Similar situation happened in the last two days when European currencies rose on little-disappointing US data and Aussie Dollar tumbled.

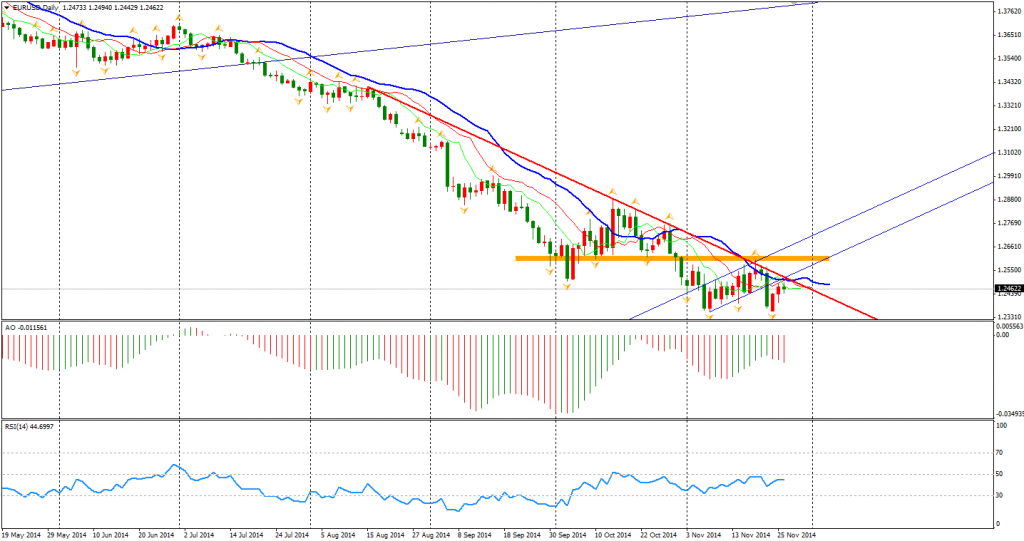

Euro emerged on its third consecutive day above 1.25. However, Friday’s loss has yet to be recovered, given this week’s movement on EURUSD was just a correction. As the As Thanksgiving Day approaches, the range of movement may contract for the rest of the week and the bearishness of Euro may probably restart after the weekend.

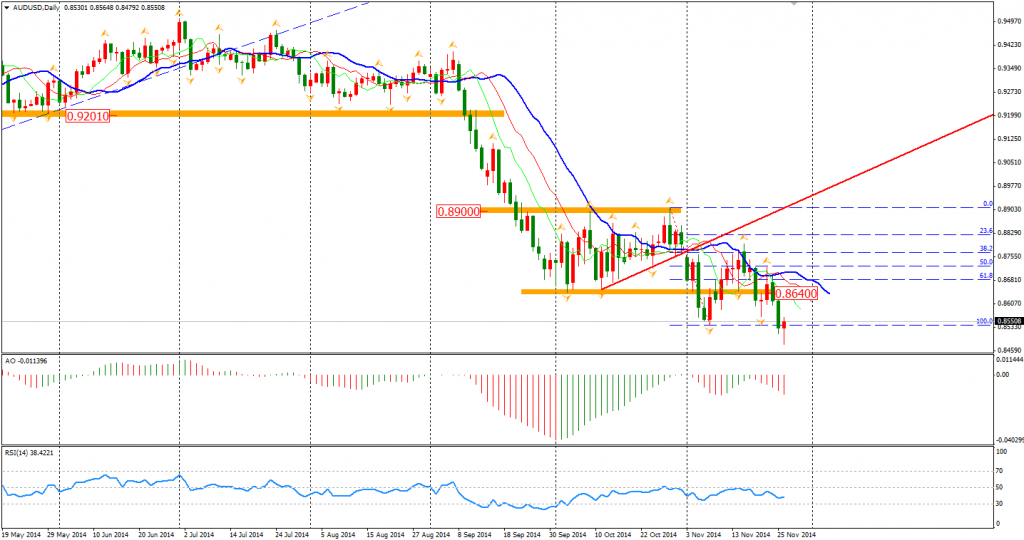

Australian Dollar was still the weakest player yesterday, refreshed low at 0.8480. RBA officials continued sending bearish speeches on their currency and the biggest export good – iron ore, remained at multi-year low. The RBA deputy governor Philip Lowe even mentioned rate cut in his speech. Even though the possibility of this action is still low in 2015, the market now has no choice but follow RBA to push the Aussie Dollar to a lower level.

Sure, we have witnessed several fake breakouts lately on AUDUSD, but this time might be real.

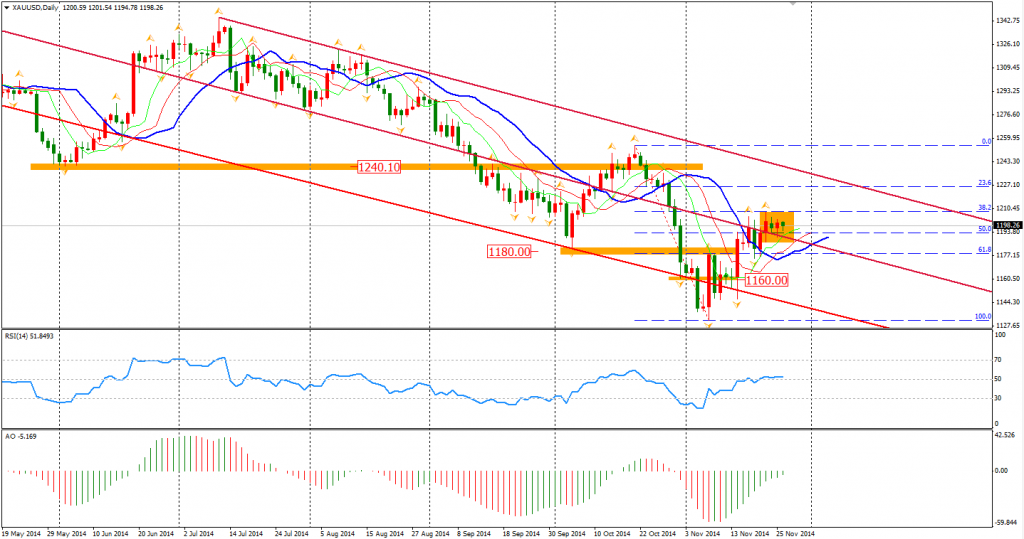

The consolidation of the yellow metal continues, the trading range of this week is still within the spin of last Friday, showing that participants are conservative before the long weekend. We can see the upper boundary of the downward channel suppressing the gold price, but we may have to wait till next week to see whether there will be a breakout or falling on the price.

Most Asian stock markets remained rising. The Shanghai Composite surged 1.43% for the third day in a row to 2604, a 39-month high. ASX 200 also advanced 1.15% to 5396. In the European stock markets, the UK FTSE was down 0.03%, the German DAX rose 0.55% and the French CAC Index lost 0.2%. The US market inched lower. The S&P 500 gained 0.28% to 2073. The Dow closed 0.07% higher at 17828, and the Nasdaq Composite Index rose 0.61% to 4787.

On the data front, Australian Private Capital Expenditure will be released at 11:30 AEDST. German Unemployment Change and Prelim CPI are the main data in European session. Also, the result of OPEC Meetings will be the focus later today.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.