The Forex market was quite peaceful yesterday after the FOMC statement confirmed Fed will raise interest rate in 2015. Sterling and commodity currencies rebounded against Dollar, while Euro and Yen remained weak.

Swiss Central Bank surprisingly cut the interest rate to -0.25% to make Swiss Franc less attractive in the market. This measurement showed the central bank’s determination to hold the 1.20 level of EUR/CHF which is being tested as investors rushed to Franc for safe-haven needs. EUR/CHF dumped 90 pips shortly after the news, but later consolidated around 1.2040.

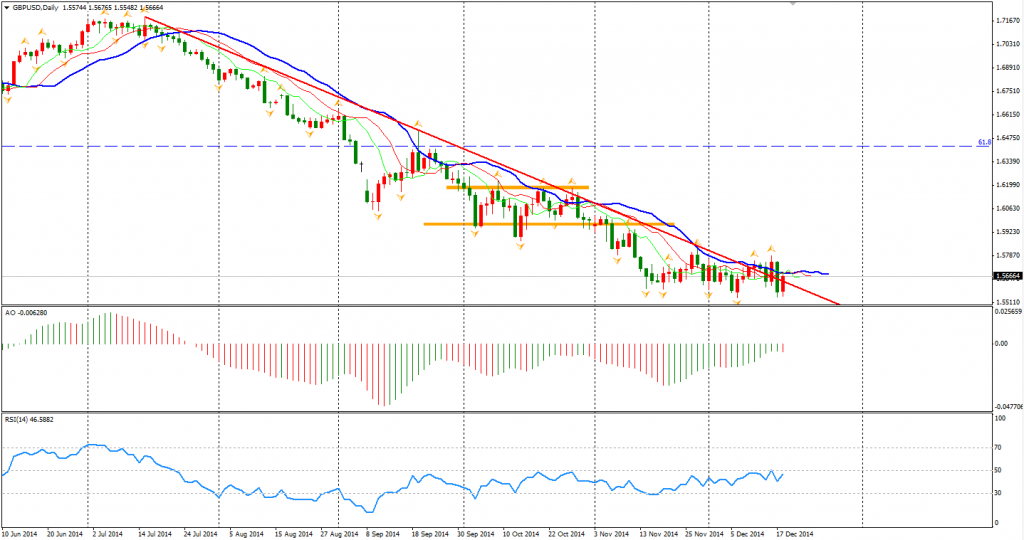

Sterling remains its strength as November retail sales data was largely higher than expected for two months in a row. The strong growth was probably due to the promotion during Black Friday. The data annual growth rate was 6.4%, which was the highest in ten years. Among with the upbeat wage growth on Wednesday, the expectation of rate hike from Bank of England rose too. However, the average price fell 2%, showing that UK was still facing the pressure of disinflation.

Back to the stock markets, the Shanghai Composite closed 0.11% lower to 3057. ASX 200 bounced 0.95% to 5210. The Nikkei Stock Average surged 2.32%, inspired by Yen’s drop. The Western stock markets were in a sea of green after the dovish statement of Yellen as Fed commited not to raise rate too early. The UK FTSE bounced 2%, the German DAX surged 2.79% and the French CAC Index rocketed 3.35%. Three major indexes of US market rallied over 2%. The S&P 500 closed 2.4% higher to 2061. The Dow surged 2.43% to 17778, and the Nasdaq Composite Index rocketed 2.24% to 4748.

On the data front, German Consumer Climate will be released at 18:00 AEDST. UK CBI Realized Sales will be at 22:00 AEDST. Canada CPI and Retail Sales will be out at 0:30 am.

This is my last market wrap in 2014. The report will resume in early January 2015. To sum up the forecast of 2015 with simple language, the bullishness of US Dollar will be the main trend in 2015, while Euro and Yen are expected to be the weakest counterparties among the majors. Commodities will remain under pressure and so will commodity currencies. The low price of oil may lead to instability of emerging nations starting from Russia and Venezuela. However, the impact will spread around world, and that will be the major risk of global economy in 2015.

I wish you a Merry Christmas and a Happy New Year in advance and I will see you soon in 2015.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.