It was a crazy and, I suppose, a great day for bulls as both European and China central banks made their moves to boost the economy and prevent deflation. Stock markets, commodity currencies and precious metals surged on Friday.

Draghi pledged to provide more measures of stimulus to revive the economy. This dovish statement shows Draghi trying to convince the investors, in the hopes of raising inflation expectations two weeks before the next policy meeting.

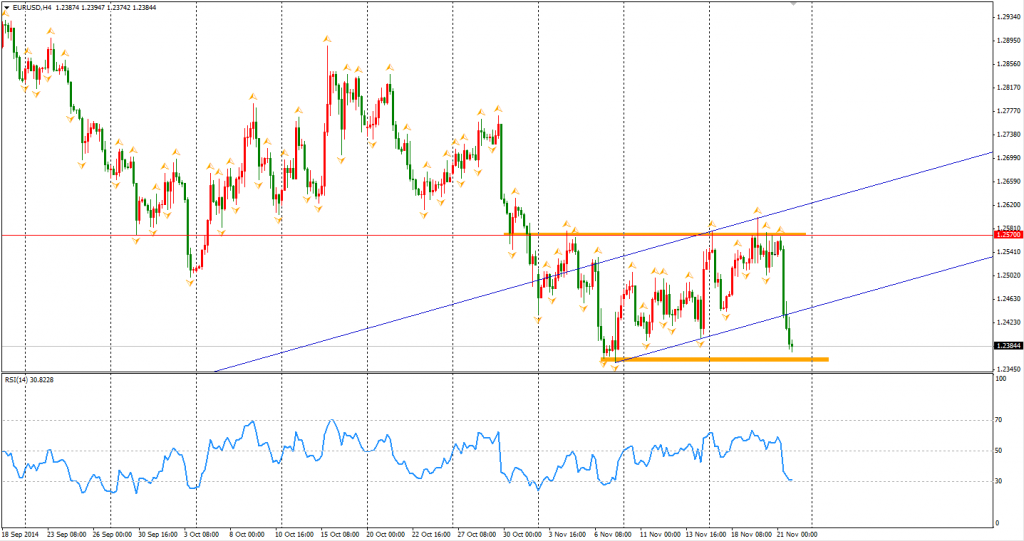

The Euro fell by over 100 pips against the dollar after the speech. It broke the upward consolidation pattern and is now close to a month low of 1.2360. After the breakthrough on Friday, the Euro Dollar may refresh its lows soon and head to 1.2050-1.21.

If we can describe the speech of Draghi as predictable, then the Chinese central bank would be called the surprise of the market. China had to cut its interest rates for the first time since 2012 after its selective monetary easing did not stop the economic growth fall to slowest rate since 1990. The recent data has shown China as confronting weaker growth and subdued inflation, making authorities realising a need for a full-scale lax policy to reboot the economy. Although the central bank said the rate cut is a neutral operation and means no change in policy direction, the market expects further cuts and easing may come out step-by-step.

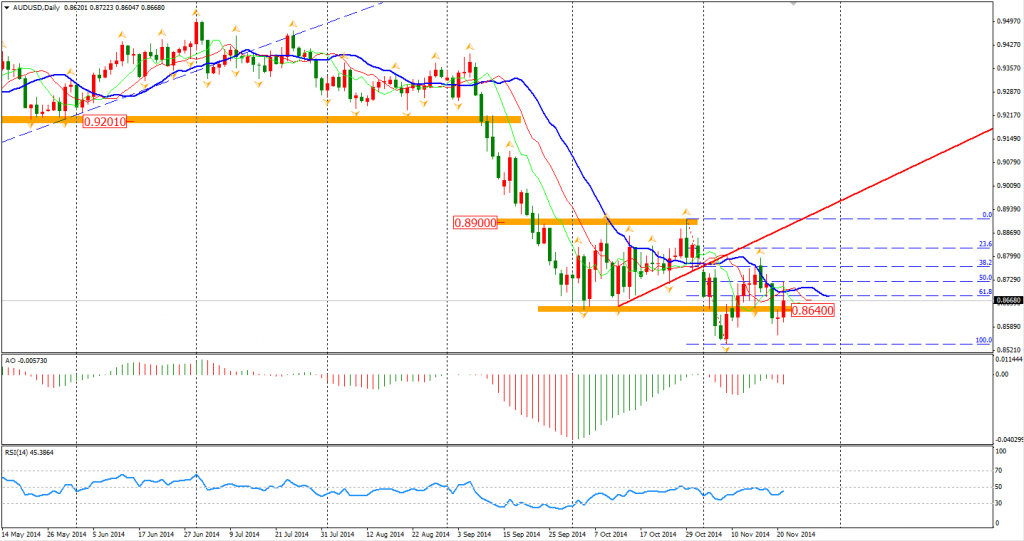

The Aussie Dollar once surged to 0.8720 with the interest cut seen as the stimulus that may relieve the dampened Australian mining industry. It finally closed at 0.8670. The trading strategy of the Aussie Dollar may need to be changed in the short term as a reversal has occurred. The upper resistance of 0.88 is the next target.

Gold prices rose to $1207 per ounce after the China rate cut, but traders are now hesitating about the short term direction. The FOMC minutes confirmed the US is heading to raise its interest rate, while other major economies are pouring more funds into the market. $1220 may be the next resistance for gold.

Most Asian stock markets closed high. The Nikkei Stock Average was up 0.33%. The Shanghai Composite surged 1.39% to 2487. ASX 200 lost 0.22% to 5304. The European stock markets were inspired by the central banks. The UK FTSE was up 1.08%, the German DAX surged 2.62% and the French CAC Index gained 2.67%. The US market refreshed new highs again. The S&P 500 gained 0.52% to 2063. The Dow rose 0.51% to 17810, and the Nasdaq Composite Index rose 0.24% to 4713.

Not much on the data front today. Only German Ifo Business Climate released at 20:00 AEDST may catch some eyes.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.