US data released last night all missed market expectations. The ISD February manufacturing PMI fell for the fourth consecutive month to 53, showing the US manufacturing expansion is slowing. Also, personal spending has contracted by 0.2% implying that US families are still careful on consumption even when job market has been improving and oil prices have fallen significantly. The January PCE price index remains lower than the Fed’s target rising by 1.3% YoY, pared to USD intraday gains and supported US stocks.

However, the major peers have yet to take opportunity to bounce against the Dollar. This is most probably due to China’s rate cut reminding the market of the monetary policy discrepancy between the US and other economies.

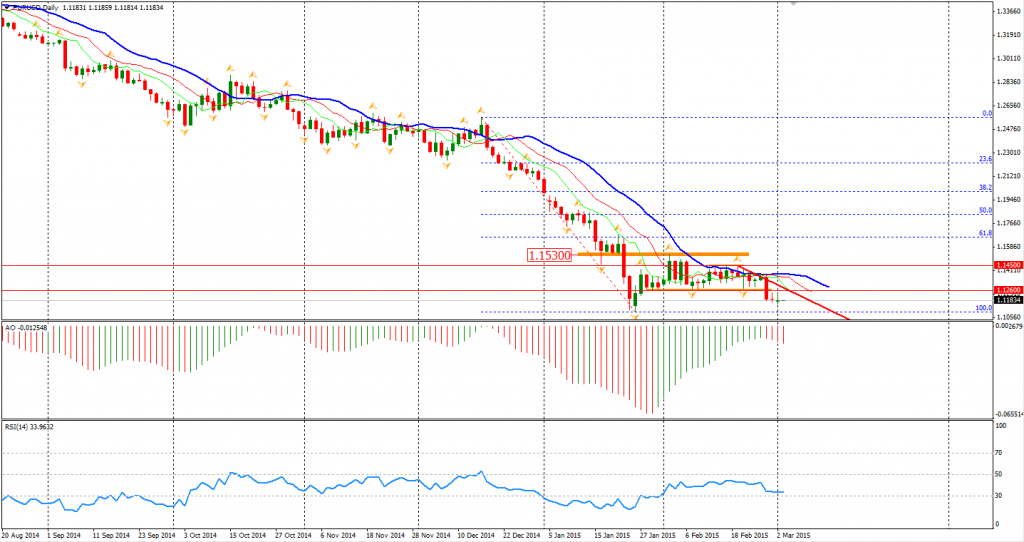

Looking across the seas, the Euro Dollar fluctuated around the 1.12 level yesterday on improving Euro-area data. Unemployment rate fell to 11.2% and deflation slowed to 0.3%. However, if 1.1260 cannot be retaken within the next trading days, the Euro will probably hit a new low in the short term.

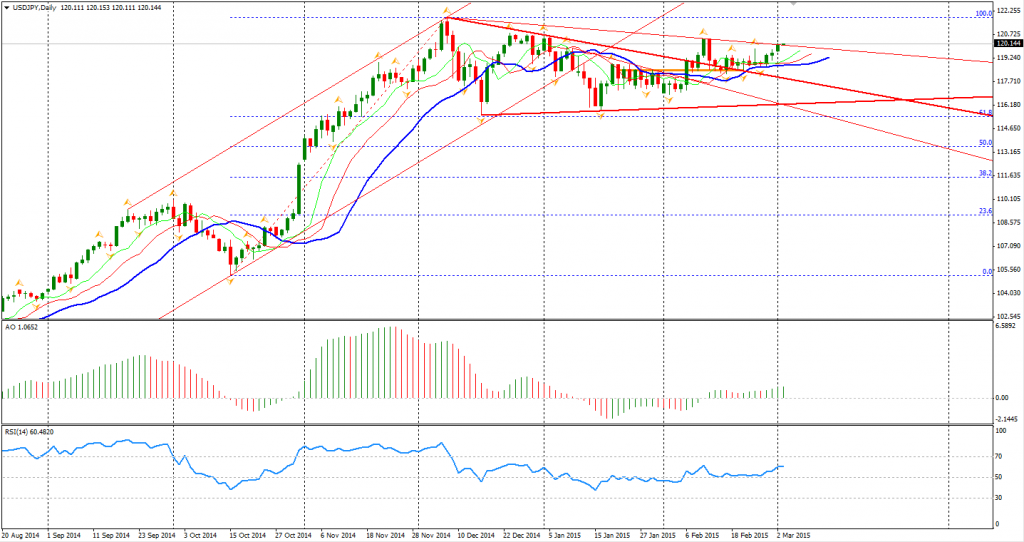

The Dollar Yen rose above the 120 mark as participants again increased their speculations on further easing coming from the Bank of Japan. Japanese economist Yuji Shimanaka, who successfully predicted BOJ’s easing in last October, warned that BOJ may surprise the market again in April as inflation level falls to zero. A confirmed breakout of the 3-month consolidation wedge will imply a significant rise of USDJPY. Former highs of 120.50 will be watched.

As to the stock markets, Shanghai Composite rose by 0.78% on rate cut. The Nikkei Stock Average gained 0.15%. Australian ASX 200 rebounded by 0.51% to 5959. In European markets, the UK FTSE was down 0.1%, the German DAX climbed 0.1% and the French CAC Index lost 0.69%. The US stock indices gained as inflation level was lower than expected with Nasdaq hitting 5000 for the first time since March 2000. The S&P 500 closed 0.6% higher at 2117. The Dow rose by 0.86% to 18289, and the Nasdaq Composite Index climbed 0.9% to 5008.

On the data front, Australia Building Approvals and Current Account will be released at 11:30 AEDST. The most focused event during the Asian session will be the RBA rate decision at 14:30 AEDST – the market has priced it for another rate cut. Canada GDP will be out at 0:30 AEDST after midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.