Earlier this morning, the Fed announced that it intends to keep its benchmark rate near zero as long as inflation remains under control. There will be no change until they see consistent gains in wage growth, long-term unemployment and other gauges of the job market. The central bank maintained conservative language signalling its plans to keep short-term rates low “for a considerable time” after it ends its monthly bond purchases after its next meeting in October.

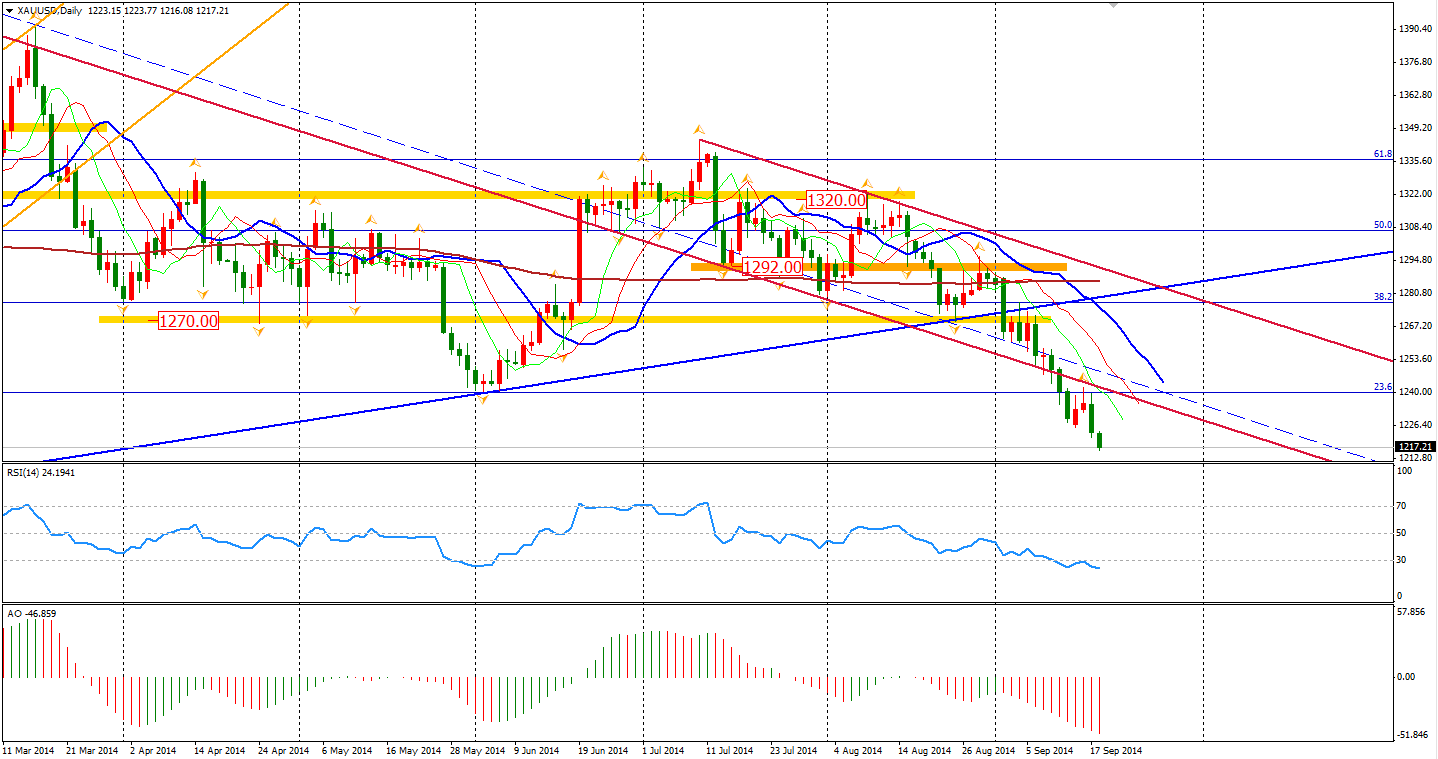

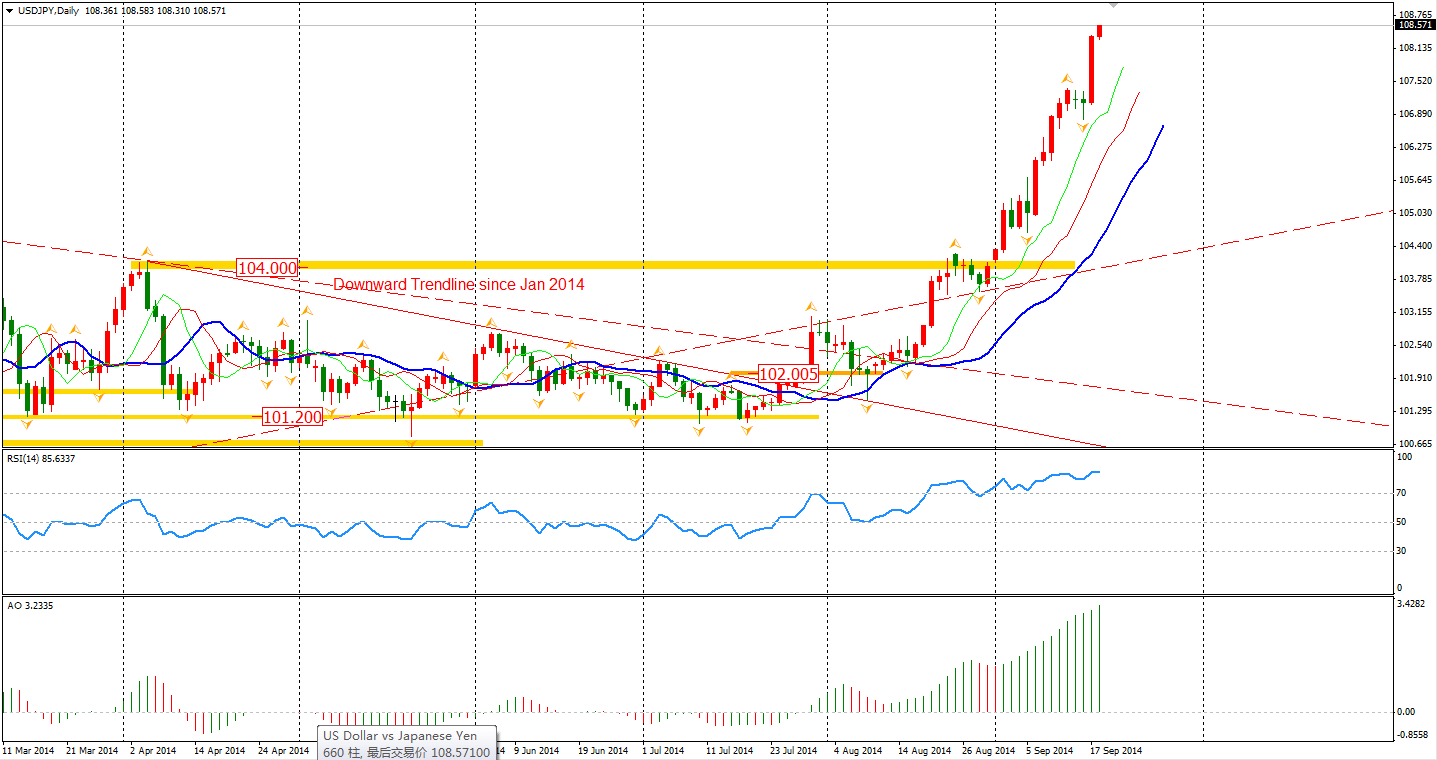

Nevertheless, the US Dollar kept its pace of ascent against other currencies, reaching a 14-month high after the release. Gold prices slumped further down and are now below $1220 per ounce.

China’s Central Bank has provided 500 billion RMB (US$81 billion) in a three-month loan to the nation’s five largest state-owned banks. The action is equivalent of a 0.5% cut in the reserve requirement ratio. The latest liquidity injection is thought as a response of recent weak economic data. It shows the monetary authority’s concern with the slowdown, especially when Fed is widely expected to quit QE and turn toward a gradual rate hike.

The industrial output expansion released last weekend was the weakest reading since the GFC. Investment and retail sales growth were also disappointing. However, Beijing shows more tolerance in this recent slowdown. In accepting that the GDP annual growth rate fell below 7.5%, it appears they are paying more attention to economic reform and liberalization which will certainly benefit China in the long term if they succeed.

With less demand for iron ore and coal from China, the Australian mining industry is suffering from the current low prices. The last time when commodity prices slumped during the GFC, Aussie/Dollar fell almost 40% to 0.60. That significant plummet is yet to happen to the exchange rate, due to the unusual operations from global central banks. However, as the Fed has pledged to normalize the monetary policy, how long will this situation remain?

The Asian stocks markets were fairly mixed yesterday before the FOMC meeting. The Shanghai Composite bounced 0.49% after the big slump on Tuesday to 2308. The Nikkei Stock Average lost 0.14%. The Australian ASX 200 dropped 0.7% to 5407. In European stock markets, the UK FTSE was down 0.14%, the German DAX gained 0.3% and the French CAC Index rose 0.50%. U.S. stocks closed slightly higher on FOMC dovish statement. The S&P 500 rose 0.13% to 2001.57. The Dows gained 0.15% to 17157, while the Nasdaq Composite Index was up 0.21% to 4562.

On the data front, UK Retail Sales will be released at 18:30 AEST. U.S. Building Permits and Unemployment Claims will be at 22:30. Philly Fed Manufacturing Index will be at midnight. However, the most watched event will undoubtedly be the Scottish Independence Vote, which may stir huge volatility in the Sterling and Euro. Investors should be wary of this risk.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.