That was the second week in a row for the weakening US Dollar. As the global economic growth perspective is clouded by the news from Japan and the Eurozone, traders are delaying their expectations of the Fed’s first move on interest rate to the second half of 2015.

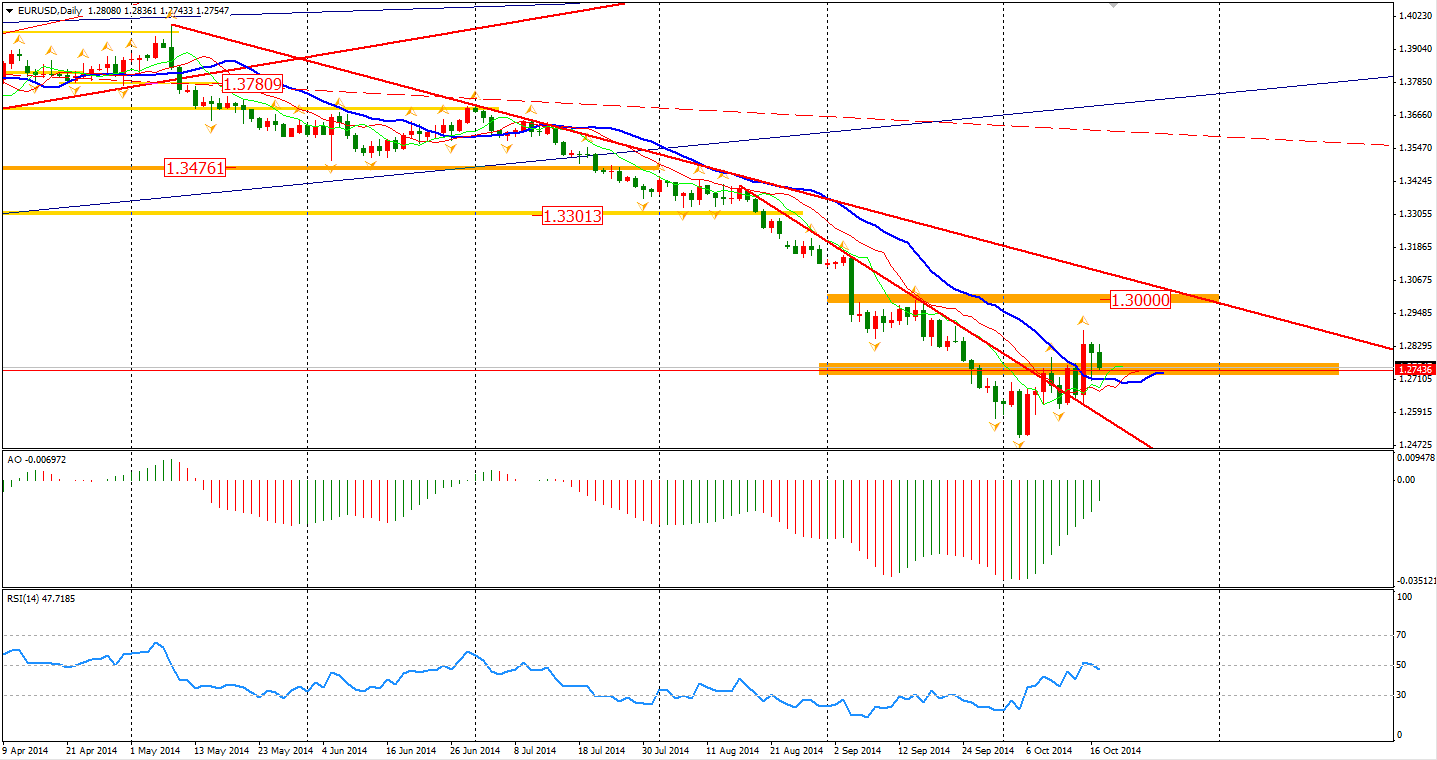

During the last week, the Euro rose 1.1% against the Dollar to 1.2760 – the biggest rally of the last six months. The pair is positioned beyond the 1.2740 level after it upwardly breaking this level and the previous trend line of last week. Technically, the rebound may continue and head to 1.30. However, considering the softening German economy and hiking Greek bond yield, traders shall be cautious when betting on the long side of the Euro.

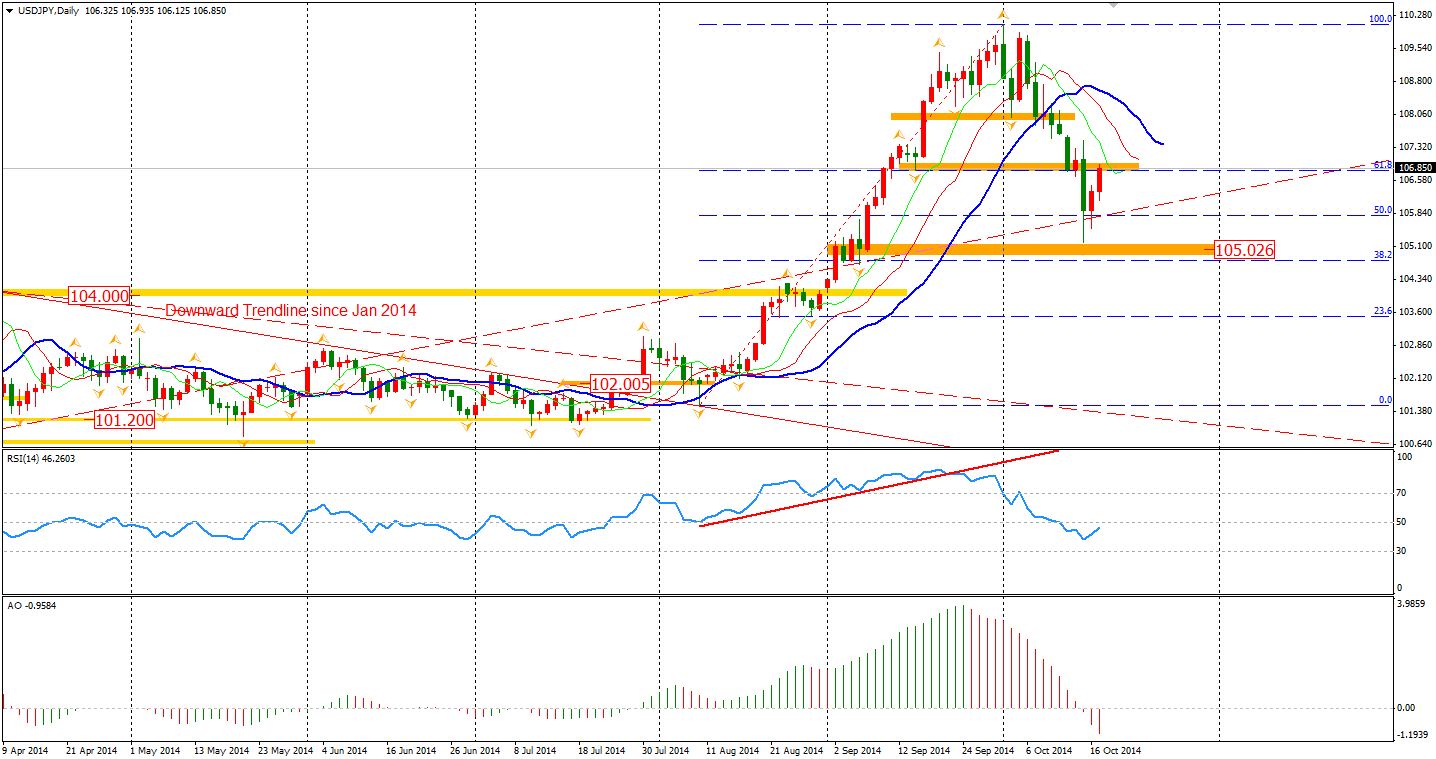

The Dollar Yen rebounded last Friday but remained below the 107 Yen level. Japan may delay the further easing policy as the benefits of a weaker Yen on the Japanese economy have been disappointing. Hence, the Yen may continue its strength for a while retesting the 105 level.

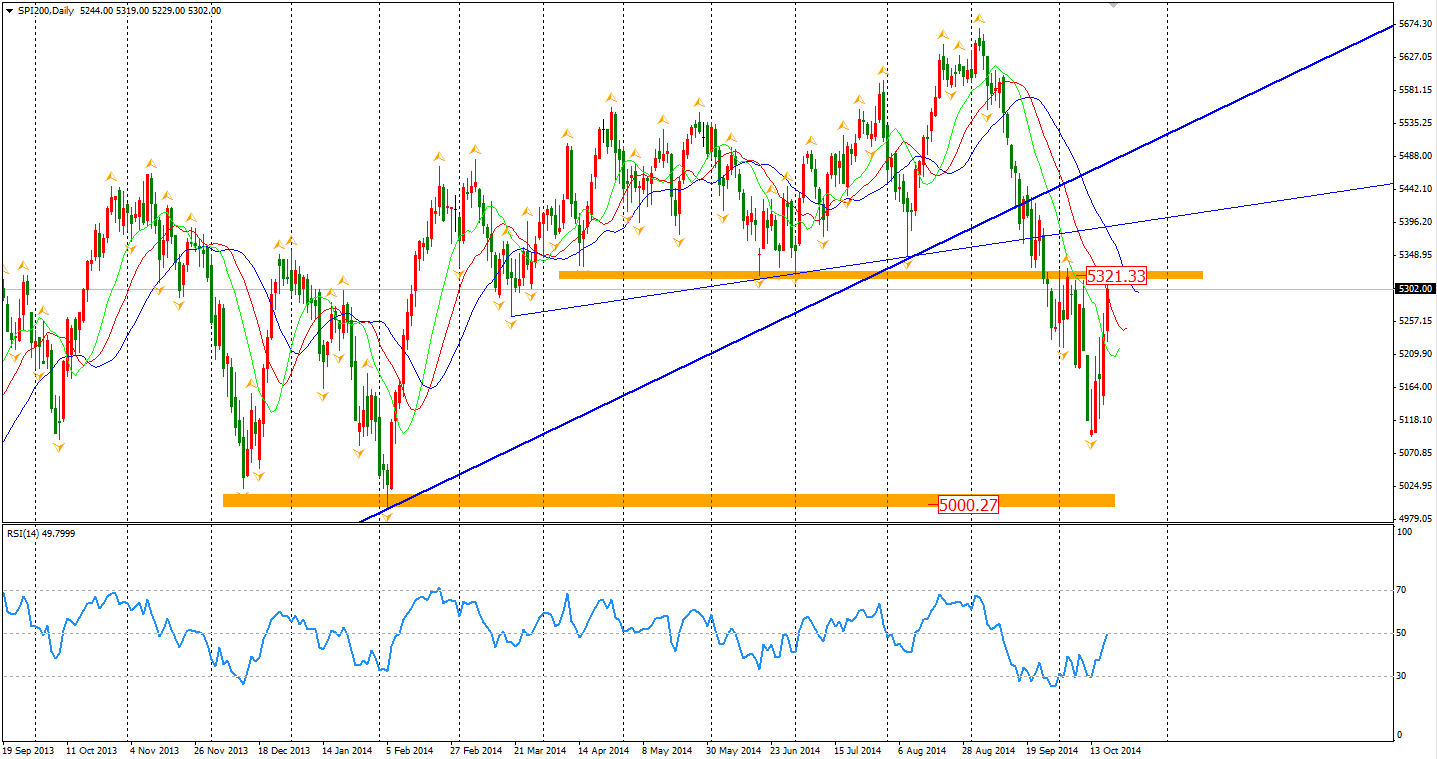

Asian stock markets performed weakly following the overnight US market on Friday. The Nikkei Stock Average slumped by 1.4%. Shanghai Composite also lost 0.6% to 2341. ASX 200 rebounded by 0.32% to 5272 as investors began purchasing oversold stocks. The index once again reached an area as high as 5320- the former critical level we previously mentioned a couple of times. Will this level again become the end of this round of rally?

The Western market was inspired by Central Banks’ officials making dovish statements to support the financial market stability. In European stock markets, the UK FTSE surged by 1.85%, the German DAX rocketed by 3.12% and the French CAC Index rebounded 2.92%. The US market bounced as well. The Dow once gained 1.63% to 16380, while the Nasdaq Composite Index edge up 0.92% to 4258. The S&P 500 surged by 1.29% to 1889.

Today’s only important data will be the Canadian Wholesale Sales release at 23:30 AEST.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.