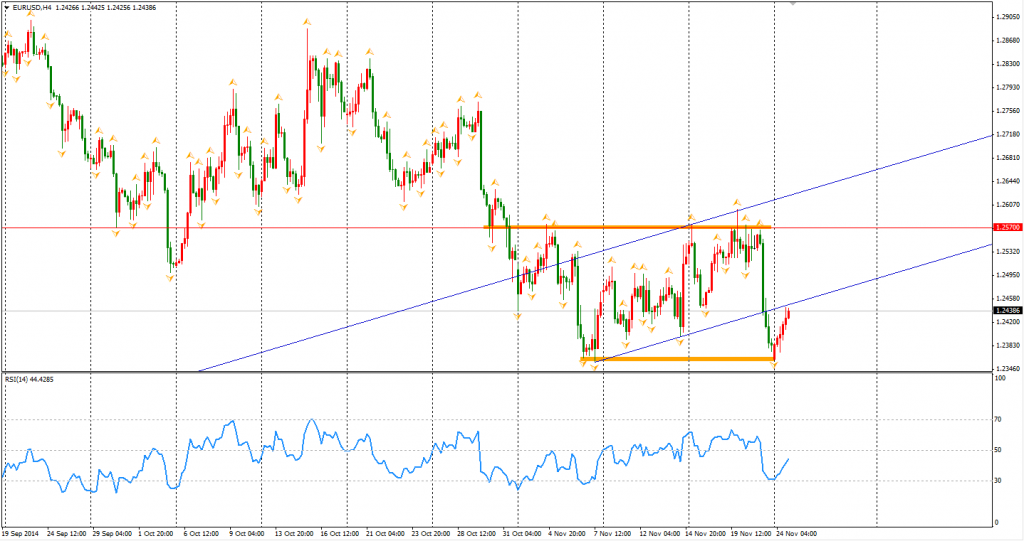

The upbeat German business confidence assisted in a Euro rebound against the dollar away from its month’s low. The business climate index rose for the first time in seven months to 104.7. It gives some hope to the Eurozone against other weak data. The Euro Dollar was around 1.2440 this morning – still weak considering the slump of last Friday. Traders can keep their bearish view on Euro as long as it remains below the lower boundary of the flag pattern.

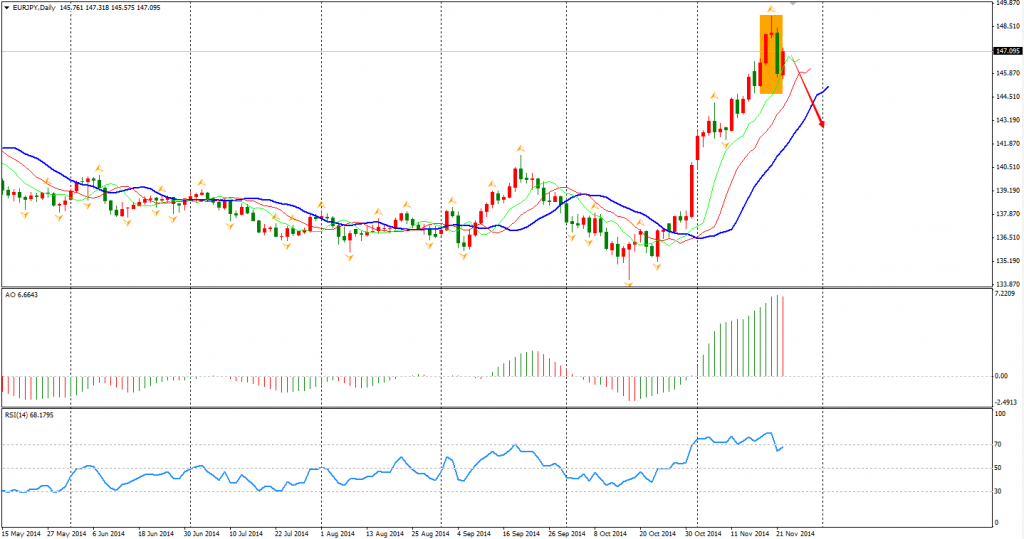

We can also see some trading opportunities in the Euro crosses. EURJPY for instance, left an evening star in the daily chart on last Friday and a doji in the weekly chart. Considering the Dollar Yen has been close to the 120 level and the Euro is expected to be under pressure from ECB’s further easing, the Euro Yen may fall in the mid-term.

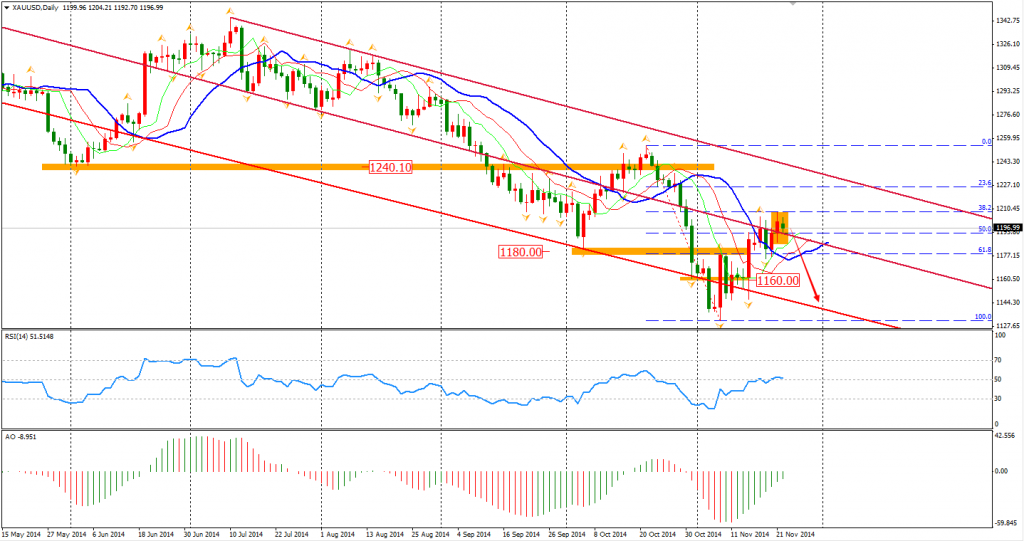

Traders maintain their doubts for the next move of gold price as gold closed as a harami in the daily chart. Some hedge funds added their wagers on a bullishness after China joined Japan and Eurozone in the team of monetary easing. However, other participants are still keeping their bearish bets as the Fed is heading to rate hike and demands from China and India are weak compared with last year. The Harami pattern may imply that the rebound is over.

Most Asian stock markets closed higher after the China rate cut. The Shanghai Composite surged 1.85% to a 3-year high of 2533. The ASX 200 also advanced 1.08% to 5362. In the European stock markets, the UK FTSE was down 0.31%, the German DAX rose 0.54% and the French CAC Index gained 0.49%. The US market kept climbing. The S&P 500 gained 0.29% to 2069. The Dow rose 0.05% to 17818, and the Nasdaq Composite Index rose 0.88% to 4754.

On the data front, BOJ Governor Kuroda will speak at 12:00 AEDST. Canada Retail Sales and US Prelim GDP will be released at 0:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.