The strength of US Dollar still exists yet we are now seeing more hesitation from the market pushing the Dollar to a higher level.

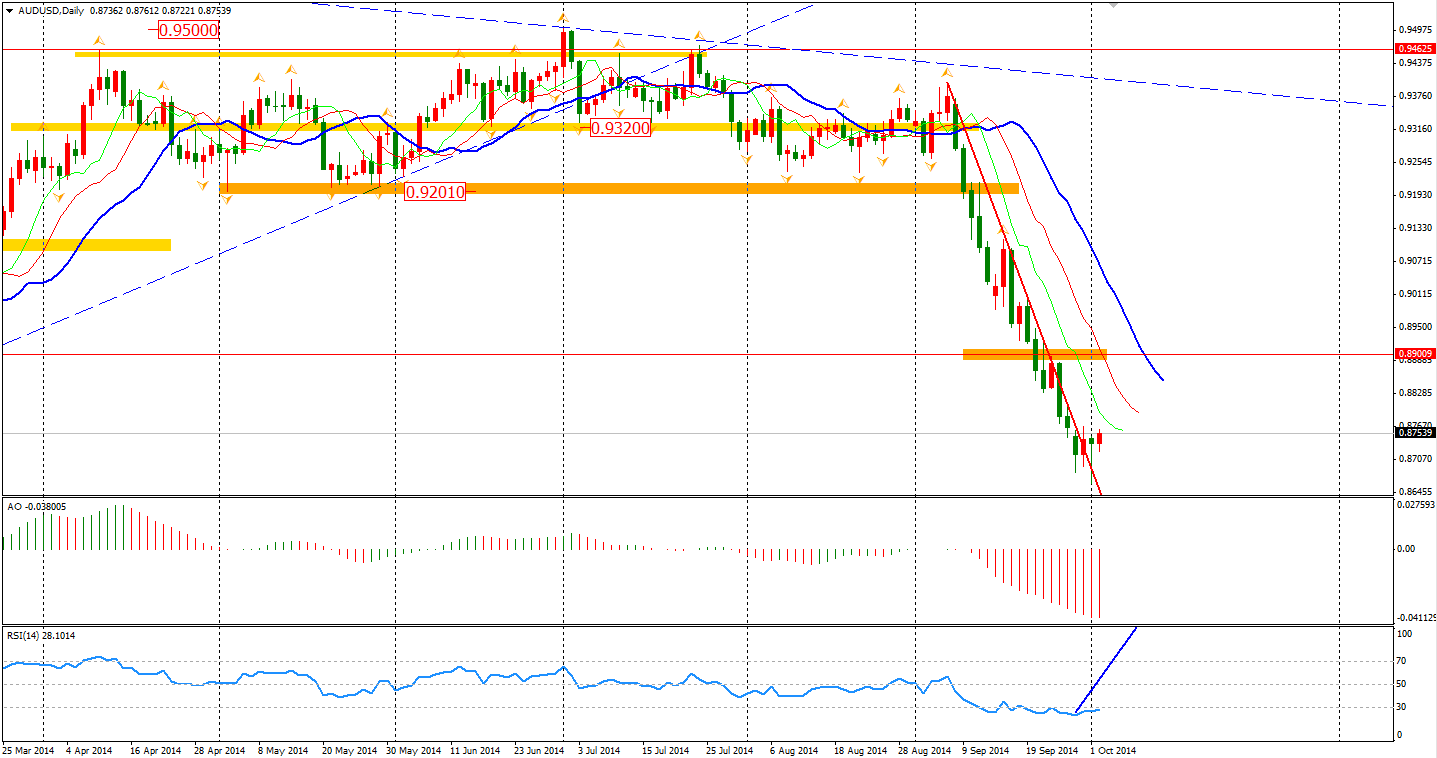

After the news that China’s official October PMI is 51.1 – the same as the previous one, the Aussie Dollar slumped to 0.87 in response to the disappointing retail sales. The growth was only

0.1% in August, missing the expected 0.4% showing a weakness in the domestic market recovery, especially in the depressed mining industry.

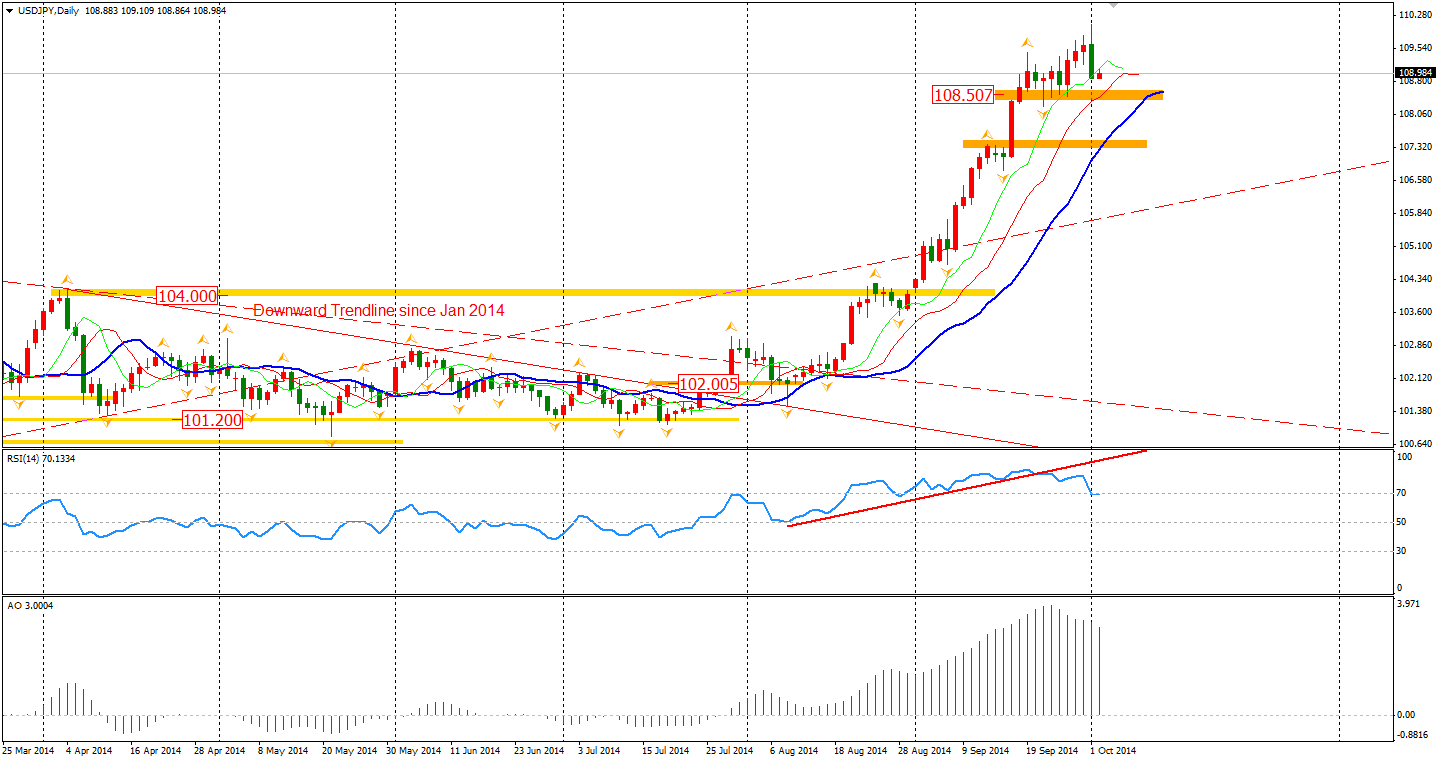

In the Asian trading session, another unmissable moment came from the Dollar/Yen. The dollar rose above 110 yen for the first time since August 2008. These two currency pairs reached the technical targets that we had forecasted a month ago. This meeting of targets suggests that the trend may be close to the end for now. The Dollar/Yen later fell from the 110 level and slumped to a 108.90 finish earlier today.

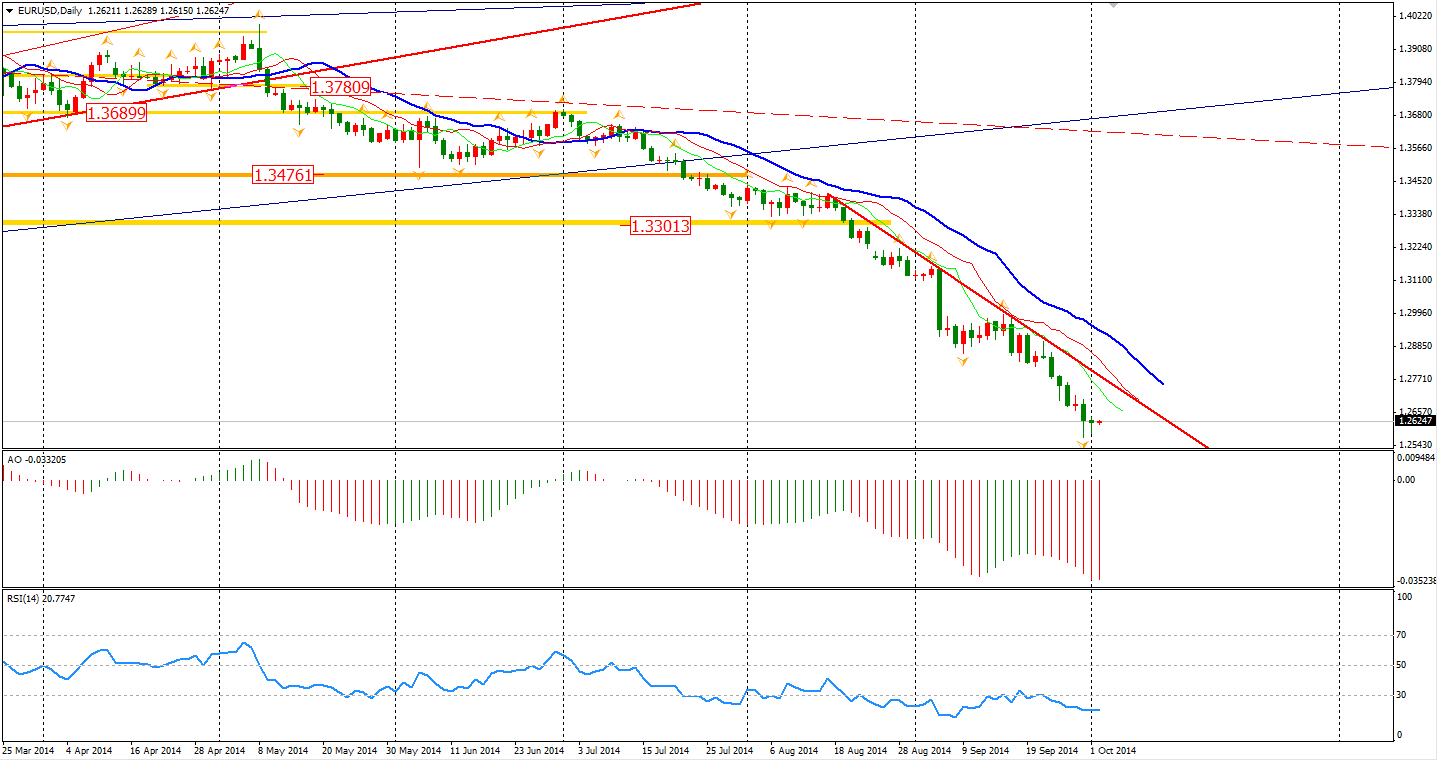

Similar worrisome signs are showing in Europe as well. Eurozone factories expanded at the slowest pace in 14 months, with manufacturing contracting in Germany, France, Austria and Greece. The figure has added extra pressure on the ECB to make moves on averting deflation. However, it seems like market participants are waiting for the decision tonight, and the Euro/Dollar consolidated near its recent lows of around 1.26.

The Asian stock markets were mixed on Wednesday as the Chinese markets were closed for the ‘golden week’ holiday. The Nikkei Stock Average lost 0.56%. The ASX 200 bounced 0.78% to 5334. In European stock markets, the UK FTSE was down 0.98%, the German DAX slumped 0.97% and the French CAC Index lost 1.15%. U.S. stocks slumped on downbeat economic data. The S&P 500 lost 1.32% to 1946. The Dow edged down 1.40% to 16805, while the Nasdaq Composite Index dropped 0.1.32% to 4422.

On the data front, Australia Building Approvals and Trade Balance will be released at 11:30 AEST. The UK Construction PMI will be at 18:30. ECB monetary decision will be released tonight and the US weekly Unemployment Claims will be at 22:30.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.