The FOMC board did delete “patience” from their March statement, but instead, the Fed emphasised that this did not mean interest rate will be raised by June. The statement opens the door for a rate hike during the year, but in the meantime, gives several reasons for “patience” – strong Dollar, weak exports, and struggling overseas growth.

This new word play disappointed the USD bulls and triggered massive stop orders at multiple levels. USD index once slumped by over 5% to 94.80. All major currencies rebounded against the Dollar. Metal and oil prices surged and US stocks were inspired.

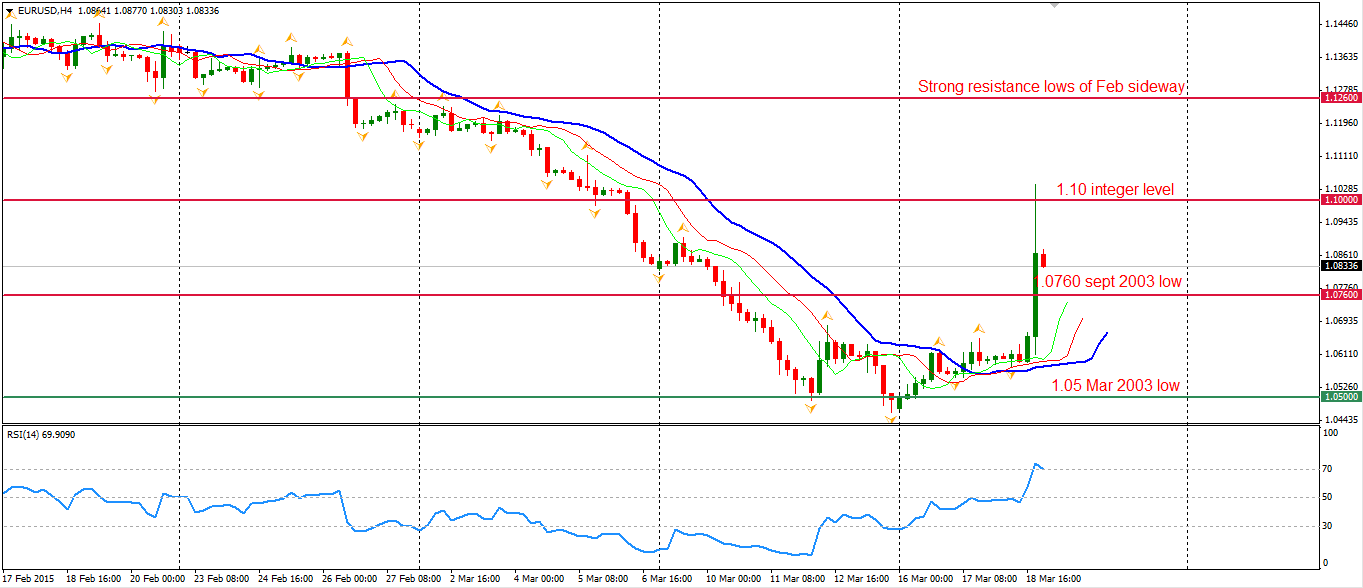

We finally see a significant bounce on EURUSD after it tumbled by over 13% since this year. The pair rocketed up 400 pips over the next two hours after the statement reaching beyond the 1.10 level, two-week high. The RSI 14 in H4 chart rose to 70 for the first time since early February.

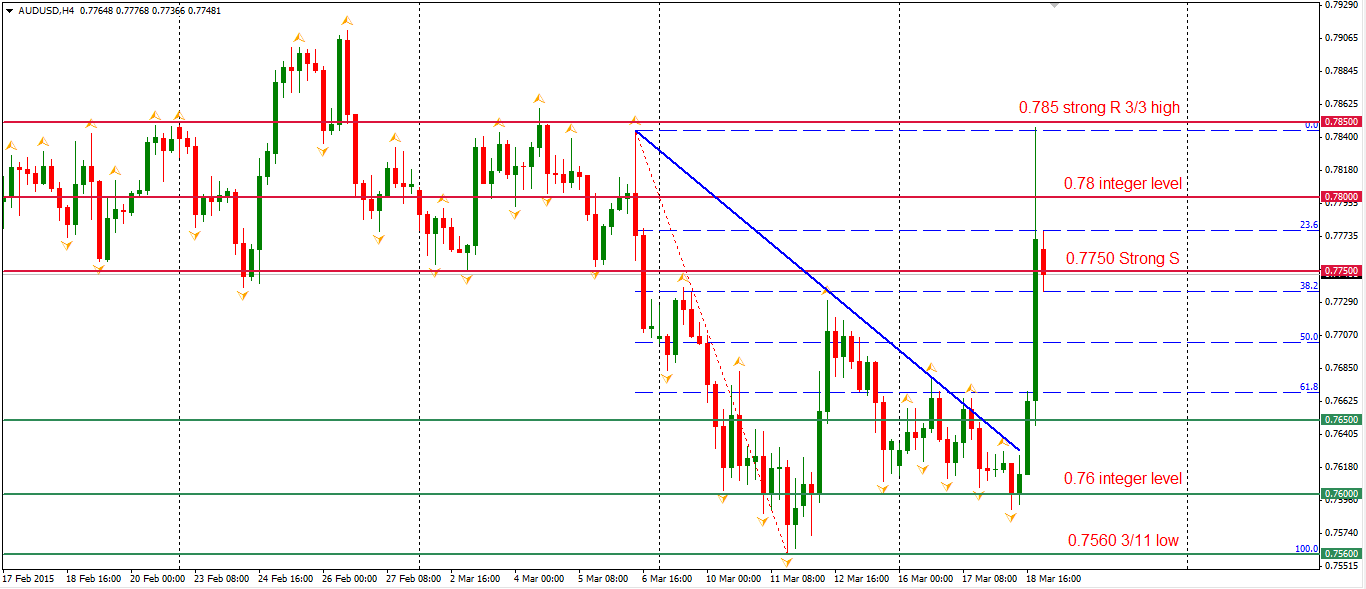

The Aussie Dollar once reached 0.7850 after it upwardly broke the short term trendline. The 0.7560 level seems to be the bottom in the mid-term as a round of rally has started.

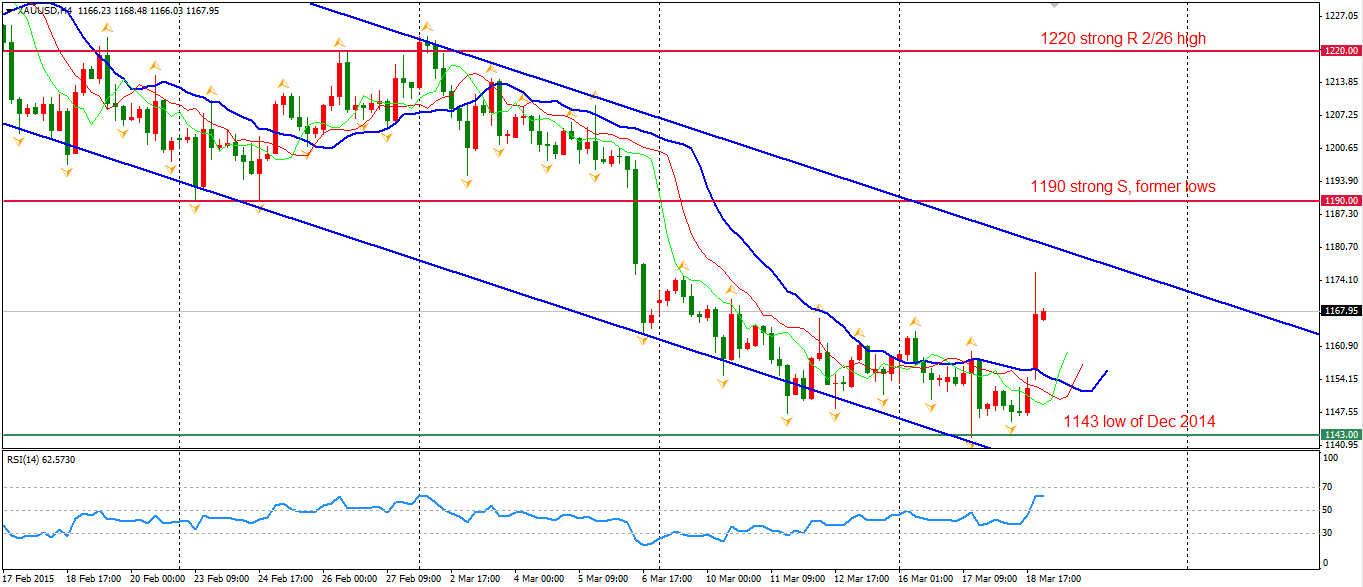

Gold prices were also inspired by the Dollar’s weakness. It rebounded from the low area of a recent bearish channel and is heading to the upper boundary of the channel.

Looking to the stock markets, the Shanghai Composite surged by another 2.13% to 3577, refreshing a 7 year high. The Nikkei Stock Average gained 0.55% as well. The Australian ASX 200 remained unchanged at 5842. In the European markets, the UK FTSE climbed by 1.57%, the German DAX retreated by 0.54% and the French CAC Index gained 0.1%. The US stock indices rose across the board on Fed’s dovish statement. The S&P 500 closed 1.21% higher at 2099. The Dow gained 1.27% to 18076, and the Nasdaq Composite Index climbed by 0.92% to 4983.

On the data front, SNB will release its March decision at 19:30 AEDST. Several US economic data such as weekly jobless claims and Philly Fed Manufacturing Index will be out around midnight AEDST.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.