Major currencies rebounded against the Dollar yesterday as Fed Chairwoman Yellen showed a slight dovish tone in her testimony to the Senate bank committee. AUD and CAD led the rises by over a 1% gain after the speech. On the other hand, the GBP barely changed as it is still suppressed by the 1.5480 level.

As I mentioned yesterday, Yellen’s monetary standpoint is biased to mild dovish. Yesterday’s testimony was in line with her position. She said Fed will stay patient and the rate hike is unlikely to happen in the next couple of meetings, which weakened the US Dollar. However, the chairwoman also mentioned that the change of guidance means Fed will discuss raising the interest rate once the economic data is strong enough. Market interprets this speech as a reminder that ‘patience’ will be deleted in March FOMC meeting.

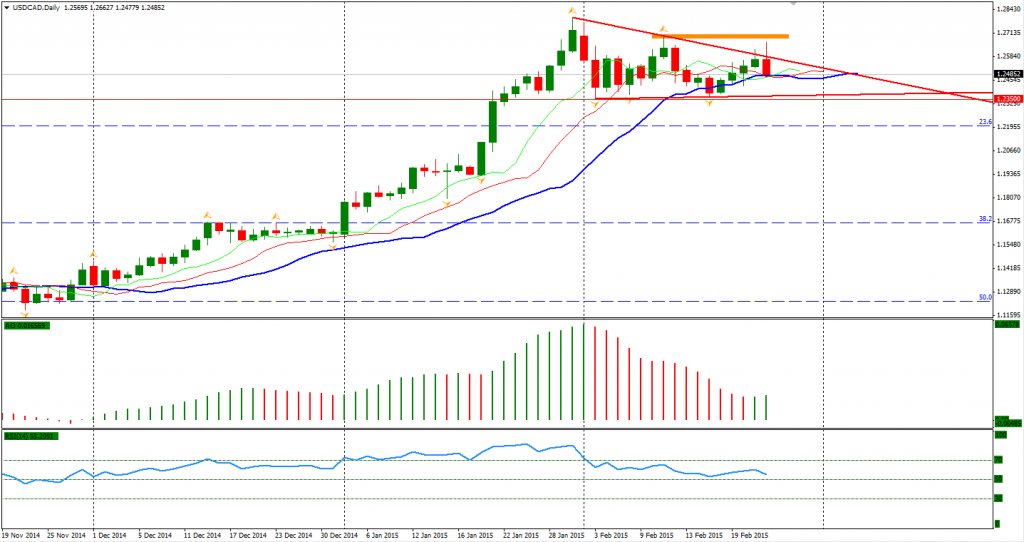

A major reversal of the USD did not happen last night as the reactions of the FX market were limited. The USDCAD once broke the upside line of its recent triangle pattern but fell back later. It is still unclear whether the temporary breakout was successful. The consolidation can be seen as over if the pair moves above 1.27.

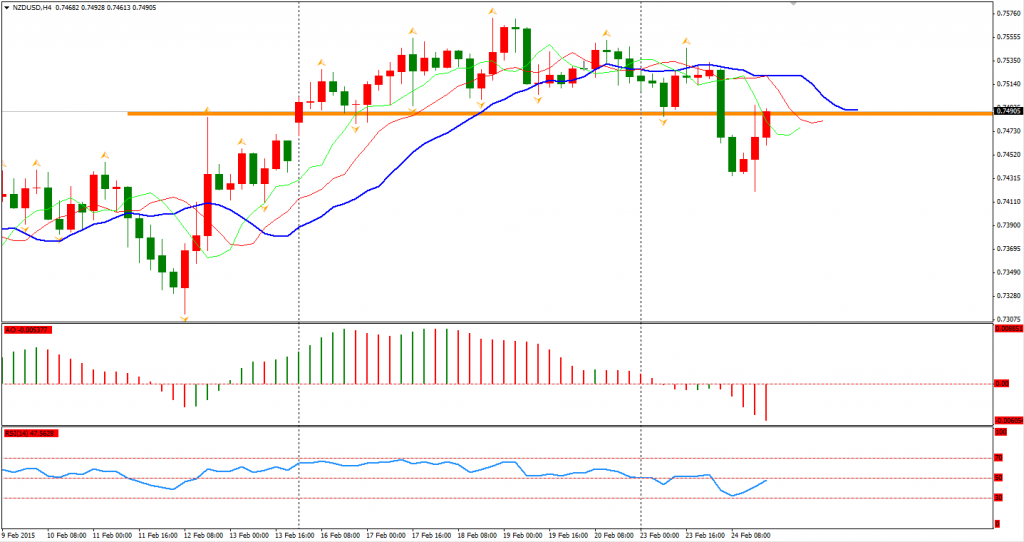

The New Zealand Dollar once slid almost 100 pips versus the USD after inflation expectations fell to 1.8% from 2.1% of previous quarter’s reading. It recovered half of its loss after Yellen’s speech but still cannot rise back above the 0.75 level. A head-and-shoulders pattern has been formed and NZDUSD remains bearish and may fall to previous lows of 0.73.

Looking to the stock markets, the Nikkei Stock Average gained 0.74% to 18603, once again refreshing its highest level of 15 years. Australian ASX 200 rebounded 0.32% to 5927. In European markets, the UK FTSE was up 0.54%, the German DAX climbed 0.67% and the French CAC Index gained 0. 5%. The US stock indices broadly rose on Yellen’s dovish testimony. The S&P 500 closed 0.3% higher at 2115. The Dow gained 0.51% to 18209, and the Nasdaq Composite Index rose 0.14% to 4968.

On the data front, China HSBC Flash Manufacturing PMI will be released in the afternoon 12:45 AEDST. BOE Governor Carney will speak at 21:00 AEDST and Fed Chairwoman Yellen will testify before the House Financial Services Committee at 2:00 AEDST.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.