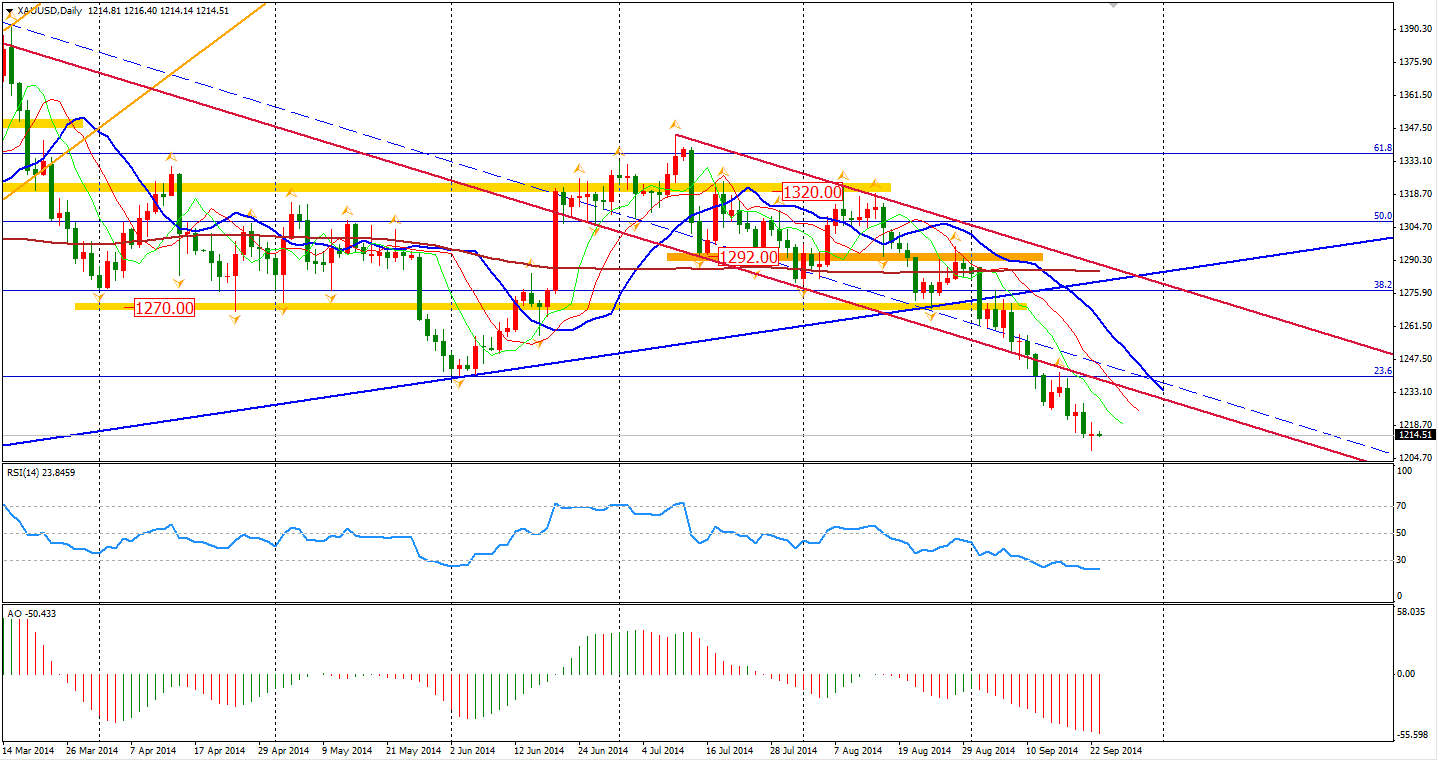

Gold slumped $10 in the Asian Monday morning session to below $1210 as the dollar’s rally dampened demand for the precious metals as alternate investments. It fell to its lowest in eight months and silver extended a slump to the cheapest in four years.

Last week, the Federal Reserve raised U.S. interest-rate projections for 2015 while affirming a pledge to keep borrowing costs low for a considerable time. However, hedge funds lowered bullish holdings in gold for the fifth straight week, the longest run this year, as equities surged and inflation remained muted. This though, left a doji in the daily chart increasing the possibility of a rebound.

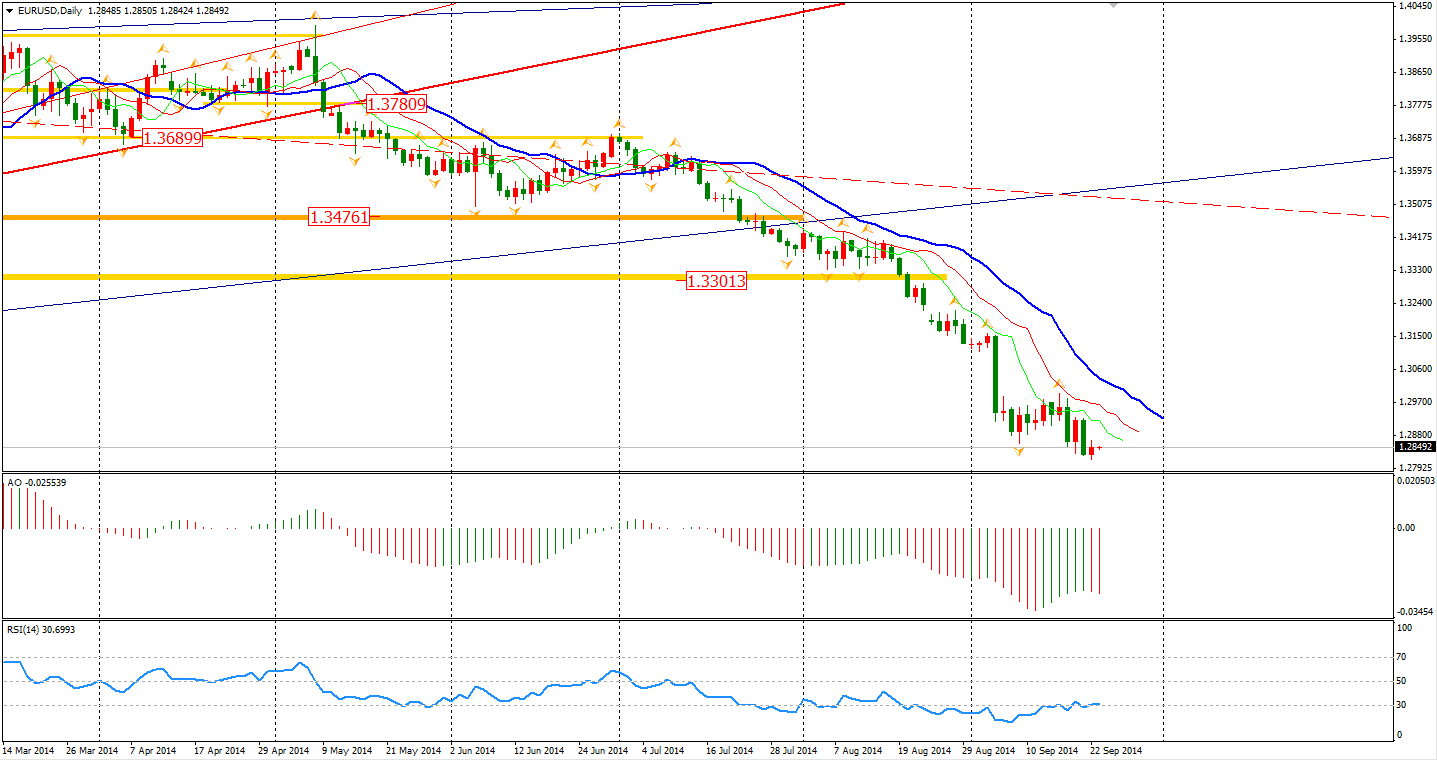

ECB president Mario Draghi inferred to the economic recovery in the Eurozone as “losing momentum” in his speech yesterday. The speech raised expectations of heightened stimulus measures. The Euro again refreshed recent lows against the Dollar. Relatively though, the Euro performed stronger than the commodity currencies.

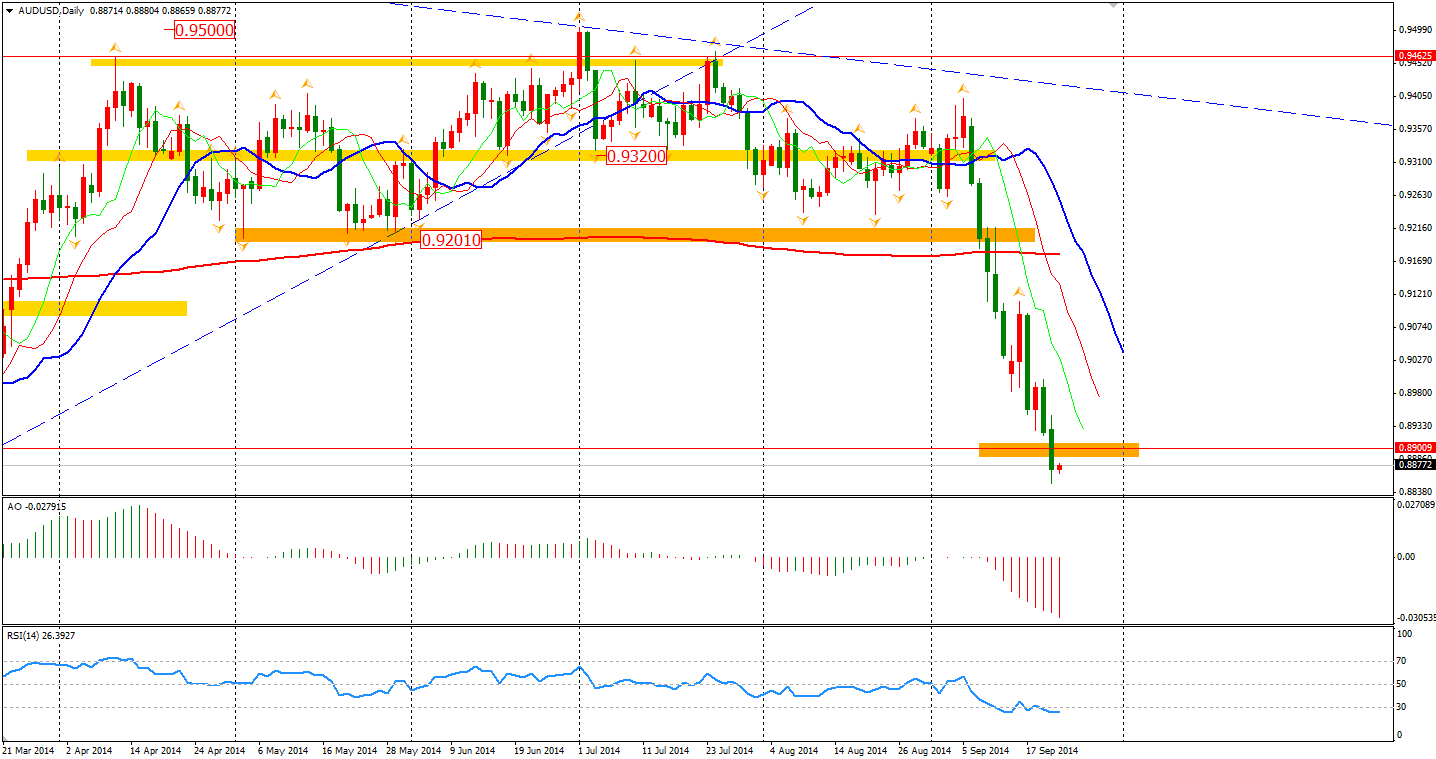

Australia’s dollar has dropped to a seven-month low as a slump in prices for raw materials has curbed demand for the currencies of commodity-producing nations. Yesterday, it broke the 0.89 level against the Dollar, where we mentioned before was our first target of bears. The next target will be the year’s low of 0.8650.

The Asian stock markets were a sea of red on Monday. The Shanghai Composite plummeted 1.70% to 2290. The Nikkei Stock Average fell 0.71% being dragged down by Softbank, as Alibaba’s largest shareholder, slumping 2%. The Australian ASX 200 lost 1.29% to 5363. In the European stock markets, the UK FTSE was down 0.94%, the German DAX lost 0.51% and the French CAC Index fell 0.42%. U.S. stocks retreated after last week’s rally. The S&P 500 fell 0.8% to 1994. The Dow edged down 0.62% to 17173, while the Nasdaq Composite Index slumped 1.14 % to 4528.

On the data front, China HSBC Flash Manufacturing PMI will be at 11:45 am AEST. Eurozone Flash PMIs will also be released successively at the beginning of the European session. Canada Retail Sales is at 22:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.