The meeting between Eurogroup and Greek leaders is in spotlight as there is still yet no sign of agreement and today is the deadline. Eurogroup first confirmed they received a letter from Greece indicating this as a positive signal. However, Greece requested to extend its loan agreement in the email which was then rejected by Germany. Market participants are now waiting for the confirmed news whether either party will compromise to an agreement on Friday.

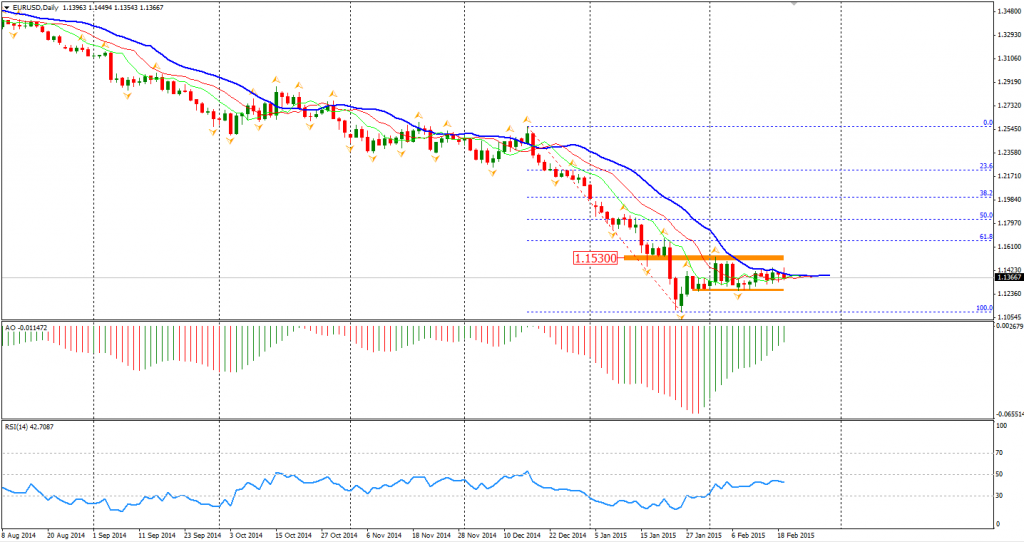

The Euro rose and tested the 1.1450 resistance level in the European morning but failed as the huge amount of offers laid still at that level. It later fell on Germany’s cold response to Greece clsoing at 1.1370 this morning.

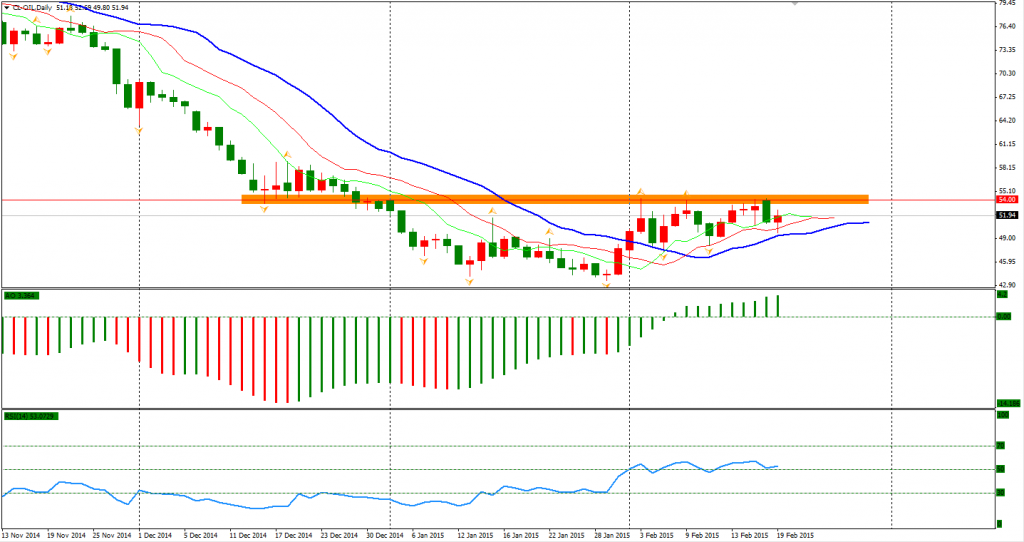

US Oil prices once slumped by 5% to the day low of $49.80 per barrel before the crude oil inventories data was released with traders expecting storage to increase and short WTI contracts in advance. The data finally confirmed the forecast, but oil prices surged back to $52 as expectation was met. The outlook of oil prices is still bearish as demand remains weak. Technically, the $54 resistance level has thwarted three times the bounce of prices. Only when this resistance is broken will oil prices continue the rebound.

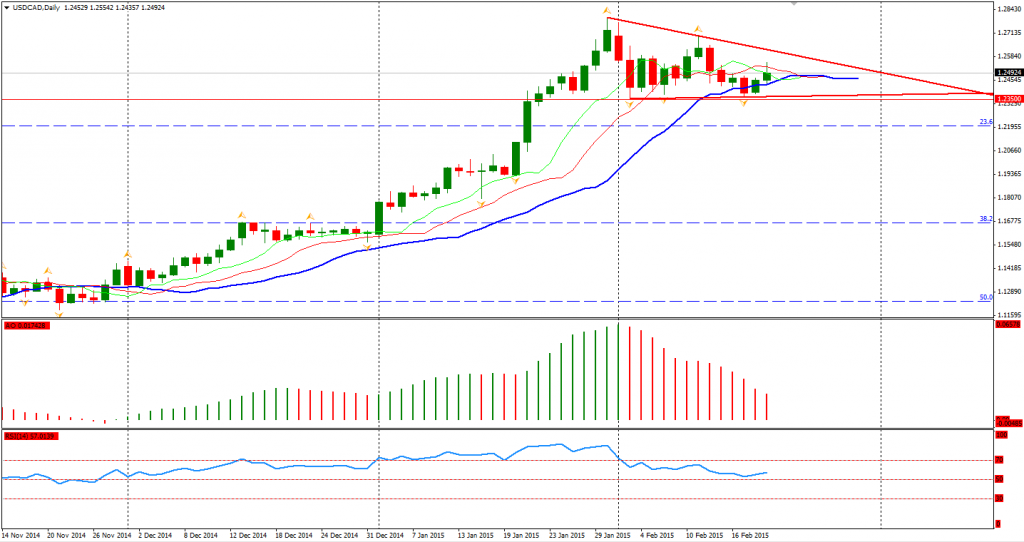

The tumbled oil prices put pressure on the Canadian Dollar, which led the commodity currency to fall against the US Dollar. A triangle consolidation pattern is forming. The low from February 3rd, 1.2350, provides strong support for the USDCAD. If oil prices slumped again as mentioned above, the USDCAD will probably upside break the triangle pattern and resume its rally.

Looking to the stock markets, the Nikkei Stock Average gained 0.35% to 18265, highest level in 15 years. Australian ASX 200 lost 0.19% to 5904. In European markets, the UK FTSE was down 0.13%, the German DAX climbed 0.4% and the French CAC Index gained 0.71%. US stocks rose broadly after the President Day. The S&P 500 closed 0.11% lower at 2097. The Dow slid 0.24% to 18030, and the Nasdaq Composite Index rose 0.37% to 4924.

On the data front, Eurozone February Flash Manufacturing PMI will be released today. UK retail sales will be at 20:30 AEDST. US Flash Manufacturing PMI and Canada retail sales will be out at 0:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.