Default Looms Large:

“It shouldn’t feel like Lehman Brothers. But it does.”

Greece has once again failed to come to a deal with it’s creditors to secure the credit that it needs to keep it’s floundering banking system above water. With the key IMF loan deadline set to expire on June 30, default is now well and truly in play. For all the talk and lead up, I can’t say I ever actually expected things to get this far… But here we are.

This morning Greece has been forced to announce capital controls on it’s banks after the ECB, on the back of European and IMF preesure has frozen the level of funding they will provide.

This move threatens to bring the entire financial system to a halt. With a deluge of ATM withdrawals as you can see by the multitude of photos doing the rounds on Twitter, a cap on the amount of cash available to the system has been kept at previous levels set on Friday, essentially forcing a bank holiday on Monday.

“As many as 500 of the country’s more than 7000 ATMs had run out of cash as of Saturday morning.”

So Greece will shut its banks Monday to avert a financial collapse and remain shut until after the July 5 referendum that Greek Prime Minister Alexis Tsipras has called, giving the Greek people the final say on whether the nation should accept the harsh austerity proposals from the IMF in exchange for a continued place in the Eurozone.

However, with the referendum set for after the deadline, what exactly are they going to be voting on asks the IMF’s Christine Lagarde:

“I can’t speak for the IMF program, because the IMF program is on, but the European financial arrangement expires June 30.”

“So, at least legally speaking, the referendum will relate to proposals and arrangements that are no longer valid.”

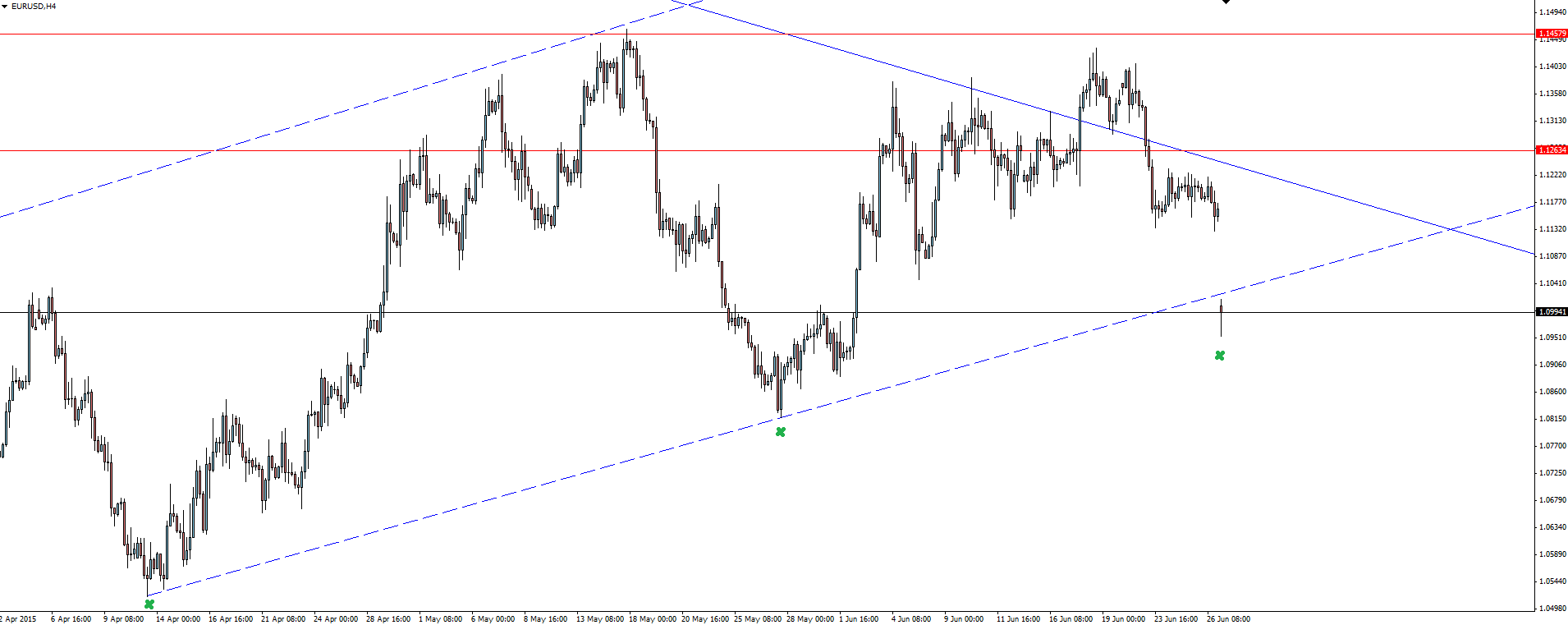

EUR/USD Daily:

Click on chart to see a larger view.

EUR/USD opened with a 200+ pip gap down, breaking short term channel/flag support and opening up new lows. Something that could be achieved very quickly if fear sets in later tonight.

EUR/USD 4 Hourly:

Click on chart to see a larger view.

I can’t stress enough using caution in your trading to begin the week. This is not the type of climate to be fading moves at key technical levels. Key technical levels do not exist right now.

European open is going to get scary.

———-

On the Calendar Today:

All about the Greek headlines as we approach the June 30 deadline so keep Twitter or your News Terminal open as we head into the European session and beyond tonight.

The calendar is light on tier 1 data today and tonight but here are a few things to take note of just in case.

Monday:

JPY Retail Sales

JPY Prelim Industrial Production

EUR Italian Bank Holiday

USD Pending Home Sales

———-

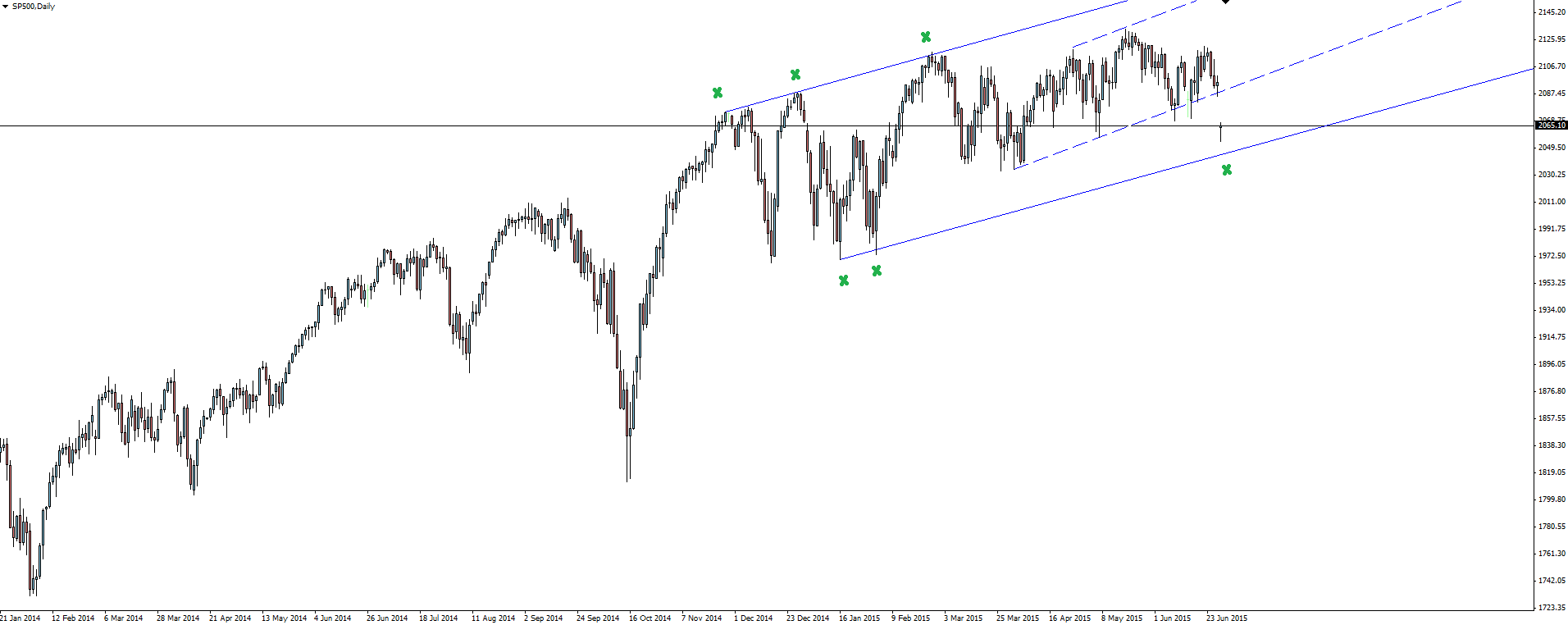

Chart of the Day:

Having looked at EUR/USD and AUD/USD above, lets take a look at something a little different in the chart of the day section.

SP500 Daily:

Click on chart to see a larger view.

US stocks have had a juicy gap down through short term channel support.

This daily chart is just a tiny section of the massive bullish run that stocks have had over the last couple of years so as I’ve said when looking at the similar Australian SPI200 index chart, it never hurts to zoom out and take a longer term view on what sort of ‘correction’ this actually is.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.