In a day of intriguing data, we saw the Dollar strengthen after the FOMC meeting minutes. Most of the committee felt that the impact from the global slowdown was fairly limited and should watch for the drop of price expectations.

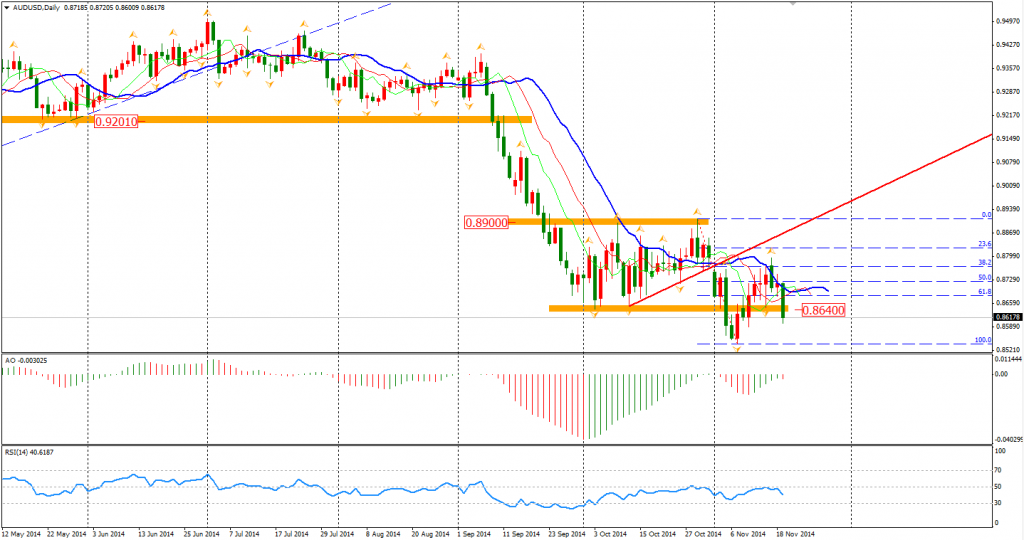

The AUD and JPY were yesterday’s biggest losers to the USD. The Aussie/Dollar declined by more than 1% to 0.86 which we foresaw as written in yesterday’s wrap. A new round of falling has been confirmed. The pair may pull back to 0.8640 testing the breakout of this support, which may see a good entry level for technical traders.

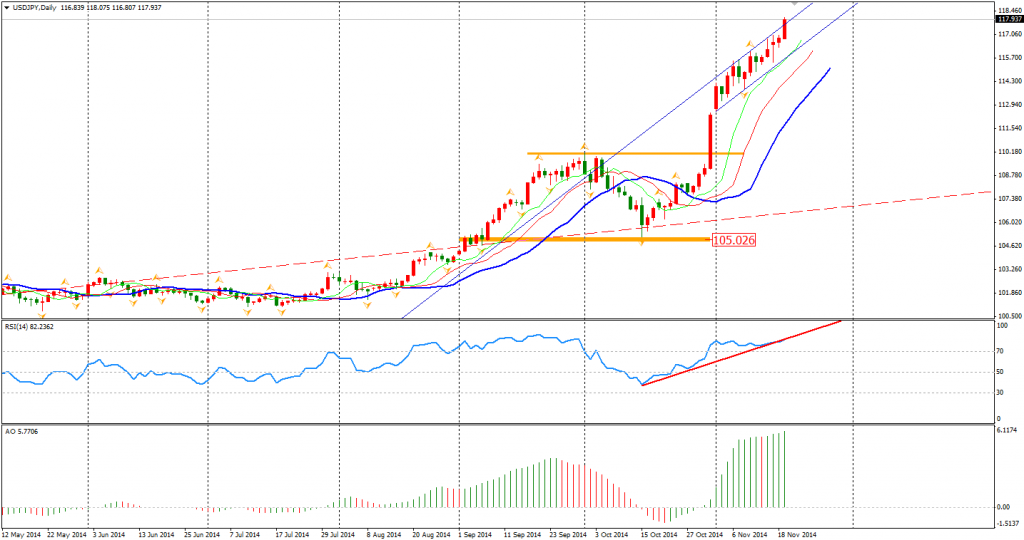

The Yen refreshed its multi-year lower for the second time this week approaching the 118 level. We still see no signs of a cease in the Yen depreciation. The BOJ has decided to maintain the current monetary policy and 80 trillion Yen purchasing program. The Dollar Yen fell a little after the release. The central bank thinks the CPI will keep at its current level and the impact of the sales tax rise is subsiding.

PM Abe may win the re-election in December but the focus of market has moved to the world’s heaviest debt burden as half of the Japanese government spending flows to interest and pensions.

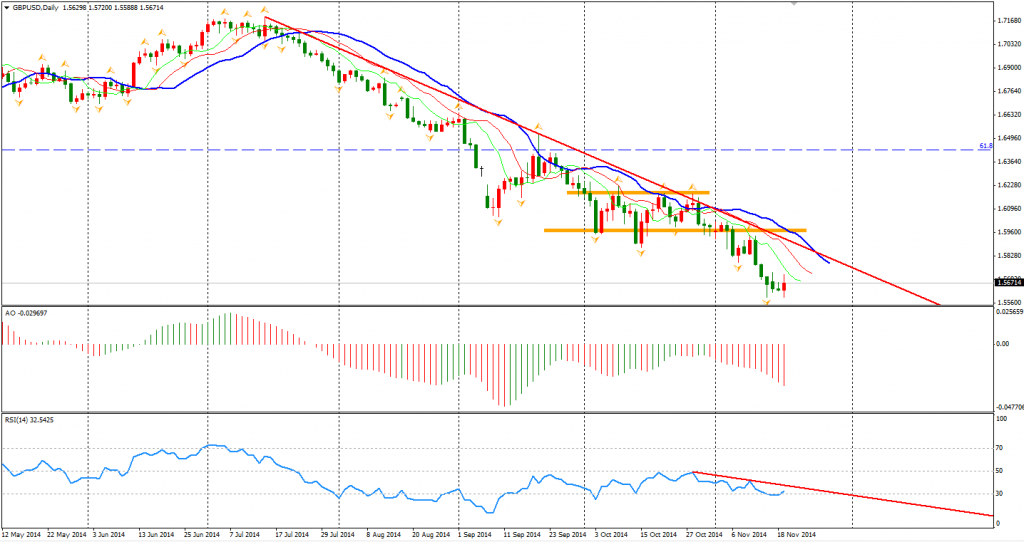

Our winner, the Sterling, on the other side, climbed against the Dollar with BOE minutes more hawkish than expected. The Pound/Dollar once drew back to the 1.57 level after it temporally touched 1.5590. It is the first rise for Sterling Dollar in the last six days, during of which the pair lost 1.8%.

The Asian stock markets closed lower on Wednesday. The Nikkei Stock Average retreated by 0.32%. The Shanghai Composite fell by 0.22% to 2451. The ASX 200 closed by 0.57% lower to 5369. In the European stock markets, the UK FTSE was down 0.19%, the German DAX rose 0.17% and the French CAC Index gained 0.09%.

On the data front, China’s HSBC Flash Manufacturing PMI will be released at 12:45 AEDST. We will see the Euro area Flash Manufacturing PMIs at the beginning of the European session, along with UK Retail Sales at 20:30 AEDST. At midnight, US Unemployment Claims and CPI will be focused.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.