The USD rose against most majors as the IMF once again downgraded global growth prospects for 2015 and 2016. The US is the only major economy being upgraded, while the expected growth rate of China, Japan, Eurozone and Russia were cut. The economic activities of major oil producing countries will fall on lower oil prices.

The IMF forecasts China will only expand by 6.8% in 2015, after the second biggest economy itself had just released its 2014 growth rate as 7.4%. Although 7.4% is the slowest GDP growth in 24 years, it is mostly in line with the government target and slightly better than expected. The pressure on Beijing is to maintain the high-speed expansion, so moderate easing is expected.

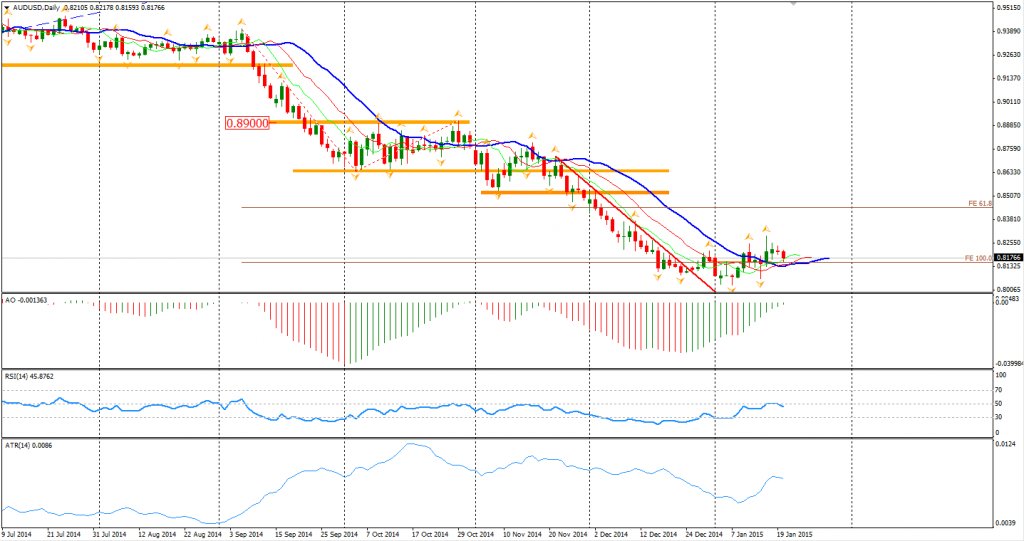

The Aussie Dollar fluctuated between 0.8150 and 0.8220 after the GDP release. However, the outlook of this pair is still bearish. The acceptable GDP growth means that large scale investments from Chinese authority may not happen in the short run. Hence, the needs of iron ore and other materials will remain weak. I suppose, shortly the AUDUSD will break the 0.8150 support and test the 0.8030 bottom again.

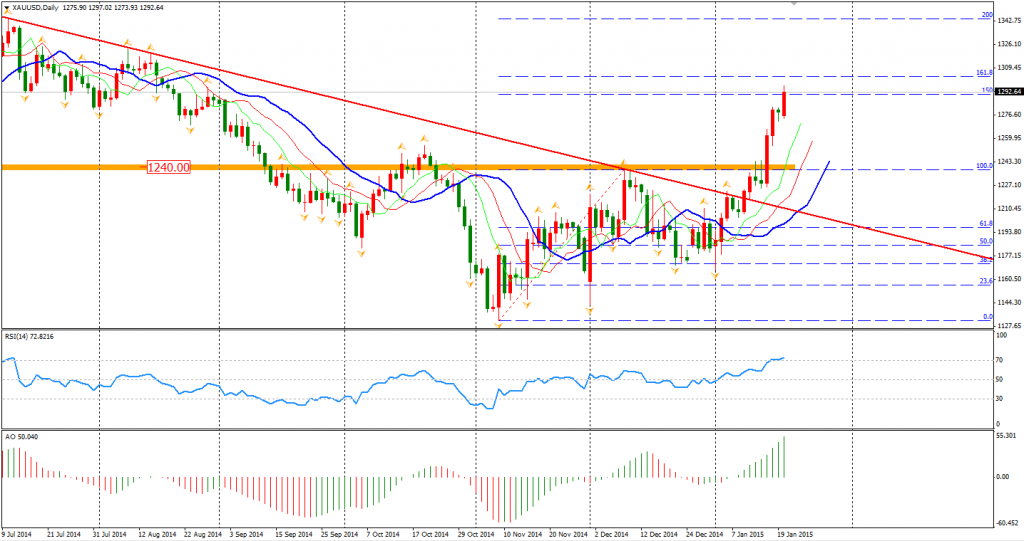

The cut of global outlook surged the safe-haven demands. Gold prices rocketed to $1292 per ounce and touched $1297 during the US session, highest since August 2014. The RSI reached 72, showing gold is overbuying in the short term, especially confronting the $1300 integer level.

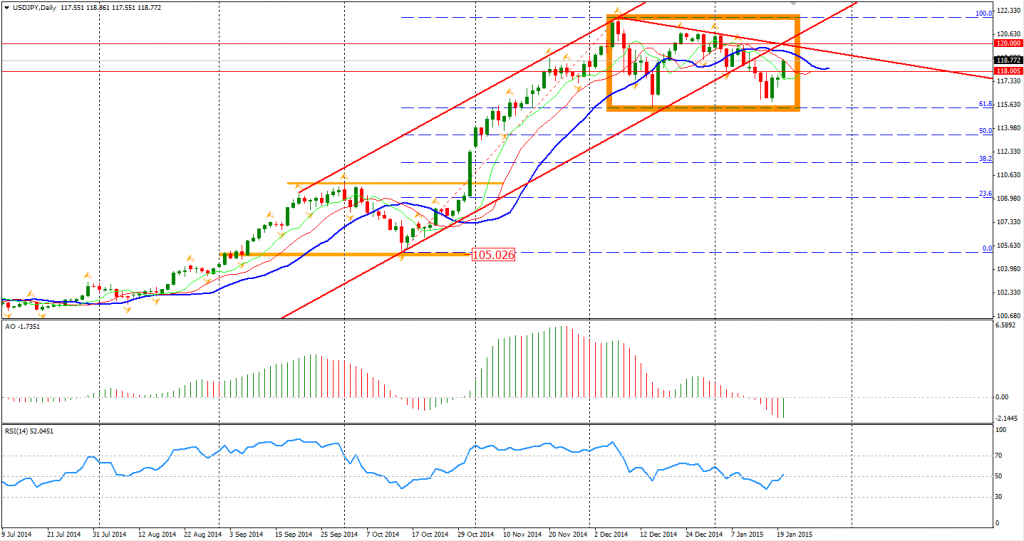

The Dollar Yen kept rising after I mentioned the bullish reversal sign on the daily chart. The consolidation will continue and the 120 level will be the next target.

Back to stock markets – the Shanghai Composite rebounded 1.82% to 3173. ASX 200 fell 0.1% to 5307. The Nikkei Stock Average gained 2.07%. In European markets, the UK FTSE was up 0.52%, the German DAX gained 0.14% and the French CAC Index rose 1.16%. The US market closed rose slightly after the holiday. The S&P 500 closed 0.15% higher to 2023. The Dow gained closed flat at 17515, and the Nasdaq Composite Index rose 0.44% to 4655.

On the data front, Australia Westpac Consumer Sentiment will be released at 10:30 AEDST. BOJ press conference will be today in the afternoon. UK jobs report and BOE rate decision will be out at 20:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.