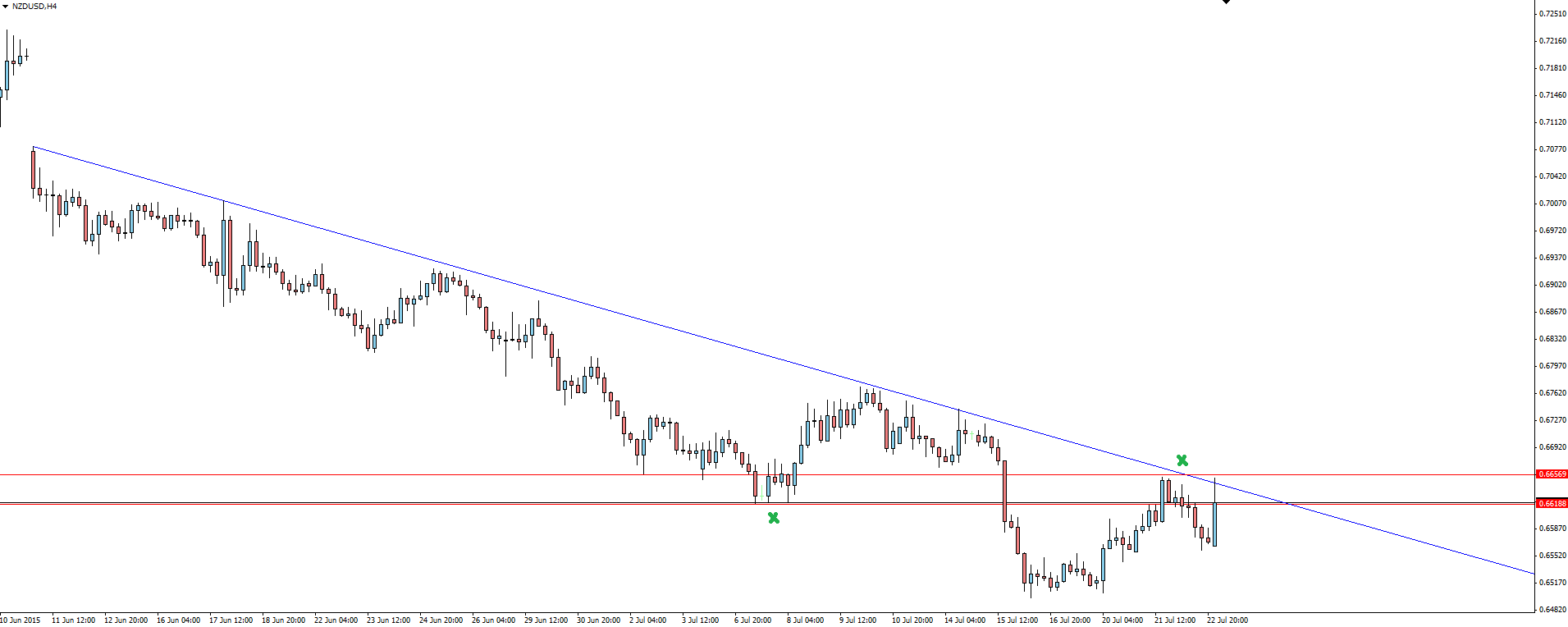

NZD/USD 4 Hourly

Click on chart to see a larger view.

Zooming into the 4 hourly chart, you can see that price has also been capped by a short term bearish trend line. Following the rate decision, price spiked back into trend line resistance which also lines up with previously broken support now being respected as resistance.

An interesting place to possibly join the short train?

The Gold Bubble:

Gold today is looking at its TENTH straight day of declines. If it gets there, this would be the longest losing streak that the precious metal has seen since 1996!

Goldman Sachs head of commodities gave us this pearler of a prediction in the WSJ today:

“Gold Prices will drop below $1000 a troy ounce for the first time in more than 6 years.”

We all know the reputation of Goldman’s public ‘predictions’ but its interesting to look at a chart on the back of this.

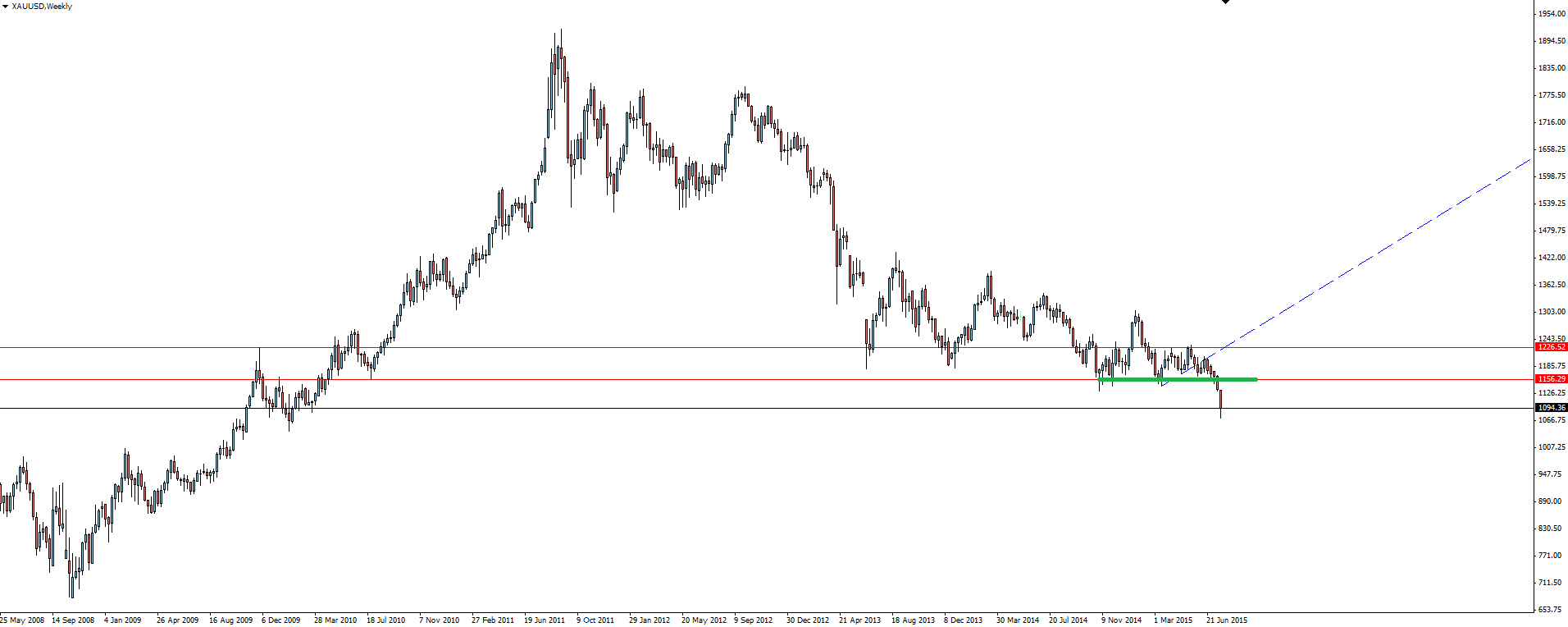

Gold Weekly

Click on chart to see a larger view.

We’ve talked about it earlier in the week but that break of weekly support really is hugely significant. Following the ultimate doom and gloom scenario that a break up of the Eurozone could have posed, the price of Gold, the supposed safe-haven asset STILL fell. If Gold can’t find any strength in that market environment, what hope does it have once the Fed actually starts raising rates?

Gold Weekly 2

Click on chart to see a larger view.

Now zoom out again and look at what could be considered a fair value once you come close to being back in the early 2000’s trading range. You’re still looking at the possibility of huge falls to come, even lower than what Goldman are saying.

My opinion is that when the loudest gold perma-bulls and fiat currency doomsday predictors have all been shaken out and public sentiment finally turns bearish, then the bottom will be in. Interestingly enough, Friday’s CFTO sentiment data actually turned bearish.

Do you see that as significant?

———-

On the Calendar Thursday:

NZD Official Cash Rate (3.00% v 3.00% expected)

NZD RBNZ Rate Statement (Less dovish than expected)

JPY Trade Balance

AUD NAB Quarterly Business Confidence

EUR Greek Gov Debt Crisis Vote

GBP Retail Sales

CAD Core Retail Sales

USD Unemployment Claims

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.